Silver prices surged past $53 per ounce on November 12th, reaching a three-week high after a period of volatility. This significant uptick in the precious metal’s value has once again captured investor attention, highlighting silver’s dual role as both a safe-haven asset and an industrial commodity.

Amid this renewed interest, Robert Kiyosaki, renowned author of the financial bestseller “Rich Dad Poor Dad,” has reaffirmed his bullish stance on silver. On social media platform X, Kiyosaki revealed his ownership of a silver mine, stating that “new silver supplies are scarce.” He has even revised his initial forecast, now predicting a potential tripling in silver’s value, up from his previous expectation of a doubling. Kiyosaki believes silver could reach even higher levels in the medium term if supply shortages persist.

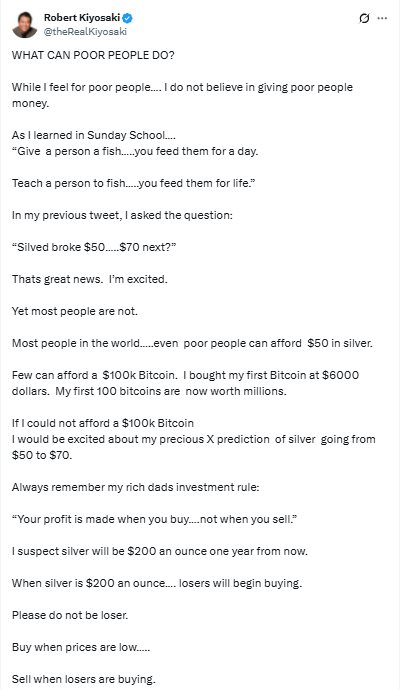

In his latest tweet, Kiyosaki shared his investment philosophy, emphasizing that the best way to help others grow wealthy is to teach them how to make money, rather than simply giving them money. He wrote, “Always remember my rich dad’s investing rule: Profits are made when you buy, not when you sell.”

Echoing his earlier tweet, Kiyosaki noted, “Silver has broken through the $50 mark and could be heading towards $70. This is incredibly exciting news.” He believes that at current prices, silver remains an accessible investment option for many, before potentially experiencing a more significant price surge next year.

“I suspect silver could reach $200 per ounce within a year. Buy silver while it’s still around $50, because when it hits $200, the market will become crowded,” he advised, underscoring the importance of buying at lower prices and selling when the market overheats.

Kiyosaki illustrated this point with his own investment experience. He shared that he purchased his first Bitcoins at just $6,000 each, when few were paying attention, and that his initial portfolio of 100 Bitcoins has since grown into millions. This, he says, exemplifies the power of long-term investing and taking action early when opportunities are still abundant.

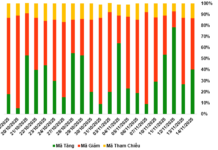

Silver price fluctuations over the past year.

According to Kitco News, some analysts attribute silver’s recent appeal to its inclusion in the U.S. Geological Survey’s (USGS) 2025 List of Critical Minerals. They suggest this designation could boost industrial silver consumption, further disrupting the global precious metals supply chain and tightening the physical market.

Silver prices hit a record high of $54.48 per ounce last month as strong physical demand depleted above-ground silver reserves in London. Meanwhile, U.S. bullion banks remain reluctant to sell their silver holdings due to concerns about potential new taxes stemming from the metal’s critical mineral status.

Additionally, the gold-to-silver ratio reached its highest annual level since World War II in 2025, surpassing peaks seen during the 1991 and 2020 global economic downturns, with an average ratio exceeding 90.

In a recent weekly note from Mitsubishi Corporation’s precious metals team, “Silver appears to have reclaimed its role as a leading indicator for activity across the broader metals market.”

In Vietnam, silver prices have also seen a sharp rise. Data from Phu Quy Jewelry Corporation shows that the price of 999 silver is listed at VND 2,043,000 per tael (buy) and VND 2,106,000 per tael (sell). Over the past year, domestic silver bar prices have increased by nearly 80%.

Silver Prices Surge 4% Consecutively, Breaking the 56 Million VND/kg Barrier

Silver prices today have surged both domestically and globally, marking a significant uptick in value across markets.

Today’s Silver Price (Nov 8): Shocking Announcement from a Leading Silver Company

After silver prices retreated to their lowest point in a month, SBJ Company unexpectedly announced the reinstatement of its spot purchasing option.