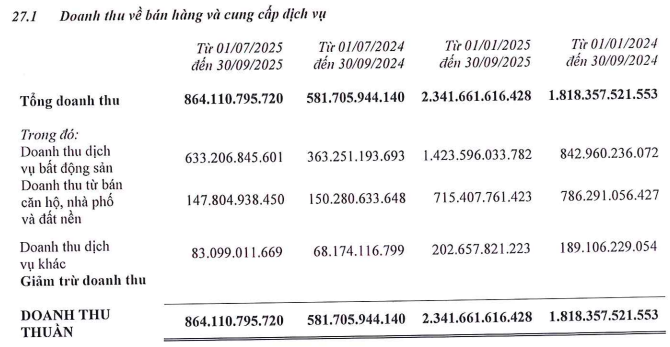

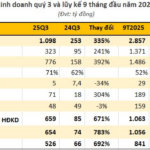

Specifically, DXS’s net revenue in Q3/2025 reached over 864 billion VND, a 49% increase year-over-year. Real estate brokerage activities, amid a recovering market, generated more than 633 billion VND in revenue, up by over 74%. The brokerage segment contributed nearly 367 billion VND in gross profit, equivalent to a gross margin of nearly 58%. Meanwhile, the segment selling apartments, townhouses, and land plots achieved a gross margin of 44%.

|

DXS’s Net Revenue Structure

Source: Q3/2025 Consolidated Financial Report

|

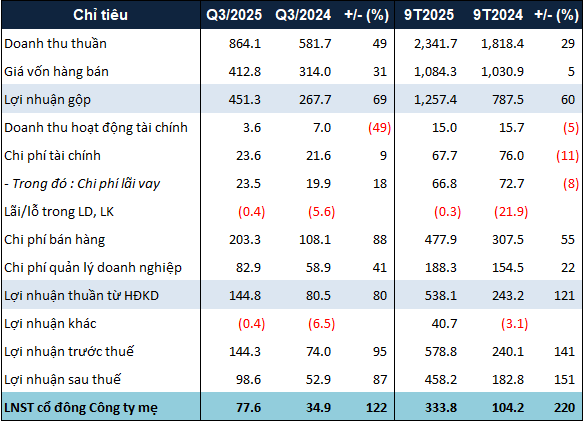

Conversely, despite receiving dividends from its subsidiary Regal Group, DXS’s financial revenue in Q3 declined by 49%, to nearly 4 billion VND.

On the cost side, most expenses surged significantly. Interest expenses, selling expenses, and administrative expenses rose by 18%, 88%, and 41%, respectively, reaching nearly 24 billion VND, over 203 billion VND, and nearly 83 billion VND, driven by increased salaries and advertising costs.

After deducting these expenses, DXS recorded a net profit of nearly 78 billion VND in Q3, 2.2 times higher than the same period last year.

For the first nine months of the year, DXS reported net revenue and net profit of over 2.3 trillion VND and nearly 334 billion VND, up 29% and 3.2 times year-over-year, respectively. Compared to the annual plan, the company achieved 45% of its revenue target and over 81% of its profit target.

|

DXS’s 9-Month Business Results in 2025. Unit: Billion VND

Source: VietstockFinance

|

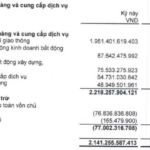

On the balance sheet, DXS’s total assets as of September-end approximated 17 trillion VND, a 13% increase from the beginning of the year. The largest component, short-term receivables, rose by 14% to nearly 10.5 trillion VND, accounting for 62% of total assets. Of this, deposits and guarantees for marketing and project distribution contracts totaled nearly 5,989 billion VND, up 22% year-to-date.

Short-term cash and inventory also increased by 54% and 10%, respectively, to over 759 billion VND and 4.8 trillion VND.

Total liabilities rose by 23%, reaching nearly 8.3 trillion VND. Outstanding loans increased by 26% to nearly 2.8 trillion VND, primarily due to bank loans. Customer deposits surged by 93%, to nearly 768 billion VND.

– 09:27 31/10/2025

Pharmaceutical Profits Dip: Binh Dinh Pharma’s Net Income Falls 20% Amid Rising Capital Costs and R&D Investments

Bidiphar (HOSE: DBD) has released its consolidated Q3 2025 financial report. Despite significant cost-cutting measures, the company experienced a decline in profits compared to the same period last year, primarily due to rising production costs and losses recorded from its joint ventures and associates.

Shock Resignation: CEO of Leading Securities Firm Steps Down Unexpectedly

This individual has tendered their resignation from all positions within the company and has formally requested to terminate their employment.

DIC Corp Seeks to Fully Divest Stake in Ceramic Tile Subsidiary

DIC Corp is offering to sell its entire stake of 8.82 million shares in DIC Anh Em at a price of no less than VND 4,696 per share, aiming to secure a minimum revenue of over VND 41.4 billion.