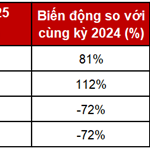

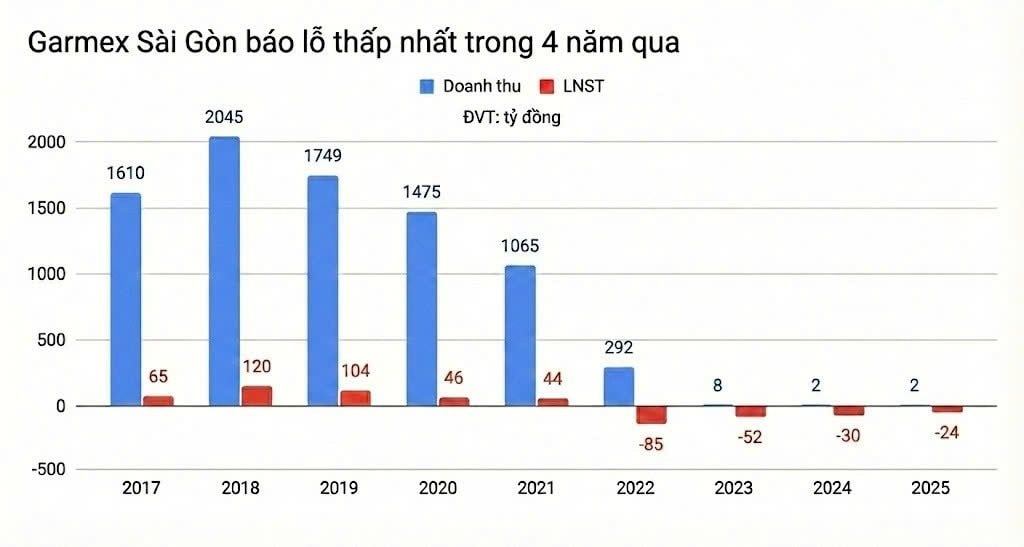

Garmex Saigon Joint Stock Company (stock code: GMC) has released its Q4/2025 financial report, revealing a net revenue of VND 486 million and a net loss exceeding VND 3 billion.

This marks the seventh consecutive quarter of losses for Garmex Saigon in 2025, extending its streak of unprofitable years to four. For the full year 2025, GMC reported a net loss of nearly VND 24 billion, a slight improvement from the VND 30 billion loss in 2024, but still the lowest since 2022–2025, indicating a prolonged decline.

In 2025, GMC’s net revenue reached over VND 1.8 billion, a 14% drop compared to the previous year. This is a stark contrast to its peak in 2020, when revenue was approximately VND 1,500 billion.

Revenue breakdown shows that nearly two-thirds of income comes from transactions with VinaPrint JSC (VPR), primarily from leasing land for a pickleball court—a new revenue stream in 2025, averaging over VND 3 million daily.

In 2025, administrative expenses totaled VND 32.3 billion, a 29% decrease year-over-year, yet still far exceeding revenue.

By year-end 2025, accumulated losses rose to nearly VND 128 billion, and equity fell below VND 342 billion. GMC maintained bank deposits of nearly VND 70 billion, with a significant shift to term deposits over three months. Long-term deposits increased to over VND 56 billion, up from VND 680 million at the start of the year, primarily due to term adjustments at Eximbank and MB Bank.

Inventory remained largely unchanged at approximately VND 109 billion, with over 98% being finished goods and nearly VND 15 billion in price depreciation reserves.

Garmex Saigon’s decline is attributed to the loss of orders from Gilimex, a key manufacturing partner now embroiled in a prolonged dispute with Amazon. Since May 2023, Garmex Saigon has halted apparel production, pivoting to new revenue sources, with pickleball court rentals becoming a primary focus.

– Cost reduction.

– Disposal of unused assets.

– Monitoring and accelerating partner deliveries.

– Urging Phu My JSC to complete the Phu My housing project for sale and capital recovery.

– Operating a pharmacy at 213 Hong Bang.

– Leveraging existing company properties.

DNSE Sets New Record in Margin Loan and Advance Payment Debt

DNSE has unveiled its Q4 and full-year 2025 financial results, marking a year of unprecedented achievements. In 2025, the company recorded a remarkable revenue of over 1.467 trillion VND, a 77% surge year-on-year. Pre-tax profit soared to more than 340 billion VND, while post-tax profit exceeded 272 billion VND, reflecting a 50% increase compared to 2024. Additionally, outstanding margin loans and advance payments for securities reached a new high of over 5.832 trillion VND.

Đất Xanh Services Offers Full Equity Transfer of Đất Xanh Miền Nam

The Board of Directors of Dat Xanh Services has approved the plan to transfer all shares in Dat Xanh Mien Nam.

How Does Ha Long Canned Food Company Operate, and Who Is Managing It?

Founded in 1957, Ha Long Canned Food Joint Stock Company stands as one of Vietnam’s oldest and most esteemed canned food producers, renowned for its signature pâté, canned meat, and canned fish products.