Prime Minister: Exploring the Creation of a 30,000 Billion VND Credit Package to Implement...

"Prime Minister Pham Minh Chinh has directed the research and development of supplementary credit support policies for households with a median standard of living engaged in agriculture, forestry, fisheries, and salt production. This includes a proposed package of 30,000 billion VND in loans for purchasing, renting, leasing, constructing, or renovating homes to implement social policies. The policies will be entrusted to the Vietnam Bank for Social Policies for effective implementation of housing credit strategies."

The Unexpected Turn of Events in the “Free” Gold Bar Market

The SJC gold bar and ring prices remain steady despite a slight dip in global prices.

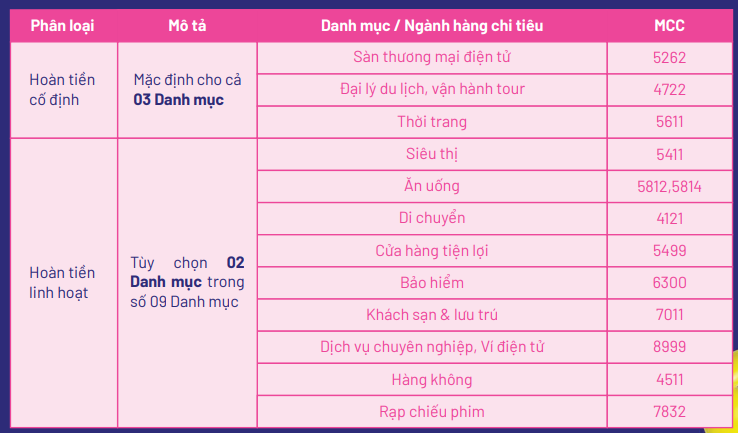

Tightening the Reins: A Credit Card Company’s New Cashback Policy

Our new refund policy comes into effect from the September 2024 billing cycle onwards.

Add a Reverse Mortgage, Cut Savings Rates from Today Aug 14

Previously, SeABank also reduced interest rates on all term deposits by 0.25% per annum across the board.

The Power of Saving: How Loose Change Can Add Up to a Fortune

With diligent savings, you can amass a small fortune over time. Even those seemingly insignificant coins and notes can amount to a substantial sum, reaching tens of thousands, if not millions, in a year. It's no joke - start saving today and watch your wealth grow!

Accelerating Digital Transformation and Enhancing Asset Quality

In the first half of 2024, Orient Commercial Joint Stock Bank (HOSE: OCB) embarked on a significant digital transformation journey, laying the groundwork for future acceleration. The highlight of this period was the launch of their cutting-edge digital banking platform, OCB OMNI 4.0. Alongside this strategic shift, the bank remained committed to enhancing the quality of its assets and strengthening its provisioning buffers, navigating the challenges of high non-performing loans prevalent in the industry.

The Perfect Script: Navigating Bad Debt in a Stagnant Property Market

As the cushion of provisioned bank non-performing loans thins and with less than five months remaining until Circular No. 02 comes to an end, the scenario for non-performing loans heavily relies on the recovery of credit demand and the liquidity of the real estate market.

“Ho Chi Minh City’s Credit Growth Surges: Up 11.47% in the First Seven Months”

As of the end of July 2024, total credit outstanding in Ho Chi Minh City reached VND 3.68 quadrillion, a slight decrease from the previous month (down 0.09%) but a significant year-over-year increase of 11.47%.

Maximizing Your Bank Interest: The Ultimate Guide

"Maximizing your savings interest rate is paramount when you're looking to simply save money rather than invest it. It's a key concern for those wanting to make the most of their hard-earned cash."

The Best Place to Save Your 500 Million VND for a 12-Month Term: Maximizing...

Many banks have once again adjusted their deposit interest rates, with a notable increase in the 12-month fixed deposit rate compared to previous periods.