NO1 has announced November 28th as the final registration date for shareholders to receive the 2024 dividend, with the ex-dividend date set for November 27th.

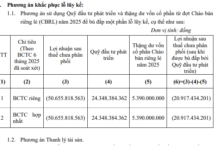

The dividend rate is 6% (600 VND per share), scheduled for payment on December 29th. With 24 million outstanding shares, the company will allocate 14.4 billion VND for this dividend distribution.

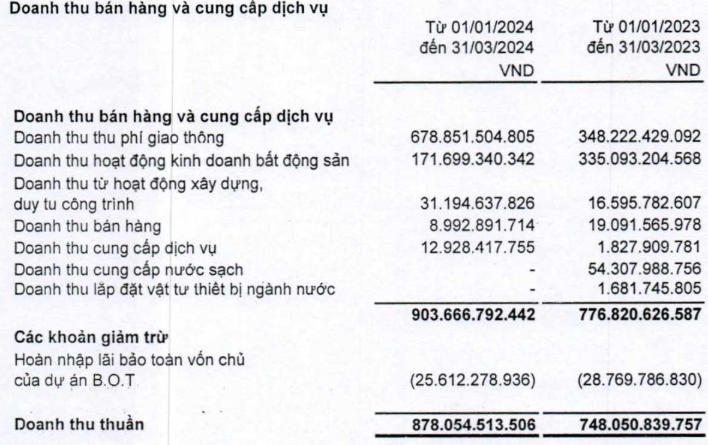

This 6% rate marks the highest dividend payout since the company’s IPO in November 2022, approved during the annual shareholders’ meeting in May 2025. This decision follows a successful 2024, where NO1 surpassed its revenue target by 34% (achieving 802 billion VND against a 600 billion VND goal) and met its after-tax profit plan of 18 billion VND.

|

NO1 to distribute highest dividend since IPO

Source: VietstockFinance

|

In the first nine months of 2025, NO1 reported over 13 billion VND in after-tax profit, a 31% decline compared to the previous year’s self-prepared financial statements. This represents 74% of the annual target of 18 billion VND.

Many shareholders had anticipated NO1 to approach or exceed its annual target, given the nearly 13 billion VND profit in the first half of the year. However, the addition of only 1.4 billion VND in Q3, equivalent to 29% of the same period last year, means profit finalization depends on Q4 results.

At the parent company level, NO1 recorded less than 200 million VND in after-tax profit in Q3. The company attributes this primarily to declining market demand (partly due to Lunar July consumer culture) and fluctuating input costs in the machinery and equipment sector. As most goods are imported, USD/VND exchange rate fluctuations have increased selling prices, impacting purchasing power and customer order timelines. Additionally, rising input costs, import prices for machinery, and international and domestic transportation expenses have significantly reduced gross profit margins.

However, the company anticipates a more positive outlook in Q4, driven by the completion of pending Q3 orders and the implementation of new business initiatives.

| NO1 faces challenging Q3/2025 |

Beyond its established products like concrete, road construction, mining, and lifting equipment, NO1 has recently ventured into the ride-hailing sector.

At the 2025 annual shareholders’ meeting, Chairman Nguyen Manh Hai announced the purchase of 400 Vinfast vehicles for the taxi project. Currently, 100 vehicles are operational, with an additional 100 being received. By the end of Q3/2025, all purchased vehicles will be received, and 911 Taxi will be officially launched.

According to the 2024 Annual Report, the 911 Taxi project has a budget of 500 billion VND, primarily operating in Dong Nai, Binh Duong, and Ho Chi Minh City (pre-merger). The goal is to expand the fleet to 800 vehicles by 2026, along with 4 2S service workshops, charging stations, sales points, and used car rentals (GF).

The 911 Taxi plan was initiated by the late Chairman Luu Dinh Tuan. During the signing of a memorandum of understanding with GSM on October 26, 2024, Mr. Tuan stated that the decision to choose electric taxis for expansion was based on the proven investment efficiency demonstrated by pioneering domestic transportation companies.

On the stock market, since a sharp decline in early 2025, NO1 shares have struggled to recover, instead trading within a narrow range near their yearly lows. As of November 24th, the share price closed at 7,280 VND, down nearly 34% year-to-date.

| NO1 shares remain near 2025 lows |

– 15:28 24/11/2025

Unveiling the Hidden Buying Power in Investment Fund Transactions

During the week of November 17–21, 2025, investment funds predominantly shifted towards selling activities as the VN-Index fluctuated between 1,620 and 1,650 points, coinciding with the expiration of the VN30 futures contract. Trading volumes from these funds remained relatively low, with individual orders ranging from tens to hundreds of thousands of shares.

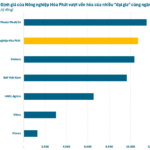

The New Ace of Mr. Trần Đình Long: A Billion-Dollar Agriculture Company Valued Higher Than Dabaco and BAF Vietnam

At an offer price of VND 41,900 per share, Hoa Phat Agriculture is valued at nearly VND 10,700 billion pre-IPO.

VPS Appoints New CEO Post-IPO, Reveals Major Shareholders List

Following its high-profile IPO, VPS Securities promptly removed Mr. Nguyen Lam Dung from his position as CEO to comply with legal regulations for publicly traded companies. The post-IPO list of major shareholders has also been disclosed, revealing Saigon Capital as the largest stakeholder with 39.9% ownership, while Mr. Nguyen Lam Dung retains an 8.7% stake.