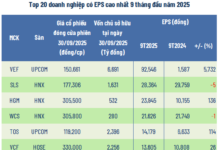

Highest EPS reaches 92,500 VND

According to data from VietstockFinance, which analyzed companies across all three exchanges (HOSE, HNX, UPCoM), there’s been a notable shift in the leader for 9-month EPS in 2025. Unlike SLS (Son La Sugar Joint Stock Company) in the same period last year, the top spot now belongs to a relatively new name—Vietnam Exhibition and Fair Centre Joint Stock Company (UPCoM: VEF).

Source: VietstockFinance

|

With a 9-month profit of 15,418 billion VND—the highest in the market and 58 times higher than the same period last year—VEF leads the market’s EPS ranking at 92,546 VND. This achievement is primarily due to a nearly 14,900 billion VND profit in Q1/2025 from transferring part of the Vinhomes Global Gate project and a significant increase in financial revenue from business partnerships.

Meanwhile, SLS dropped to second place with an EPS of 28,364 VND, a 5% decrease year-over-year, reflecting a profit decline due to reduced net revenue.

Another long-standing company in the top EPS group, Western Bus Station Joint Stock Company (HNX: WCS), maintained a steady EPS of 21,626 VND/share. Despite a 9% increase in 9-month net profit to 65 billion VND, WCS’s EPS remained unchanged as profit growth lagged behind the 20% increase in charter capital following a 5 million share issuance to shareholders.

Source: VietstockFinance

|

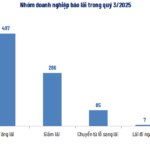

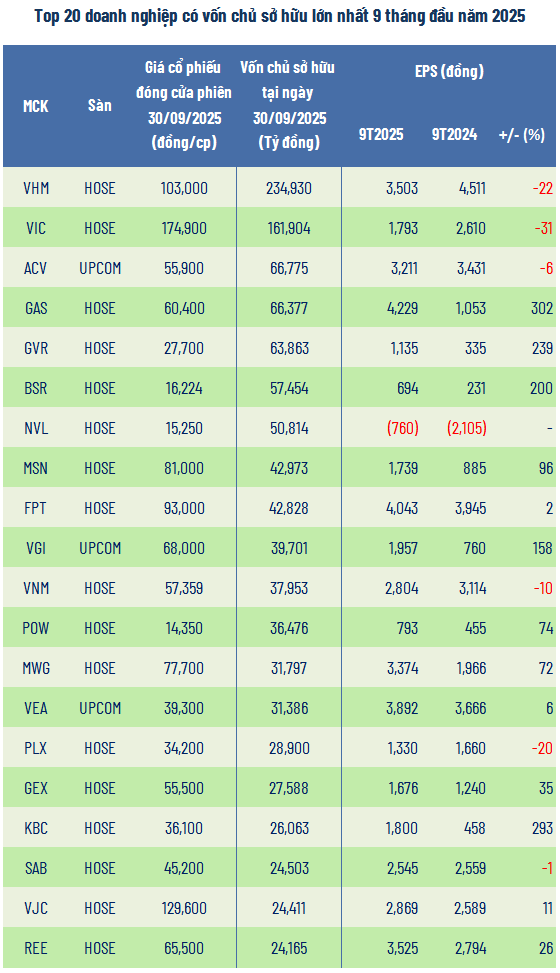

Among the top 20 companies by equity, only 7 reported declining EPS, and just 1 real estate company maintained a negative EPS.

Notably, despite their large equity, Binh Son Refining and Petrochemical Joint Stock Company (HOSE: BSR) and Petrovietnam Power Corporation (HOSE: POW) both recorded EPS below 1,000 VND. However, both saw significant EPS growth compared to the same period last year, thanks to substantial improvements in net profit.

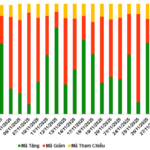

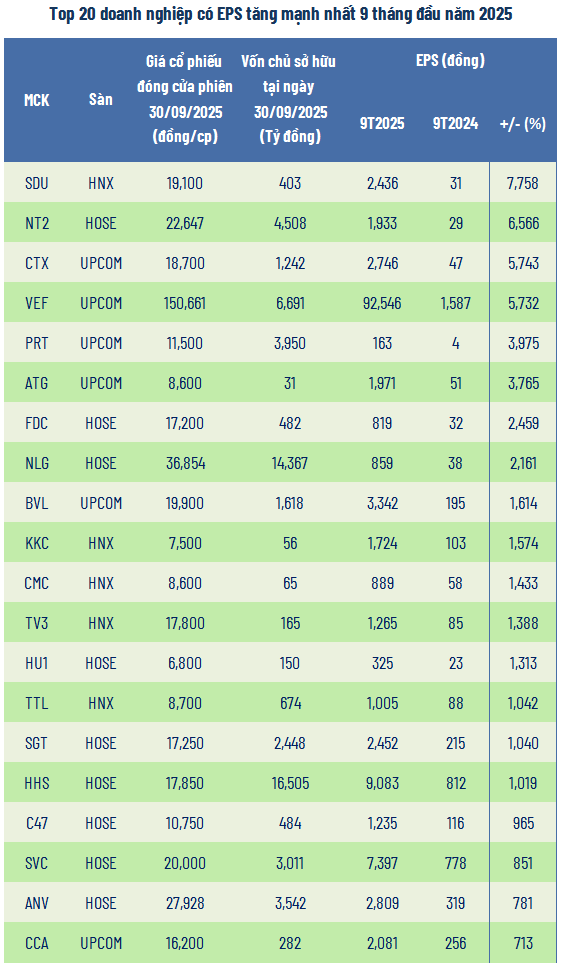

Soaring EPS

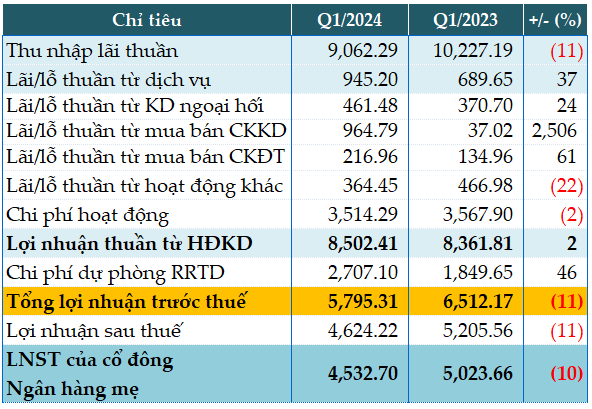

Source: VietstockFinance

|

Song Da Urban Development and Investment Corporation (HNX: SDU) saw the most impressive EPS growth—from just 31 VND in the first 9 months of 2024 to 2,436 VND in the same period this year, a 78.6-fold increase. This surge resulted from a 9-month net profit of nearly 49 billion VND, 78 times higher than last year, driven by a strong Q2 performance boosted by higher revenue and a provision reversal for investments in a subsidiary.

Nhon Trach 2 Power Joint Stock Company (HOSE: NT2) also reported a multi-fold EPS increase, reaching 1,933 VND compared to 29 VND last year. Over 9 months, NT2 posted a profit of over 577 billion VND, 69 times higher than last year, as the company no longer faced pressure from selling electricity below cost.

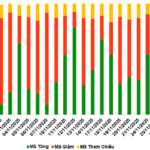

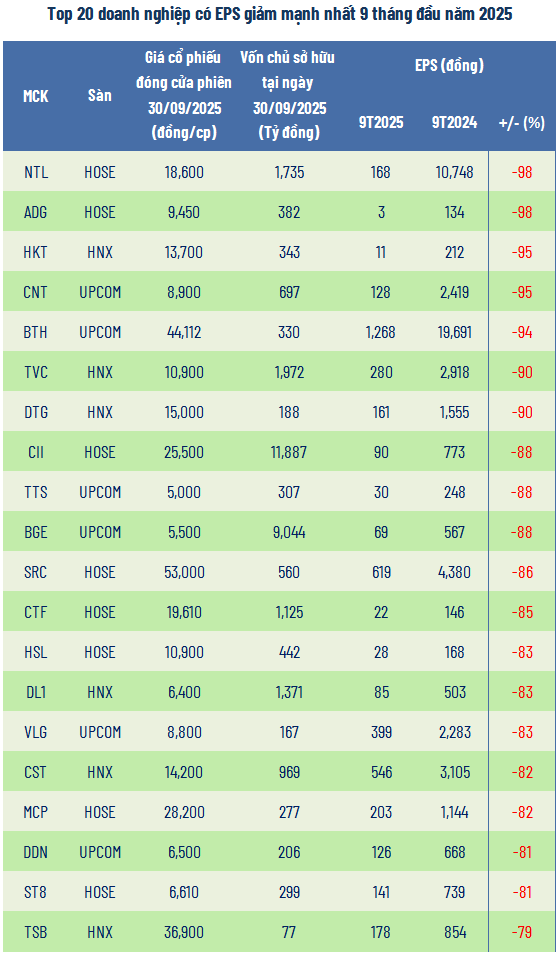

Shrinking EPS

Source: VietstockFinance

|

Conversely, Clever Group Joint Stock Company (HOSE: ADG) and Tu Liem Urban Development Joint Stock Company (HOSE: NTL) saw the sharpest profit declines, with 9-month net profits down 97% year-over-year.

ADG’s profit drop was due to high production costs and operating expenses, while NTL’s profit plummeted as it generated almost no revenue from core operations, as the company focused on completing investment and construction procedures for new real estate projects.

With a 97% profit decline, both companies’ EPS nearly vanished, dropping 98%. NTL, once among the market’s highest EPS companies, now stands at just 168 VND, while ADG fell to the market’s lowest EPS at 3 VND.

– 08:05 01/12/2025

9-Month Business Overview: Profit Growth Outpaces Revenue Surge

The Q3 and 9-month 2025 financial results of listed companies reveal a shifting growth narrative. While revenue remains important, net profit growth has outpaced it significantly, indicating that profitability is now the key driver. This growth gap stems from various factors, including cost-cutting measures and non-core income streams playing a more prominent role in overall performance.

November 27, 2025: Foreign Investors Return to Net Buying in Warrant Market

As the trading session closed on November 26, 2025, the market witnessed 186 stocks advancing, 63 declining, and 39 remaining unchanged. Foreign investors returned to net buying, with a total net purchase value of VND 676.73 million.