Unveiling the Masterminds: The Arrest of the Trio Behind Over 1,000 Scams in Just...

Between September 2023 and July 2024, a series of scams were perpetrated, with over 1,000 cases reported. The scammers targeted individuals in Ha Tinh and across the nation, resulting in significant financial losses for their victims.

What Are the Benefits of Short-Term Savings?

"Despite the low-interest rates, short-term savings deposits are still a popular choice for customers with active capital. This is because short-term savings provide a safe and liquid option for those who need quick access to their funds, without compromising on the security of their principal amount."

The Golden Opportunity: Unveiling the Latest SJC Gold Prices and Beyond

The morning of August 16th witnessed a stagnant gold price in the domestic market, with no significant changes from the previous day. While the selling price of SJC gold remained at 80 million VND per tael, the gold ring price hovered just below 78 million VND per tael.

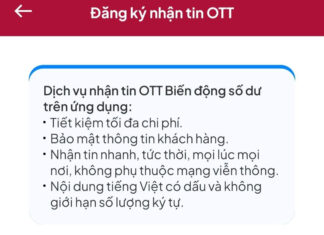

“Not All Banks Offer Free Balance Alerts on Their Apps: A Major Player Charges...

To avoid incurring additional charges for SMS banking, many customers are opting to use in-app notification services offered by banks. However, it's important to note that not all banks provide this service free of charge.

“Quality Payments – Boost Back-to-School Vibes” with Sacombank’s Exclusive Offers

From August 15 to October 31, 2024, Sacombank is offering a special back-to-school promotion, “Pay with Style, Boost Your School Mood,” with discounts of up to 50% for parents, students, and educators across Vietnam. This exciting opportunity encourages users to pay their tuition fees via the Sacombank Pay app and purchase academic supplies with their Sacombank cards, making the new academic year more affordable and accessible for all.

A Bank Successfully Blocks Hundreds of Money Transfer Scams This Year

Scam artists typically pose as officials from law enforcement, prosecution, or judicial agencies, contacting unsuspecting individuals via phone or social media. Their modus operandi involves threatening unsuspecting individuals and demanding money transfers under the guise of assisting an investigation.

“Commercial Banks Need to Plot a Course for Compliance: Navigating Shareholding Ratios.”

The State Bank is drafting a circular on commercial banks with shareholders, and related parties, who own shares exceeding the ratio stipulated in Clause 55 of the Law on Credit Institutions No. 47/2010/QH12. This has been amended and supplemented with certain provisions under Law No. 17/2017/QH14. The focus is on constructing and implementing a roadmap to ensure compliance with the provisions set out in the Law on Credit Institutions No. 32/2024/QH15.

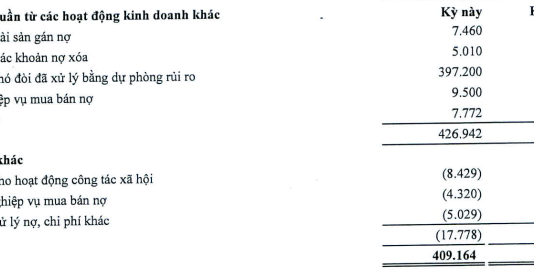

The Best Place to Save Your 400 Million VND for a 6-Month Term with...

"With interest rates on 6-12 month fixed deposits now surpassing 5% per annum, those with idle funds are turning back to savings accounts as a safe and lucrative option. "

“Revolutionizing Social Housing: Exploring Vietnam’s New 30,000 Billion VND Credit Package”

"The Prime Minister has instructed the Ministry of Construction to take the lead in collaborating with other relevant ministries and agencies to devise a VND 30,000 billion package for social housing. This package will be entrusted to the Vietnam Social Policy Bank for implementation, with the aim of providing much-needed support for social housing initiatives."

The Great Bank Exodus: When Top Dogs Leave Their Posts

The "hot seat" at various banks has seen a recent exodus of top bosses, as they step down from their powerful positions.