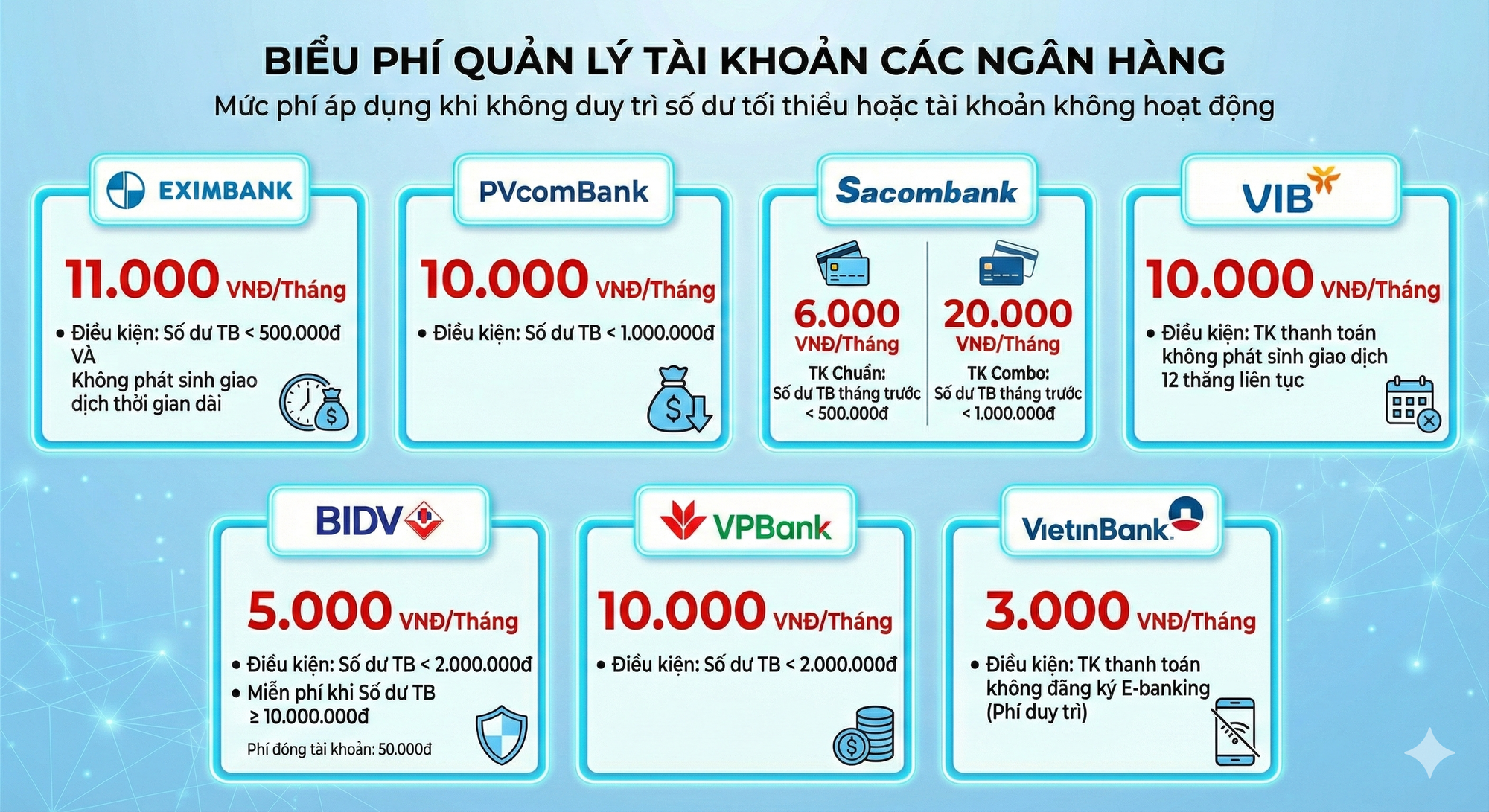

As reported by Nguoi Lao Dong newspaper, not only Eximbank and VIB have announced account management fees starting from December 2025, but several other banks are also charging similar fees for transaction accounts.

Many banks impose account management or maintenance fees based on the average monthly balance in the customer’s account.

PVcomBank charges a 10,000 VND account management fee for average balances below 1 million VND per month.

Sacombank applies a 6,000 VND monthly fee for accounts with average balances under 500,000 VND. For Combo accounts—including transaction accounts, payment cards, and automatic transaction alerts via Sacombank Pay—the fee is 20,000 VND if the previous month’s average balance falls below 1 million VND.

Account management fees across select banks. Banks waive fees for customers meeting specific balance requirements. Graphic: AI

BIDV charges a 5,000 VND monthly fee for transaction accounts with average balances below 2 million VND, waiving it for balances of 10 million VND or higher. Closing an account on-demand incurs a 50,000 VND fee.

VPBank levies a 10,000 VND monthly fee for accounts with average balances under 2 million VND.

VietinBank charges a 3,000 VND monthly maintenance fee for transaction accounts without ebanking services.

Other commercial banks, including TPBank, LPBank, and Vietcombank, also impose varying account management fees, waiving them for customers meeting balance criteria.

Transaction accounts are non-term deposit accounts used for services like transfers, cash withdrawals, bill payments, and more.

While some banks waive fees to encourage account openings and cashless payments, others maintain fixed charges.

For instance, account holders may face monthly fees for account closure requests, balance confirmations, statement copies, inter-provincial transfers within the same bank, counting fees, transaction verification, and cancellation fees.

A commercial bank executive noted that ensuring fast, secure digital banking requires significant investment in technology infrastructure, storage, security, and app maintenance. Banks also pay providers for each customer account.

Previously, Nguoi Lao Dong reported Eximbank’s 11,000 VND monthly fee for accounts with average balances below 500,000 VND and no recent activity, sparking public debate.

Many criticized fees for low-balance accounts, while banks advised customers to close unused accounts at branches to avoid unwanted charges.

What happens when you don’t use your credit card account? How do banks handle it?

After the story of the credit card that was used for 8.5 million VND but incurred a debt of 8.8 billion VND, the account without any transaction still charges an account management fee, many people are “encouraging each other” to close their bank accounts.

Surprising Charges for Unused Bank Accounts Leave Many Bewildered

To avoid incurring fees, users should proactively close unused payment accounts, credit card accounts, and any other financial services accounts that they no longer need. It is important to regularly review and assess one’s financial accounts to ensure they are still necessary and to minimize the risk of unauthorized access or fraudulent activity. By taking proactive steps to close unnecessary accounts, users can maintain better control over their finances and reduce the potential for unexpected fees or security breaches.