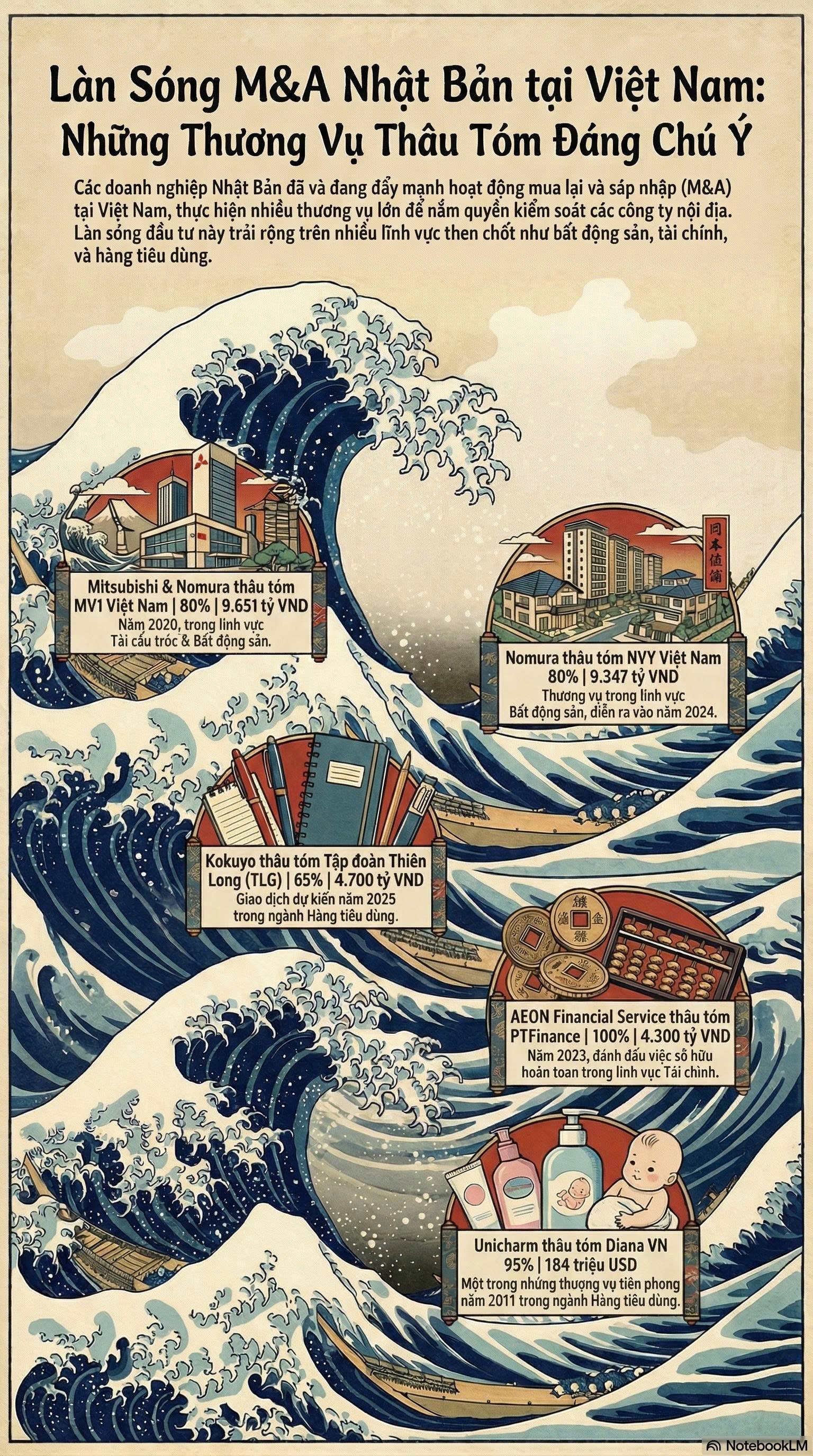

Over the past two decades (2008–2025), major Japanese conglomerates have consistently executed notable mergers and acquisitions (M&A), investing billions of USD into Vietnamese brands across various sectors. Many of these companies have made significant investments to gain controlling stakes in local enterprises.

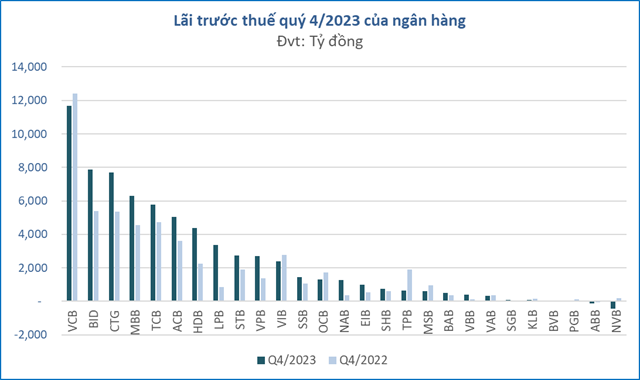

Finance, Banking, and Billion-Dollar Deals

The finance and banking sector has consistently attracted the largest share of Japanese investment.

In 2023, SMBC announced a 35.9 trillion VND investment (approximately 1.5 billion USD) to acquire a 15% stake in VPBank (VPB). VPBank will issue over 1.19 billion shares in a private placement to SMBC at an expected price of 30,159 VND per share.

All shares issued in this private placement to the foreign strategic investor will be subject to a 5-year transfer restriction from the date of registration with the Securities Depository Center.

Other major commercial banks have also seen significant Japanese involvement. In 2011, Mizuho Bank, one of Japan’s largest financial institutions, invested 567 million USD (11.8 trillion VND) to acquire a 15% stake in Vietcombank (VCB). This was one of the largest foreign investments in Vietnam’s banking sector at the time.

By 2019, Mizuho purchased an additional 16.7 million VCB shares to maintain its 15% ownership.

Similarly, in 2013, BTMU acquired a 20% stake in Vietinbank (CTG) for 743 million USD. Earlier, in 2008, SMBC had purchased a 15% stake in Eximbank for 225 million USD.

In consumer finance, SMBC acquired a 49% stake in FE Credit in 2021 for 1.4 billion USD. In 2023, AEON Financial Service fully acquired PTFinance for 4.3 trillion VND.

In the insurance sector, Sumitomo Life purchased an 18% stake in Bao Viet (BHV) in 2012 for 360 million USD and further invested over 4 trillion VND in 2019.

Consumer Goods, Food & Beverage, and Retail: Acquiring Local Brands

The consumer goods, food & beverage (F&B), and retail sectors have been prime targets for full acquisitions or controlling stakes.

A notable example is Unicharm’s 2011 acquisition of 95% of Diana Vietnam for 184 million USD.

Other full acquisitions include Earth Chemical’s 2017 purchase of A My Gia for 80 million USD, Morinaga Milk Industry’s 2021 acquisition of Elovi Vietnam, and Sojitz’s 2023 purchase of New Viet Dairy.

Retail giant Aeon established its presence by acquiring 49% of Citimart and 30% of Fivimart in 2015.

In the food sector, Ezaki Glico acquired an 11% stake in Kinh Do in 2012, Nichirei Food purchased 19% of Cholimex Food the same year, and Maruha Nichiro Corporation acquired 58% of Saigon Food in 2021.

Recently, on December 4th, Kokuyo Corporation announced plans to acquire Thien Long Group (TLG), Vietnam’s largest stationery manufacturer, through two transactions: purchasing shares and a public tender offer.

Kokuyo will first acquire all shares of Thien Long An Thinh (TLAT), which holds 46.82% of Thien Long, owned by the founder and associates. Subsequently, Kokuyo will publicly tender for an additional 18.19% of Thien Long’s shares.

The estimated value of the deal is 4.7 trillion VND. If successful, Kokuyo will own 65.01% of Thien Long, officially making it a subsidiary. Vietnam’s iconic stationery brand will thus come under foreign ownership.

Healthcare, Energy, and Logistics: Strengthening Supply Chains

Japanese investors have also made significant inroads into healthcare, energy, and logistics to strengthen supply chains and expand market presence.

In healthcare/pharmaceuticals, Taisho initially acquired a 24% stake in 2016 for 100 million USD and has since increased its ownership to 51.01%. In the same year, Zeria Pharmaceutical acquired 78% of FT Pharma.

In energy, JX Nippon Oil & Energy purchased a 9% stake in Petrolimex in 2016, alongside investments in PV GAS D (PGD) by Saibu Gas (21%) and Tokyo Gas Asia (25%). TEPCO Renewable Energy acquired 25% of VNPD (VPD) in 2022.

In logistics, ANA Holdings acquired a 9% stake in Vietnam Airlines in 2016 for 2.262 trillion VND, and Sagawa purchased 80% of Vinlinks the same year.

SSJ Consulting (Vietnam), a Sumitomo Corporation subsidiary, became a major shareholder of Gemadept in July 2019 after acquiring nearly 29.7 million GMD shares, equivalent to 10% of the company’s capital.

Recently, SSJ Consulting (Vietnam) registered to sell 10 million GMD shares to divest. The transaction is expected to take place via order matching and/or negotiation from December 8th to December 31st, 2025.

If successful, SSJ Consulting’s GMD holdings will decrease from nearly 29.7 million shares to 19.7 million shares, reducing its ownership from 6.96% to 4.62% of Gemadept’s capital.

Real Estate and Construction: A Playground for Giants

Japanese conglomerates have shown significant interest in Vietnam’s real estate, construction, and infrastructure development, often through substantial equity acquisitions.

A joint venture between Nomura and Mitsubishi acquired 80% of two entities: MV1 Vietnam Real Estate LLC and MV Vietnam Real Estate JSC.

Nomura further expanded its presence in 2024 by acquiring an 80% stake in NVY Vietnam Real Estate for 9.347 trillion VND.

Other notable deals include Toshin Development’s 2016 purchase of 70% of A&B Development, Samty’s 2020 acquisition of 90% of S-Vin Vietnam for 3.273 trillion VND, and Haseko Corporation’s 2020 purchase of 36% of Ecoba.

Vietnam’s Stock Market Diverges: King Stocks and VN-Index No Longer in Sync

Amidst the ongoing correction in the market’s largest-cap stocks, the VN-Index managed to maintain its upward trajectory in November. This divergence highlights that the market’s momentum is increasingly driven by sectors beyond banking, signaling a broader-based rally.

Prime Minister Urges Banking Sector to Channel Capital into Priority Areas, Cut Costs, and Leverage Technology to Lower Interest Rates

On the afternoon of November 24th, in Hanoi, Prime Minister Pham Minh Chinh attended and delivered a speech at the 9th Patriotic Emulation Congress of the Banking Sector (2025-2030), organized by the State Bank of Vietnam.