Illustrative Image: MarketTimes

Streamlined Approval Processes Boost Project Development

According to VIS Rating, project approvals have been significantly accelerated, thanks to new policies aimed at simplifying procedures. Licensing and approval activities in Q3/2025 reached record levels, with 113 new commercial housing projects approved, marking a 391% increase year-over-year (YoY).

Policies such as Decree 144/2025/NĐ-CP and 151/2025/NĐ-CP, which outline provincial and communal authority, have played a pivotal role in reducing approval times for real estate projects.

Additionally, the establishment of International Financial Centers (IFCs) in Ho Chi Minh City and Da Nang, scheduled for December 2025, along with accompanying incentives, is expected to stimulate housing demand, benefiting developers with substantial project portfolios in nearby areas.

Property Prices Continue to Rise, Supply Shifts Toward Mid-Range Segment

While housing supply has improved across all segments, with total supply in Hanoi and Ho Chi Minh City increasing by 55% YoY in Q3/2025 (compared to a 34% YoY rise in 2024), primary prices continued to climb, ranging from 31% to 41% YoY in Q3.

Positively, absorption rates in Hanoi and Ho Chi Minh City remained robust at 100.5%, driven by optimistic market sentiment fueled by infrastructure enhancements.

Notably, there is a pronounced shift in supply dynamics. Housing supply is increasingly moving toward the mid-range segment.

In Ho Chi Minh City, mid-range housing supply tripled in Q3/2025. This new supply primarily originates from neighboring areas like Binh Duong, with an average price of 46 million VND/m², 47% lower than core Ho Chi Minh City areas.

VIS Rating anticipates continued expansion in affordable to mid-range housing supply, enhancing accessibility for low- to middle-income earners.

Record-High Real Estate Credit Growth

Real estate credit reached unprecedented levels in Q3/2025. Home loan debt surged by 20% YoY (higher than the 12% YoY growth in 2024). VIS Rating expects continued growth in social housing and first-time homebuyer loans, supported by favorable policies and interest rates.

During this quarter, real estate business loan debt rose by 37% YoY, propelling real estate credit to a record high of 23.7% of total credit debt. This could adversely impact banks’ capital adequacy ratios.

This robust credit growth underscores the need for diversified project funding sources. Corporate bond issuance in the real estate sector rebounded significantly, reaching 34.1 trillion VND in Q3/2025, a 50% increase compared to the first half-year average. This recovery reflects developers’ efforts to diversify funding.

While new issuances are expected to recover between December 2025 and Q1/2026, alleviating pressure from a 15% bond maturity increase, refinancing risks remain high for companies like NVL, as most maturing bonds are ineligible for extension under current regulations.

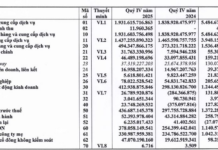

Improved Cash Flow Reduces Leverage Pressure; Credit Disparities Widen

Most developers’ credit profiles remain stable, despite debt-to-EBITDA ratios rising to 4.4 times (from 3.1 times in Q1/2025), driven by a 40% YoY increase in total debt. Companies like VHM, HPX, and SJS recorded the largest debt increases to fund new projects.

Credit stability is supported by improved operating cash flow (CFO), driven by customer advances from leading firms such as VHM, DXG, and VPI. Project deliveries over the next 12–18 months are expected to further bolster cash flow and profit recognition.

However, credit disparities are widening. Developers facing legal challenges, such as LDG, NRC, and NVL, continue to struggle. These firms reported weak margins and cash flow in the first nine months of 2025, maintaining their low credit profiles.

Ho Chi Minh City: Boosting Housing Supply to Drive Down Prices

The Ho Chi Minh City People’s Committee has tasked multiple departments and agencies with boosting housing supply and lowering property prices.

After the Prolonged Boom, Real Estate Prices Face Sharp Correction Due to This Key Factor

The real estate market is teetering on the brink of a significant cooldown, and the culprit can be summed up in two words: interest rates.

Reining in Real Estate Prices: Fundamental Solutions Needed

Amidst the relentless surge in property prices over recent times, experts emphasize the urgent need for fundamental solutions, particularly in effectively regulating investment capital flows. Such measures are crucial to fostering a healthy and sustainable development of the real estate market, which significantly influences both the economy and society at large.