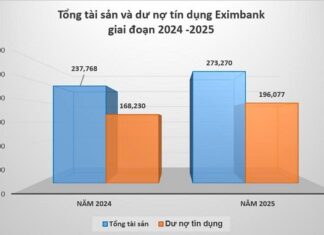

Eximbank Reports Over 1.5 Trillion VND in Profit, Prioritizing Risk Provisions During Transition Phase

The year 2025 marks a pivotal and decisive turning point for Eximbank. Rather than pursuing short-term growth metrics, the bank has strategically prioritized cleaning up its balance sheet and investing heavily in comprehensive restructuring.

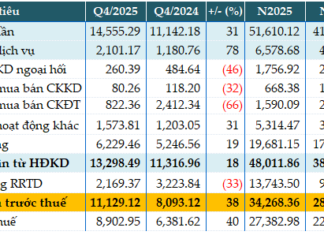

MB Targets 18% Pre-Tax Profit Growth by 2025 as Credit Surpasses 1 Million Billion...

In 2025, Military Commercial Joint Stock Bank (MB, HOSE: MBB) reported pre-tax profits exceeding VND 34,268 billion, marking an 18% year-on-year increase. This impressive growth is attributed to the bank's robust core operations and a significant rise in service revenue, as reflected in its consolidated financial statements.

BAOVIET Bank 2025: Strengthening the Foundation for Growth

Amidst the turbulent financial landscape of 2025, BAOVIET Bank (Bank for Foreign Trade of Vietnam) has demonstrated remarkable resilience and growth. The bank’s performance is highlighted by its expanded asset portfolio, robust capital mobilization, and a strategic restructuring approach focused on safety and sustainability.

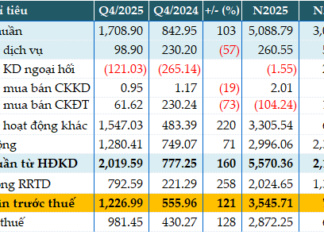

ABBank Profits Surge Ahead of New Brand Identity Launch

An Binh Commercial Joint Stock Bank (ABBank, UPCoM: ABB) has reported a remarkable pre-tax profit of nearly VND 3.546 trillion for 2025 in its consolidated financial statements, marking a 4.5-fold increase compared to the previous year and surpassing 97% of its annual target. Notably, the bank’s non-performing loans (NPLs) saw a significant improvement, decreasing by 73% from the beginning of the year, resulting in an NPL ratio of less than 1%.

OCB Unveils a Fusion of Traditional and Modern Music at “Confident Tet”

Embark on a unique journey fueled by inspiration and ambition, celebrating the cultural richness, landscapes, and people of Vietnam through every musical masterpiece. This Tet, Orient Commercial Joint Stock Bank (HOSE: OCB) takes on the role of a “matchmaker,” blending traditional and contemporary melodies in a groundbreaking musical extravaganza titled “Confident Tet.” For the first time ever, this spectacular event will grace the Nguyen Hue Pedestrian Street on January 25, 2026.

MSB Reports Pre-Tax Profit of Over VND 7,058 Billion in 2025, Driven by Significant...

The consolidated financial report reveals that Maritime Bank (HOSE: MSB) achieved a pre-tax profit of over 7,058 billion VND, marking a 2% increase compared to the previous year. Notably, the CASA ratio rose from 26.4% to 28.9%.

2025: NAPAS Transactions Surge by 24% in Volume, 8% in Value

On January 20th, the National Payment Corporation of Vietnam (NAPAS) successfully hosted the "2026 Task Deployment Conference," marking a significant step forward in the company's strategic planning and operational goals for the upcoming year.

“Revitalize Old Batteries, Nurture a Greener Earth” – OCB Continues to Spread Positive Living...

Building on the success of Phase 1, which saw nearly 5,000 kg of used batteries collected and processed nationwide, Orient Commercial Joint Stock Bank (HOSE: OCB) has officially launched Phase 2 of the OCB Pin Hunter campaign, expanding to nearly 200 collection points. Committed to fostering green transaction hubs and promoting a positive lifestyle, this initiative aims to enhance environmental awareness and contribute to a sustainable community and society.

2025 Pre-Tax Profit Stagnates, Vietcombank’s NPL Ratio Improves

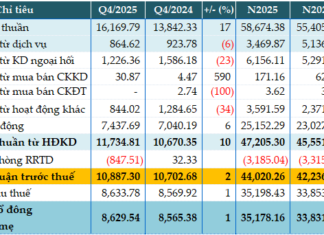

Vietcombank (HOSE: VCB) has reported a pre-tax profit of over VND 44,020 billion in its latest consolidated financial statement, marking a 4% increase compared to the previous year. This growth is primarily driven by a significant rise in non-interest income. Notably, the bank’s non-performing loans (NPLs) decreased by 31% at year-end compared to the beginning of the year.

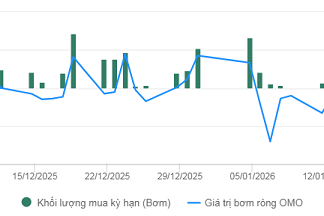

Central Bank Maintains Net Inflow Momentum in Open Market Operations

System liquidity continued to be tightened by the State Bank of Vietnam (SBV) during the week of January 19-26, as new injections were limited while a significant volume of forward contracts matured.