Despite the market’s volatility causing the main index to fluctuate, Vietnam’s stock market closed the November 18th session in the green. At the end of the day, the VN-Index rose by 5.5 points to reach 1,659.92. Trading volume remained low, with matched orders on HoSE totaling approximately VND 20.1 trillion.

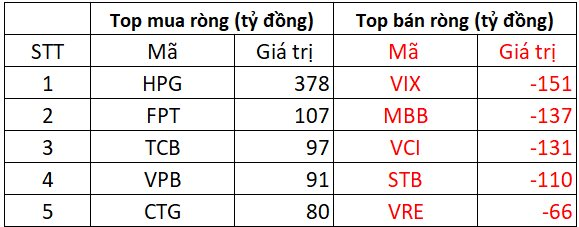

Regarding foreign trading, although the net selling trend continued, the selling pressure eased during today’s session, with a net sell-off of around VND 84 billion across the market. Specifically:

On HoSE, foreign investors net sold approximately VND 51 billion

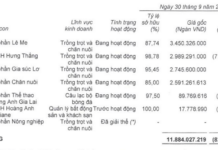

On the buying side, Hoa Phat (HPG) stocks were the most heavily purchased by foreign investors, with a value of up to VND 378 billion. FPT shares followed, with foreign investors buying over VND 100 billion. Banking stocks such as TCB, VPB, and CTG were also in focus, with net buying values ranging from VND 80 billion to VND 97 billion.

Conversely, the top net-sold stocks were primarily from the financial sector. Foreign investors heavily sold VIX shares, totaling about VND 151 billion. MBB, VCI, and STB shares were also net sold, ranging from VND 110 billion to VND 137 billion, while VRE saw a net sell-off of VND 66 billion by foreign investors.

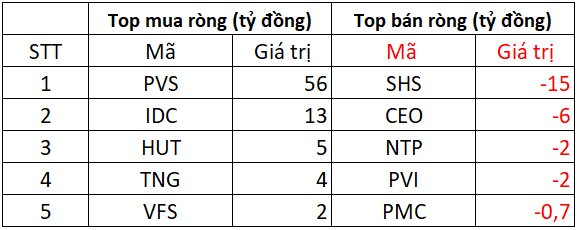

On HNX, foreign investors net bought approximately VND 54 billion

On the buying side, foreign investors heavily purchased PVS shares, with a net buy of VND 56 billion, and invested over VND 10 billion in IDC. Additionally, HUT, TNG, and VFS saw slight net buying of a few billion dong each.

On the selling side, SHS and CEO shares were significantly net sold by foreign investors, ranging from VND 6 billion to VND 15 billion per stock. NTP and PVI were also among the top net-sold stocks, with values of VND 2 billion each.

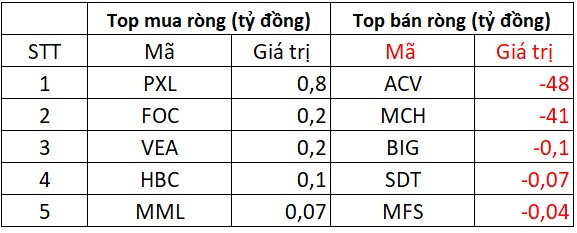

On UPCOM, foreign investors net sold approximately VND 87 billion

On the buying side, foreign investors invested a few hundred million dong in stocks like PXL, FOC, and VEA. Additionally, HBC and MML saw slight net buying of a few tens to hundreds of million dong.

Conversely, MCH and ACV shares were net sold for VND 41 billion and VND 48 billion, respectively. BIG, SDT, and MFS also experienced minor net selling by foreign investors.

Proprietary Trading Firms Reverse Course, Offloading Hundreds of Billions in Vietnamese Stocks on November 18th: Which Stock Takes Center Stage?

Proprietary trading firms reversed their stance, shifting to net sellers with a total of VND 365 billion on the Ho Chi Minh Stock Exchange (HOSE).