State-Owned Enterprises Witness Significant Decline in Numbers

At the forum titled “State-Owned Enterprises Enhancing Competitiveness and Leadership Roles,” organized by VOV on the morning of November 20th, Ms. Nguyễn Thu Thủy, Deputy Director of the State-Owned Enterprise Development Agency under the Ministry of Finance, stated that in any country, including those with developed markets, state-owned enterprises (SOEs) play a crucial role in ensuring macroeconomic stability, social welfare, and leading other economic sectors. In Vietnam, SOEs are recognized as one of the significant achievements of the state economy, yet their operational results have not matched their resource potential.

Ms. Thủy highlighted that the Party’s policies and viewpoints regarding SOEs have evolved over different periods, aligning with the processes of innovation and integration. These changes can be divided into three main phases. Specifically, from 1991 to 2001, the number of SOEs sharply decreased from approximately 12,000 to 500. Between 2001 and 2016, the number continued to drop from 500 to around 700 (based on new classification criteria). Since 2017, the restructuring pace has slowed, with the number of fully state-owned enterprises reducing to about 200, though the restructuring process has become more in-depth.

Ms. Nguyễn Thu Thủy – Deputy Director, State-Owned Enterprise Development Agency, Ministry of Finance.

According to Ms. Thủy, there are currently 866 state-funded enterprises nationwide, including approximately 500 fully state-owned enterprises. SOEs contribute about 12.5% to GDP and 27-30% to total budget revenue (excluding crude oil), maintaining their leadership in strategic sectors such as energy, infrastructure, telecommunications, logistics, and national defense.

Ms. Thủy identified six major challenges for SOEs: unclear leadership roles, limited value chain creation and private sector linkages; underutilized capital and assets due to stringent legal regulations; low autonomy and competitiveness, with many business decisions delayed pending approval; inefficient operations, prolonged losses, and financial insecurity in some enterprises; slow governance modernization, lagging behind international standards; and slow progress in equitization and capital divestment, with prolonged settlements failing to meet requirements.

Enhancing SOE Governance

Mr. Nguyễn Tất Thái, Deputy Director of the Forecasting, Statistics, and Monetary Stability Department at the State Bank of Vietnam, noted that Vietnam’s four state-owned commercial banks (Vietcombank, VietinBank, BIDV, Agribank) currently hold total assets exceeding 9.36 million billion VND, a significant portion of the SOE sector. Their credit outstanding accounts for 44% of the entire banking system.

Mr. Nguyễn Tất Thái – Deputy Director, Forecasting, Statistics, and Monetary Stability Department, State Bank of Vietnam.

However, Mr. Thái emphasized several significant challenges. Primarily, there are limitations in capital and state investment mechanisms. While asset growth is rapid, the chartered capital of state-owned commercial banks only constitutes about 20% of the entire system, significantly lower than that of joint-stock banks. Prolonged difficulties in capital increases have reduced the capital adequacy ratio, limiting credit supply capabilities, large project financing, and policy leadership roles. Additionally, many SOEs remain heavily reliant on borrowed capital, with high debt ratios and efficiency not commensurate with their resources.

Mr. Lê Quang Thuận, Head of the Enterprise Development and Business Environment Department at the Institute for Strategy and Financial Policy, Ministry of Finance, stressed that one of the most significant limitations of SOEs today is the slow pace of corporate governance innovation. Despite Resolution 12 in 2017 setting requirements for governance improvements aligned with international practices, progress remains slow. The OECD’s extensive recommendations highlight numerous critical areas where Vietnam needs to take more decisive action.

Mr. Lê Quang Thuận – Head of Enterprise Development and Business Environment, Institute for Strategy and Financial Policy, Ministry of Finance.

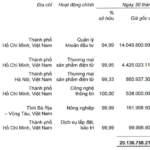

MWG Set to Execute Two Subsidiary Transfers Valued at Over 2.1 Trillion VND

MWG has recently approved the transfer of all shares in Thợ Điện Máy Xanh and Dược Phẩm An Khang Pharm, along with a strategic restructuring plan for its subsidiaries to focus on specialized business operations.

Year-End Interest Rates Surge: What It Means for You

Interest rates on deposits are heating up as multiple banks have collectively raised their rates since the beginning of November.