The draft of the Personal Income Tax Law (amended) is currently under review by the National Assembly, which is seeking feedback to finalize and pass it during the 10th session.

One of the key points attracting attention from National Assembly delegates and the public is the proposal to impose a 0.1% personal income tax on gold bar transactions. This measure aims to enhance market transparency and curb speculation.

The National Assembly is reviewing and discussing the draft of the Personal Income Tax Law (amended)

Delegate Phạm Văn Hòa agreed with the explanatory report, stating that individuals profiting from buying and selling gold bars or engaging in speculative activities should be subject to taxation. However, he noted that the proposed 0.1% tax rate is insignificant for these individuals.

Therefore, he suggested revisiting the tax rate to better regulate the income of these individuals, thereby limiting speculation and stabilizing the market. He also proposed exempting taxation for individuals and families purchasing gold for savings, inheritance, or emergencies.

Delegate Trịnh Xuân An (Đồng Nai) mentioned that this regulation is unprecedented, as no other country currently taxes gold bar transactions like Vietnam. However, he believes the proposal is reasonable given Vietnam’s unique gold management context.

Addressing concerns about taxing individuals saving gold, Trịnh Xuân An noted the difficulty in distinguishing between saving and speculative purchases.

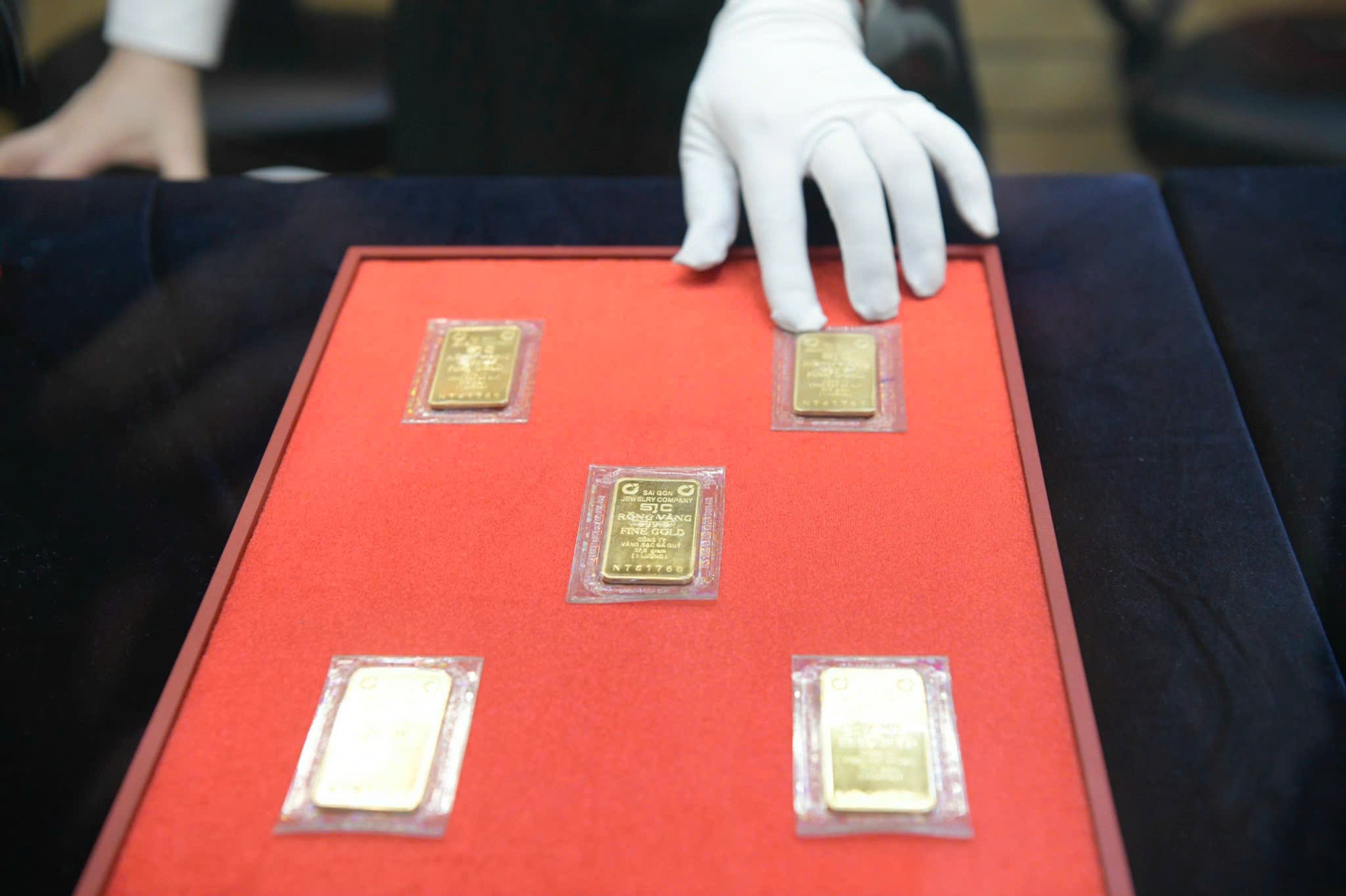

According to An, taxing only gold bars, alongside other regulatory tools, is an appropriate policy. “It’s hard to call it saving when people stay up all night or queue from 3 a.m. to register for gold bars, or switch to buying gold rings when bars are unavailable. That’s not how saving works,” he stated, emphasizing that the tax applies only to gold bars, not rings.

Clause 11 of Article 3 in the draft law authorizes the Government to adjust the 0.1% tax rate as needed. Delegate An suggested that such adjustments should be reviewed by the National Assembly’s Standing Committee, given the sensitivity of this area. “Taxing gold bar transactions won’t lead to double taxation or affect citizens’ savings,” he asserted.

Proposal to impose a 0.1% tax on gold bar transactions

In an interview with Người Lao Động newspaper, Lawyer Hoàng Hà (Ho Chi Minh City Bar Association) also highlighted the difficulty in legally and practically distinguishing between gold purchases for savings and speculation.

He explained that determining a buyer’s intent is challenging, as the line between long-term savings and short-term speculation lies in the buyer’s subjective purpose. The law cannot infer intent to determine whether gold is bought for inheritance or quick resale.

Additionally, current laws limit the definition of speculation. Under Article 196 of the 2015 Penal Code (amended in 2017), speculation requires exploiting scarcity or disasters to hoard goods for profit. Normal market trading for profit is a legitimate business activity, making it hard to classify as illegal.

“Third, behaviors overlap. For instance, a saver might sell gold in an emergency (like a speculator), while a speculator might hold gold for months due to market conditions (like a saver),” Lawyer Hoàng Hà analyzed.

Thus, without tools like identification numbers or synchronized transaction histories, it’s nearly impossible to differentiate between savers and speculators based solely on counter transactions.

Lawyer Hoàng Hà (Ho Chi Minh City Bar Association) finds it challenging to distinguish between gold purchases for savings and speculation

The draft law tasks the Government with specifying the taxable gold bar value threshold, implementation timeline, and tax rate adjustments aligned with gold market management. A key question is determining an appropriate threshold to avoid taxing savers while targeting speculators.

Lawyer Hoàng Hà suggested the Government needs a behavioral filter for the gold market rather than a fixed threshold. If a threshold is necessary, he proposed the following approaches:

First, a transaction value threshold. The current VND 400 million threshold (per Decree 11/2023/QĐ-TTg, requiring large transactions to be reported to the State Bank) is the most legally grounded reference.

“If setting a tax threshold, the Government could consider this level. Transactions below this could be deemed as small-scale savings and exempted, while those above could be taxed or require purpose verification,” he suggested.

Drawing on international experience, he noted that some countries tax gold speculation based on holding periods. For example, in Germany, physical gold held for over a year is tax-exempt upon sale, regardless of profit. Sales within a year are subject to personal income tax.

Instead of focusing on transaction value, Lawyer Hoàng Hà recommended Vietnam develop infrastructure to tax based on holding periods. For instance, gold held for 5–10 years (e.g., for inheritance) could be taxed at 0%, while frequent short-term trading (indicating speculation) could face progressive taxation.

He agreed that the proposed 0.1% tax rate is insufficient to deter speculation, as it’s too small compared to gold price fluctuations. Gold prices can vary by VND 1–2 million per tael daily (1–2% fluctuation).

“Speculators accept profit margins of VND 2–3 million per tael. Adding a 0.1% tax (around VND 80,000–90,000 per tael) is like a small transaction fee, unlikely to deter speculators or manipulators,” he concluded.

According to Minister of Finance Nguyễn Văn Thắng, based on feedback from relevant agencies and the draft law review, the Government will determine the taxable gold bar value threshold and tax rate adjustments based on gold market management conditions.

“A 0.1% personal income tax will be applied to gold bar transactions, with the implementation timeline carefully considered,” the Minister stated.

The Ministry of Finance emphasized that the primary goal of this tax is to regulate gold trading behavior, prevent speculation, and reduce market pressure. Minister Nguyễn Văn Thắng also confirmed that there is no “double taxation” issue.

Revised Title:

“Parliamentary Delegate Proposes Tax Threshold for Household Businesses at Minimum of VND 500 Million to VND 1.5 Billion”

According to delegate Hoàng Văn Cường, for retailers and agents, the minimum taxable threshold should be 1.5 billion VND. For service providers and businesses that do not incur material costs, such as construction contractors who do not include material expenses, this threshold should be at least 500 million VND.

Finance Minister Confirms More Favorable Tax Policy for Household Businesses: Threshold Increased from 100 Million VND to 200 Million VND Annual Revenue

Minister of Finance Nguyen Van Thang stated that the fundamental tax calculation method remains unchanged. Previously, it was based on a fixed tax system (where business owners self-declared revenue), whereas now it relies on revenue declaration. Transitioning to this declaration system significantly reduces losses, particularly in economically developed areas.

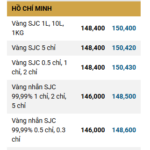

Gold Prices Drop by Day’s End on November 17th; SJC Company Issues Critical Announcement on Gold Bars

Global gold prices retreated towards the end of the trading day, while domestic SJC gold bars held steady. Notably, SJC Company has temporarily suspended online gold purchase registrations.