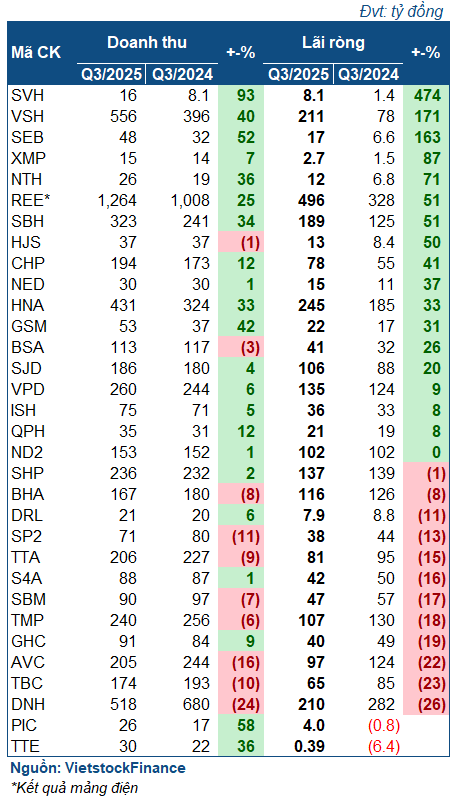

According to VietstockFinance, out of 58 power companies that released Q3 financial reports, 33 reported increased profits, with 4 turning losses into gains. Meanwhile, 21 saw declines, and 5 reported losses.

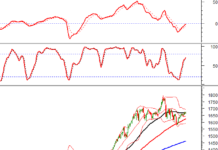

Hydropower Continues to Shine

Favorable hydrological conditions remained a cornerstone for hydropower companies’ success. Some even achieved profit growth multiples compared to the same period last year.

|

Q3/2025 Performance of Hydropower Companies

|

Vinh Son – Song Hinh Hydropower (HOSE: VSH) led with a net profit of VND 211 billion in Q3, 2.7 times higher than the same period last year. VSH attributed this to increased water flow, boosting electricity output by nearly 43% and driving revenue growth.

| VSH’s Business Performance |

Similarly, Song Vang Hydropower (UPCoM: SVH) saw the highest profit growth in the hydropower sector, with a net profit of VND 8.1 billion, 4.7 times higher than the same period last year. SEB also achieved a 2.6-fold increase, reaching VND 17 billion, thanks to high output from its two hydropower plants.

Other companies also reported strong profit growth. SBH (Song Ba Ha Hydropower) earned VND 189 billion, up 51%. CHP (Central Hydropower) profited VND 78 billion, a 41% increase. HNA (Hua Na Hydropower) grew 33%, reaching VND 245 billion.

REE‘s power segment profit rose 51% to VND 496 billion, primarily due to strong performances from subsidiaries like VSH and SBH. PIC and PTE even turned losses into gains, thanks to favorable hydrological conditions.

| REE enjoyed a profitable quarter thanks to its hydropower subsidiaries |

Some hydropower companies experienced profit declines, though not significantly. DNH (Da Nhim – Ham Thuan – Da Mi Hydropower), the most affected, saw a 26% drop but still achieved a profit of over VND 200 billion. AVC (A Vuong Hydropower) and TBC (Thac Ba Hydropower) saw 22-23% profit declines due to lower average electricity selling prices.

Thermal Power Struggles with Electricity Prices

While hydropower thrived, thermal power companies faced challenges, with most reporting profit declines or losses, and only two showing growth.

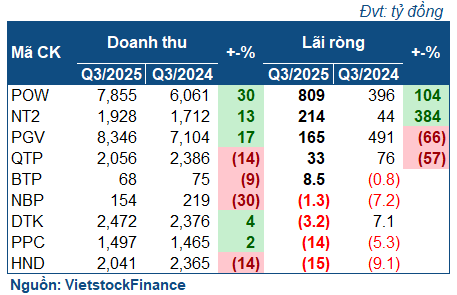

|

Q3/2025 Performance of Thermal Power Companies

|

POW (PV Power) led the thermal power sector with a 30% revenue increase to nearly VND 7.9 trillion and a net profit of VND 809 billion, double the same period last year. This was partly due to POW‘s ownership of hydropower plants like HNA. Another subsidiary, NT2 (Nhon Trach 2), achieved a VND 214 billion profit, nearly five times higher than last year, thanks to strong revenue growth outpacing cost increases. However, NT2‘s impressive growth was also due to a low base in the same period last year.

| POW grew strongly thanks to its hydropower subsidiaries and NT2 |

BTP (Ba Ria Thermal Power) turned a loss into a VND 8.5 billion profit. The company explained that despite plant downtime, revenue from fixed electricity prices in Q3/2025 was 19% higher than the same period last year.

Other thermal power companies faced challenges. EVNGENCO3 (HOSE: PGV) reported a VND 165 billion profit, down 66% year-on-year, mainly due to foreign exchange losses (VND 102 billion in Q3/2025, compared to a VND 689 billion reduction in losses last year). QTP (Quang Ninh Thermal Power) saw a 57% profit decline due to falling electricity prices in the competitive market.

Some companies reported losses. HND (Hai Phong Thermal Power) lost VND 15 billion (up from VND 9.1 billion last year) due to declines in electricity output, Pc contract prices affected by falling coal prices, and lower market electricity prices.

| HND reported losses due to electricity prices |

PPC (Pha Lai Thermal Power) lost VND 14 billion, up from VND 5.3 billion last year. Three main reasons were: operating below cost, leading to gross losses; reduced financial revenue from dividends; and the absence of compensation received last year.

DTK (TKV Power) lost VND 3.2 billion (compared to a VND 7.1 billion profit last year) due to unpaid dividends and foreign exchange losses. NBP (Ninh Binh Thermal Power) lost VND 1.3 billion due to scheduled maintenance but reduced losses compared to last year through cost savings.

Renewable Energy Smiles

Renewable energy companies had a bright Q3/2025. HDG‘s power segment generated VND 573 billion in revenue, up 29%, and VND 424 billion in profit, up 37%. Similarly, PC1 increased profit by 13% to VND 264 billion. However, both companies operate hydropower plants, which benefited from favorable hydrological conditions.

GEG, driven by official electricity prices for its Tan Phu Dong 1 (TPD1) and A7 wind power projects, saw a 24% revenue increase to VND 671 billion and a VND 75 billion profit (compared to a VND 27 billion loss last year).

| GEG continued to grow after securing electricity prices for its two major projects |

PTC (Icapital Investment) saw a six-fold profit increase to VND 33 billion, mainly due to strong financial revenue. The company realized profits from high-yield investments and reversed provisions for securities trading losses (approximately VND 22 billion).

BGE saw a 76% profit decline to VND 37 billion. Reasons included increased investment provisions, unpaid profits from joint ventures, and higher financial costs due to exchange rate differences.

Short-Term Bright Spots and Legal Improvement Expectations

PetroVietnam Securities (PSI) estimates that total power output will grow by around 11.3%. However, with commercial power output up only 3.9% in the first eight months, full-year 2025 growth is likely to be in the single digits. For 2026, PSI forecasts 7.5-8% growth, based on a 6.1% GDP growth projection by the World Bank.

In the short term, hydropower is the bright spot. PSI expects increased hydropower output due to heavy rainfall, while MBS (MB Securities) also predicts higher hydropower utilization due to above-average rainfall. For thermal power, MBS believes profit margins for coal and gas power will improve due to falling imported coal prices and high Qc output.

Long-term expectations focus on new policies, particularly the adjusted Power Master Plan 8 (PMP8) and the amended 2024 Electricity Law. The focus is on policy implementation and completion, with targets for gas power and renewable energy.

PMP8 aims to increase renewable energy capacity to 44%, addressing legal obstacles and transitioning from the FIT mechanism to competitive bidding. For gas power, LNG is seen as essential to offset declining domestic gas supplies, targeting a 12% contribution to the total energy mix by 2030.

– 09:00 25/11/2025

Revised Title:

Ministry of Industry and Trade Amends Electricity Generation Pricing Framework and Service Rate Determination Methodology

The Ministry of Industry and Trade has recently issued Circular 54, which amends both Circular 09 and Circular 12. These amendments pertain to the power generation price framework, electricity import prices, and the methodology for determining power generation service prices.

Vietnam Conglomerate Unveils Strategic Masterplan: 81km Expressway to Dutch-Korean Scale Port City

These strategic projects are poised to catalyze transformative growth in Vietnam’s southernmost province.

T&T Group and Cà Mau Province Sign Landmark Cooperation Agreement to Develop Major Projects

T&T Group and the People’s Committee of Ca Mau Province have signed a Memorandum of Understanding (MoU) to collaborate across multiple key sectors. This partnership paves the way for exploring investments in large-scale projects that will drive the development of infrastructure, urban planning, industrial-logistics, and energy initiatives in Vietnam’s southernmost region.