On November 29, at the HUBA Business Coffee program organized by the Ho Chi Minh City Business Association (HUBA) with the theme “Economic Forecast for 2026: Growth, Interest Rates, and Exchange Rates,” Mr. Vu Anh Khoa, Vice Chairman of HUBA and Head of the HUBA Business Coffee Executive Board, noted that one of the major concerns for many businesses is whether lending interest rates will rise alongside deposit rates. Additionally, there is significant pressure on exchange rates toward the end of 2025 and into 2026.

According to Dr. Can Van Luc, a member of the Prime Minister’s Policy Advisory Council, deposit interest rates have been trending upward recently. This comes as the State Bank of Vietnam maintains a stable operating interest rate of around 4.5% to stimulate economic growth.

Dr. Can Van Luc shares insights at the forum. Photo: Hoang Chuong

Dr. Can Van Luc discusses factors driving the increase in the USD/VND exchange rate.

The rise in deposit interest rates has multiple causes, including the attractiveness of alternative investment channels such as stocks, digital currencies, and startups.

As these alternative investments gain traction, the flow of idle funds into banks has not met expectations. Meanwhile, the banking sector is pushing for credit growth of approximately 16-17% this year. In the past 10 months, credit growth has already reached nearly 15%, indicating a high demand for capital.

“However, the Government and the State Bank of Vietnam have mandated that lending interest rates must not increase. As a result, banks will need to reduce costs and lower their net profit margins,” Dr. Luc explained.

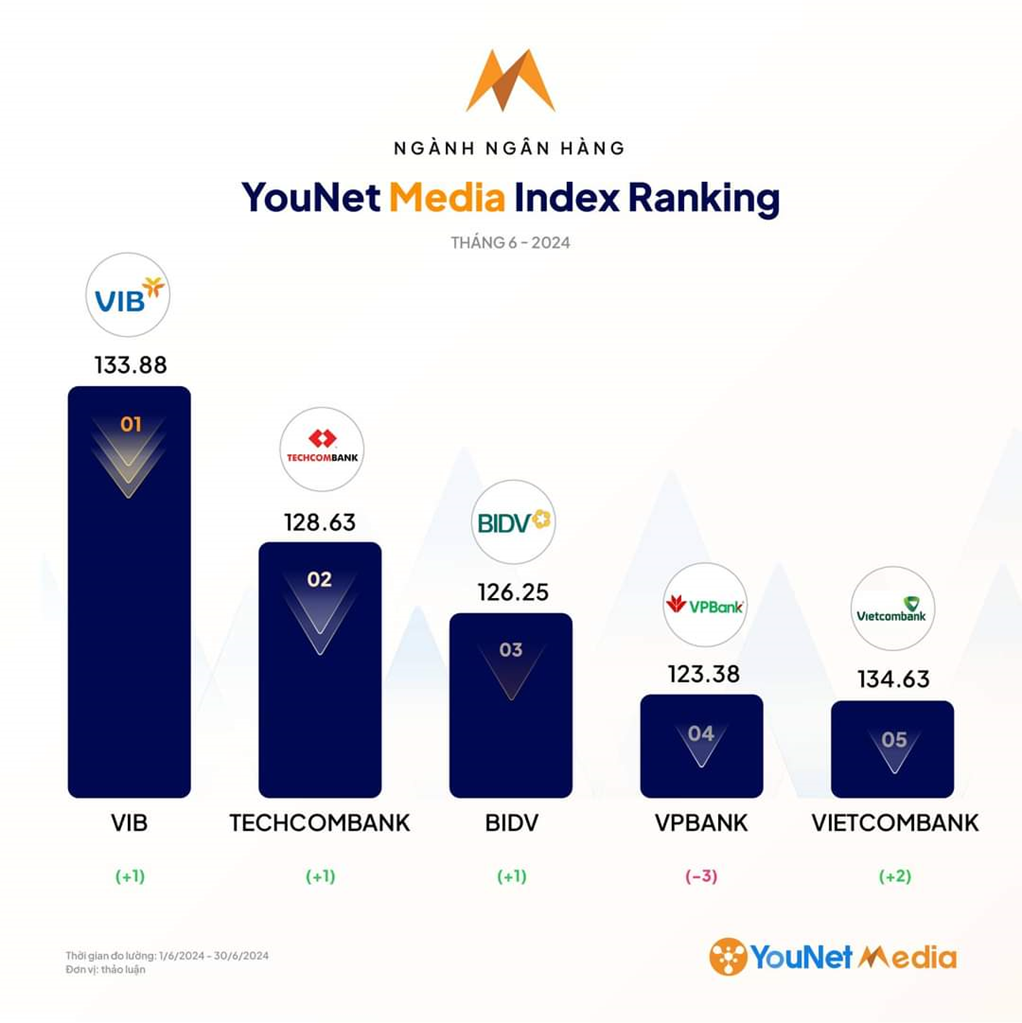

As reported by the People’s Labor Newspaper, since October, several banks have raised savings interest rates across various terms, including Nam A Bank, Techcombank, Vikki Bank, Cake by VPBank, BVBank, NCB, OCB, LPBank, and Kienlongbank.

Other banks, while not increasing interest rates, have launched promotional programs offering gifts and prizes to attract idle funds from the public.

Regarding the USD/VND exchange rate, over the past 11 months, it has increased by approximately 3.36%. Dr. Can Van Luc noted that foreign-invested enterprises (FDI) are particularly concerned about exchange rate fluctuations, not just domestic import-export businesses.

He attributed the recent rise in the exchange rate to various factors, including those related to gold. The Government has implemented decisive measures to stabilize this market.

Looking ahead, the licensing of additional commercial banks and enterprises to produce and import gold is expected to increase market supply and eliminate the monopoly of SJC gold bars.

Additionally, the anticipated rate cuts by the U.S. Federal Reserve (FED) in December and throughout 2026 are expected to ease pressure on the USD/VND exchange rate.

“In reality, the exchange rate in the free market has stabilized significantly over the past two weeks, and the official market rate has not increased as much as before,” Dr. Can Van Luc concluded.

Confidence Returns: Businesses See a Brighter Market Ahead

Amidst a stable market backdrop, accelerated public investment, robust export performance, and an expanding capital market, numerous economic experts forecast that 2026 will be an exceptionally favorable year for Vietnam’s economy.

Interest Rates Remain Stable to Bolster Year-End Business and Production Growth

With a stable macroeconomic environment, controlled inflation, and robust capital mobilization, financial institutions are poised to optimize costs and maintain competitive lending rates. This strategic approach empowers businesses by fostering growth in production, trade, and services, particularly during the critical year-end period.

New Bank Card Regulations: Mandatory In-Person Verification and Cash Withdrawal Limits

The State Bank has recently issued Circular 45, introducing stricter regulations for bank card issuance. These measures include mandatory in-person meetings, biometric verification, and cash withdrawal limits for credit cards.