Amid the robust recovery of Vietnam’s stock market, VTC shares of VTC Telecommunication JSC on the HNX exchange have remained in the spotlight. Closing the session on November 26, VTC’s stock price hit its ceiling for the sixth consecutive session, reaching 14,100 VND per share—its highest level in over 3.5 years (since April 2022).

Liquidity also saw a significant surge, with 68,000 shares traded, the highest volume in more than a year.

This positive momentum follows VNPT’s announcement of auctioning off its entire stake in VTC Telecom at a starting price significantly higher than the current market value.

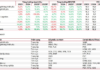

Specifically, Vietnam Posts and Telecommunications Group (VNPT) plans to auction over 2.1 million VTC shares (representing 46.67% of the issued capital based on actual contributions to the charter capital). The starting price is set at over 104.1 billion VND, equivalent to 49,200 VND per share—3.5 times higher than the closing price on November 26.

Mr. Le Xuan Tien, Chairman of the Board; Mr. Bui Van Bang, CEO; and Mr. Tran Van Mua, Deputy CEO of VTC Telecom, are the representatives of VNPT’s capital contribution in VTC Telecom.

Registration and deposit submission procedures will take place from November 18, 2025, to 3:30 PM on December 12, 2025. Payment for the shares must be completed between December 19, 2025, and December 25, 2025.

In terms of financial performance, VTC Telecom reported a post-tax loss of 2.9 billion VND in Q3 2025, marking its third consecutive quarterly loss. This is primarily due to several new projects not yet being accepted for revenue recognition, while implementation costs continue to be accounted for in the period.

According to VNPT’s announcement, the divestment from VTC is in line with Decision No. 620/QĐ-TTg dated July 10, 2024, by the Prime Minister, approving the restructuring plan of Vietnam Posts and Telecommunications Group until 2025. It also aligns with Document No. 1944/UBQLV-CNHT dated August 28, 2024, from the State Capital Management Commission regarding the divestment from 24 enterprises listed in the approved divestment plan under Decision No. 620/QĐ-TTg.

The State Capital Management Commission has urged VNPT to expedite the divestment process to focus resources on core areas, particularly digital infrastructure and services.

As part of the restructuring plan until 2025, VNPT will also auction over 10 million shares (equivalent to 31.43% of the charter capital) of Post and Telecommunications Informatics Corporation (CTIN, code: ICT) at a starting price of 74,106 VND per share, four times higher than the market price. The auction is scheduled for December 17.

Additionally, VNPT aims to divest from VMG Media (code: ABC). According to the auction plan, VNPT intends to sell its entire stake of 5.77 million ABC shares (28.3% of the charter capital) at a starting price of 190.2 billion VND, equivalent to approximately 32,950 VND per share—about 2.3 times higher than the closing price on November 20.

Dual Momentum: SHB’s Capital Raise Strategy and Foreign Investment Attraction Opportunities

SHB’s upcoming capital increase strategy is poised to propel the bank into the top 4 private banks by charter capital, solidifying its competitive edge through enhanced financial strength. Additionally, SHB is anticipated to join the FTSE Russell global equity index basket once Vietnam achieves its upgrade to emerging market status. These dual catalysts collectively fuel SHB’s potential for exceptional growth in the foreseeable future.

Unlocking Growth: Strategic Stock Picks for the Next Market Surge

The Vietnamese stock market is entering a new growth cycle, underpinned by a stable macroeconomic foundation and robust policy enhancements from regulatory authorities. This pivotal moment invites individual investors to reevaluate the role of equities as a sustainable wealth accumulation channel, aligning with the nation’s economic expansion.