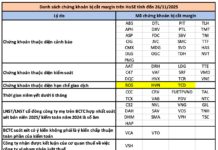

Pham Trung Kien, Chairman of the Board of Directors of Lam Dong Pharmaceutical Joint Stock Company (Ladophar, stock code: LDP, listed on HNX), has registered to sell 809,600 LDP shares to restructure his investment portfolio.

The transaction is expected to take place between November 25 and December 27, 2025. If successful, Mr. Kien’s holdings will decrease from 898,398 shares (6.74%) to 88,792 shares (0.7%). The sale will be conducted through both agreement and order-matching methods.

The Ladophar Chairman has been actively reducing his stake recently. Previously, from October 9 to November 5, 2025, he successfully sold only 275,400 out of the 1.085 million LDP shares he had registered, citing unfavorable market conditions as the reason for the incomplete transaction.

In other developments, Ladophar will hold an extraordinary shareholders’ meeting on December 10 to discuss several key issues, including: a plan to address accumulated losses, a rights issue to existing shareholders, and the addition of new business activities.

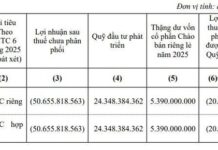

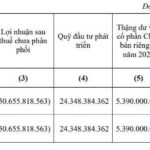

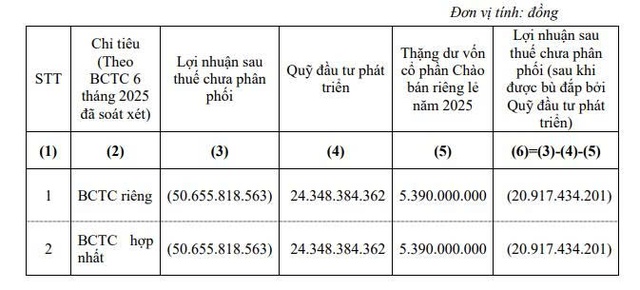

To address accumulated losses, the company plans to use its development investment fund and surplus capital from the 2025 private placement to offset the deficit. Additionally, asset liquidation will be undertaken to cover the losses.

Source: LDP

Regarding capital increase, Ladophar proposes issuing nearly 9.4 million shares to existing shareholders at a ratio of 2:1, allowing shareholders holding 2 shares to purchase 1 new share.

With an offering price of VND 10,000 per share, Ladophar expects to raise over VND 93.6 billion. The proceeds will be allocated as follows: VND 90 billion to address investment shortfalls in the LDP CO2 plant and/or repay loans from organizations/individuals, and the remaining VND 3.6 billion to supplement working capital.

The issuance is planned for 2026, pending approval from the State Securities Commission (SSC) for the private placement.

If the issuance is successful, Ladophar’s chartered capital will increase from nearly VND 187.3 billion to over VND 280.9 billion.

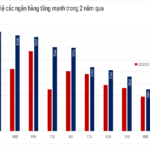

Dual Momentum: SHB’s Capital Raise Strategy and Foreign Investment Attraction Opportunities

SHB’s upcoming capital increase strategy is poised to propel the bank into the top 4 private banks by charter capital, solidifying its competitive edge through enhanced financial strength. Additionally, SHB is anticipated to join the FTSE Russell global equity index basket once Vietnam achieves its upgrade to emerging market status. These dual catalysts collectively fuel SHB’s potential for exceptional growth in the foreseeable future.

Unveiling the Two New ‘Capital Giants’ in the Banking Sector

In the coming period, two prominent banks are set to join the exclusive club of financial institutions with chartered capital surpassing the 50,000 billion VND threshold.

Ladophar Aims to Utilize Investment Fund and Surplus Capital to Address Accumulated Losses

At the upcoming extraordinary shareholders’ meeting, Ladophar will present a plan to utilize its development investment fund and surplus share capital from the 2025 private placement to reduce accumulated losses from nearly VND 50.7 billion to over VND 20.9 billion.