EVF Navigates Challenges in a Turbulent Year

2025 has proven to be a year of significant challenges for financial institutions. Despite a cooling in interest rates compared to 2024, pressures from capital costs, credit risks, and shifting macroeconomic policies have left many financial entities grappling with the balance between growth and stability.

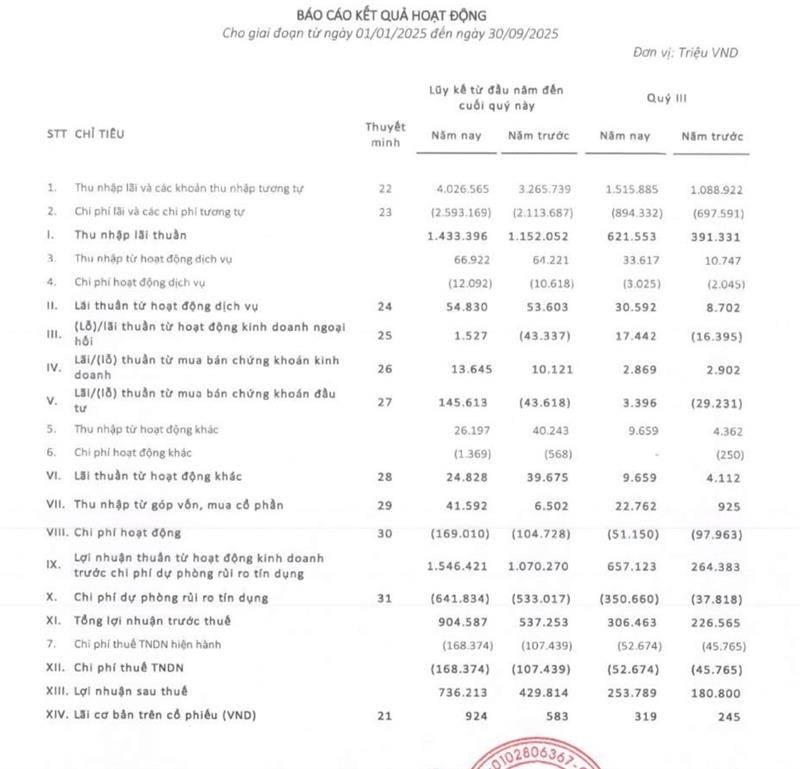

Amidst this landscape, EVF stands out with a distinct performance. Having achieved 94% of its pre-tax profit plan for 2025, EVF is poised to exceed its annual profit targets, particularly as the fourth quarter typically marks a period of accelerated growth in the financial sector. As of September 2025, EVF’s credit balance reached VND 51.335 trillion, a nearly 9.73% increase from the beginning of the year. Net interest income surged by 39% to VND 1.515 trillion. Notably, the net interest margin (NIM) remained stable at 3.28%, surpassing the average of many consumer finance companies.

Contributing to pre-tax profits, net gains from securities investment in the first nine months of 2025 amounted to VND 145.6 billion, a stark contrast to the VND 43.6 billion loss in the same period last year. This reflects the effectiveness of EVF’s risk-controlled and safety-focused investment strategy. Additionally, income from capital contributions and share purchases in Q3 2025 reached VND 41.59 billion, a sixfold increase compared to Q3 2024.

As of September 30, 2025, EVF’s total assets stood at VND 71.622 trillion, an increase of VND 12.023 trillion (20.2%) from the beginning of the year. This growth is primarily driven by a rise in customer loans from VND 46.803 trillion to VND 51.355 trillion, deposits and loans to other credit institutions from VND 4.892 trillion to VND 10.168 trillion, and trading and investment securities from VND 2.616 trillion to VND 3.754 trillion. This expansion underscores EVF’s growing operational scale, enhanced profitability, and asset growth.

On the funding side, liabilities as of September 30, 2025, totaled VND 61.917 trillion, an increase of VND 11.326 trillion (22.4%) from the beginning of the year. Notable increases include securities issuance, which rose from VND 18.556 trillion to VND 28.047 trillion (51%), and deposits and loans from other credit institutions, which increased from VND 11.734 trillion to VND 13.959 trillion. Shareholders’ equity as of September 30, 2025, reached VND 9.705 trillion, an increase of VND 698 billion (7.7%), primarily from retained earnings.

Low Operating Costs: A Hidden Competitive Advantage

Another surprising figure is the Cost to Income Ratio (CIR), which stands at just 9.85%, significantly lower than the industry average. This is a “quiet yet significant” advantage for EVF, especially as many other financial companies are heavily investing in operations and technology without proportionate returns.

Analysts attribute this efficiency to EVF’s robust digital transformation and streamlined organizational strategy over the past few years. With tightly controlled costs, profit margins naturally improve without the need to pursue risky growth.

Green Credit: A Long-Term Strategic Differentiator

A less noticeable but strategically significant aspect is EVF’s continued focus on green credit, targeting sectors like solar energy, electric vehicles, and environmentally friendly production models. Instead of traditional short-term lending, EVF is experimenting with a more sustainable approach, albeit on a smaller scale. Green credit products not only expand EVF’s customer base but also open doors to preferential funding sources domestically and internationally, potentially offering long-term advantages.

Growth Momentum Continues in Q4

With profits nearing annual targets, EVF’s surpassing of its 2025 goals is imminent. The peak season at year-end provides additional growth potential for EVF, solidifying its position as one of the most efficient financial companies in the market.

Earlier, EVF underwent significant changes, including a name change to include “Comprehensive” in compliance with the Law on Credit Institutions, and the adoption of a new brand identity logo, “EVF” (its stock code), replacing “EVNFinance.” In late September 2025, EVF also relocated its headquarters to the 6th and 7th floors of Thaisquare Caliria Building, 11A Cát Linh, Ô Chợ Dừa Ward, Hanoi.

FPT Profits Soar: Earning $1.5 Million Daily

After the first nine months of 2025, FPT reported revenues of VND 49,887 billion and pre-tax profit of VND 9,540 billion, achieving 71% of the annual plan and marking a nearly 18% increase compared to the same period last year. This positive performance is driven by the growth of the Technology and Telecommunications segments, with overseas IT services and the Made-by-FPT ecosystem continuing to expand robustly.

Digital Land Titles Coming to VNeID App

The Ministry of Public Security is collaborating with the Ministry of Agriculture and Environment to develop a feature on the VNeID app. This feature will enable citizens to self-submit, verify, and authenticate land and residential ownership information directly from the National Population Database, eliminating the need to provide physical copies of land certificates or citizen ID cards.

LPBank Surges Ahead in Profit Race, Reporting Over 9.6 Trillion VND in Earnings After 9 Months

LPBank (Loc Phat Bank) has unveiled its financial report for the first nine months of 2025, boasting a pre-tax profit of 9.612 trillion VND—an unprecedented high in the bank’s history. Surging ahead in the profit race, LPBank is setting new benchmarks, solidifying its sustainable growth foundation, and striving toward long-term objectives.