New Regulations Proposed for Private Corporate Bond Offerings in Vietnam

|

The Ministry of Finance has announced proposed amendments to Decree No. 153/2020/NĐ-CP, which governs the issuance and trading of corporate bonds in Vietnam. These amendments, introduced through Decree No. 65/2022/NĐ-CP and Decree No. 08/2023/NĐ-CP, outline regulations for private placements, including investor eligibility, issuance conditions, procedures, documentation, approval processes, issuance methods, and disclosure requirements.

The current structure fails to differentiate between issuers subject to the Securities Law (public companies, securities firms, and investment fund management companies) and those governed by the Enterprise Law. To address this, the revised Chapter II of the draft decree will clearly separate regulations for these two groups, ensuring clarity and facilitating oversight by relevant authorities, in alignment with the Securities Law and Enterprise Law.

Chapter II of the draft decree is reorganized into five sections: General Principles; Private Placements by Non-Public Companies, Securities Firms, and Investment Fund Management Companies; Private Placements by Public Companies, Securities Firms, and Investment Fund Management Companies; Bond Registration, Custody, and Trading; and Bond Principal and Interest Payments.

Regulations on Investors Participating in Private Corporate Bond Transactions

Regarding the categorization of professional investors in private bond transactions, the Ministry of Finance notes that amendments to the Enterprise Law (Law No. 56/2024/QH15) and Securities Law (Law No. 76/2025/QH15) have redefined eligible professional investors. The Enterprise Law permits professional securities investors to participate in private bond transactions as per securities regulations. The Securities Law allows professional organizational investors to engage in all types of private bond transactions, while individual professional investors are restricted to bonds with credit ratings, collateral, or payment guarantees.

For public companies, securities firms, and investment fund management companies issuing convertible bonds, participation rules align with those for private equity placements, including strategic investors and both organizational and individual professional investors.

The draft decree proposes the following regulations to align with the Securities Law and Enterprise Law:

Non-public companies issuing private bonds (ordinary, convertible, or warrant-linked) to individual professional investors must ensure these bonds have credit ratings and either collateral or payment guarantees, as per Article 11 of the Securities Law (amended by Law No. 56/2024/QH15).

Public companies, securities firms, and investment fund management companies issuing convertible bonds to individual professional investors follow private equity placement rules (Article 31 of the Securities Law, amended by Law No. 56/2024/QH15). For ordinary or warrant-linked bonds, credit ratings and guarantees are required, as per Article 11 of the Securities Law.

Regarding investor commitment letters, the Ministry proposes that only individual professional investors be required to sign commitments acknowledging risk awareness and responsibility, while exempting organizational investors to reduce administrative burdens.

Bond Issuance Methods and Service Providers

The draft decree retains the four private bond issuance methods from Decree No. 153/2020/NĐ-CP: auction, underwriting, agency issuance, and direct sales by credit institutions. Issuers may choose the method best suited to their needs and must disclose this to investors.

Additionally, the decree standardizes issuance advisory services to enhance documentation quality, ensuring compliance with legal requirements. It also clarifies the responsibilities of issuers and advisors in private bond issuances.

– 08:25 27/11/2025

Unveiling a Wave of New Regulations in the Stock Market

New securities regulations aim to foster high-quality products, safeguard investors, and promote a sustainable stock market.

Vietnam’s Securities Regulator Outlines Market Development Roadmap Post-Upgrade

On October 16, 2025, the State Securities Commission (SSC) of Vietnam, in collaboration with the JICA Project, hosted a conference in Ho Chi Minh City titled “Dissemination of Amendments and Supplements to the Securities Law and Detailed Implementing Regulations” for the Southern region. During the event, a key question emerged regarding the policy direction for market development following FTSE’s upgrade of Vietnam’s market classification.

VBMA: Over VND 19.5 Trillion in Bonds Repurchased Prematurely in September

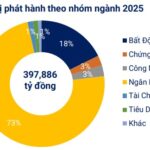

As of September 30, 2025, data compiled by the Vietnam Bond Market Association (VBMA) from the Hanoi Stock Exchange (HNX) and the State Securities Commission (SSC) reveals that 27 corporate bond issuance rounds have been conducted, totaling over 23.7 trillion Vietnamese dong.