|

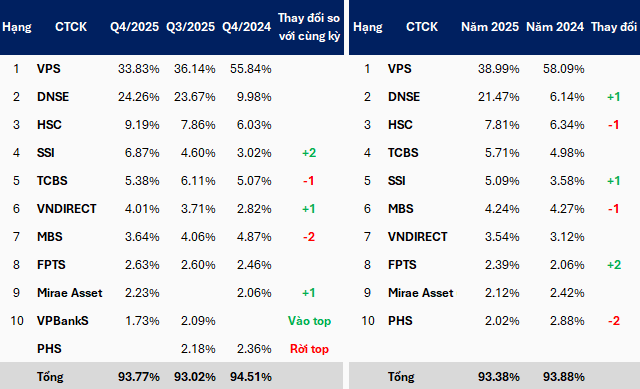

Top 10 Derivatives Brokerage Market Share in Q4/2025 and 2025

Source: HNX, compiled by the author

|

In Q4/2025, VPS Securities maintained its lead in the derivatives brokerage market, though its market share significantly narrowed compared to Q4/2024, dropping from 55.84% to 33.83%, indicating a noticeable slowdown.

Competition intensified as several brokerage firms demonstrated efforts to capture market share. Notably, DNSE surged from 9.98% to 24.26%, and Ho Chi Minh City Securities (HSC) rose from 6.03% to 9.19%, securing the second and third positions, respectively. SSI Securities also increased its market share from 3.02% to 6.87%, climbing two spots to fourth place.

Other firms improved their rankings, including VNDIRECT Securities, which moved up one spot to sixth, and Mirae Asset (Vietnam) Securities, which advanced one spot to ninth, both due to market share growth. Notably, VPBank Securities (VPBankS) maintained its position in the top 10 for the second consecutive quarter.

VPBankS has made a strong impression with its recent significant strides. In Q4/2025, the brokerage firm retained its top 10 market share on UPCoM, rose to the top 6 on HNX, and entered the top 10 on HOSE for the first time, ranking ninth.

In contrast, Techcombank Securities (TCBS) and MB Securities (MBS) saw declines, dropping one and two spots, respectively, due to reduced market share. Additionally, PHS Securities fell out of the top 10.

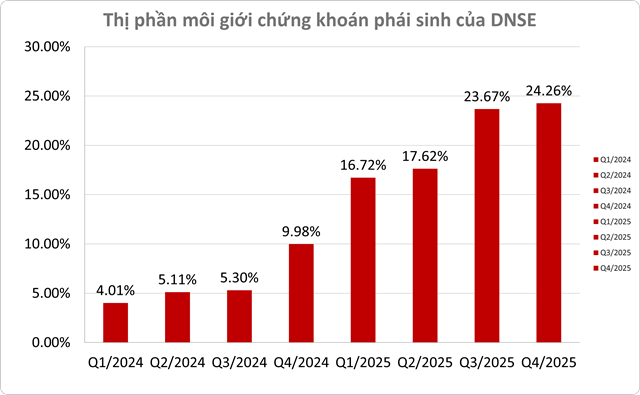

For the full year 2025, the top 10 derivatives brokerage market share saw no new entrants compared to 2024. However, similar to the trends in the final quarter and previous periods, the market share landscape is shifting, with VPS’s share plummeting from 58.09% to 38.99%. Conversely, the chasing group, particularly DNSE, experienced a remarkable rise from 6.14% to 21.47%.

DNSE has achieved a significant leap in the derivatives segment just 2.5 years after its launch, becoming a key business focus for this tech-driven brokerage firm.

Source: HNX

|

– 11:29 09/01/2026

How Will the HoSE Brokerage Market Share Fluctuate in 2025?

Among the top 3 brokerage firms leading the HoSE market share in 2025, VPS Securities appears to be lagging behind, while TCBS and SSI are surging ahead with remarkable momentum.