Crude oil prices drop 2%

Crude oil prices fell over 2%, following reports of no ceasefire agreement between Israel and Hamas and after a power outage forced a major US oil refinery to shut down.

At the close of trading on February 1, Brent crude oil dropped $1.85, or 2.5%, to $78.7 per barrel, while West Texas Intermediate crude oil fell $2.03, or 2.7%, to $73.82 per barrel.

US manufacturing activity remained stable in January 2024, with new orders increasing, but inflation at the factory gate rose.

Natural gas prices hit 9-month low in the US

Natural gas prices in the US dropped 2% to the lowest level in 9 months, due to forecasts of warmer than usual weather until mid-February 2024, reducing heating demand.

March 2024 natural gas futures on the New York market fell 5 US cents, or 2.4%, to $2.05 per mmBTU – the lowest since April 13, 2023.

Gold prices reach near 1-month high

Gold prices rose to the highest level in nearly a month, after data showed an increase in US jobless claims last week, while the market turned its attention to US nonfarm payrolls data for clues about the US Federal Reserve’s policy path.

Spot gold on the LBMA market rose 0.9% to $2,054.89 per ounce – the highest since January 3, 2024, at the start of the trading session. April 2024 gold futures on the New York market rose 0.2% to $2,071.1 per ounce.

Copper prices decrease

Copper prices in London fell due to reduced expectations of a US interest rate cut in March 2024 and increased sales volume as copper prices fell below $8,600 per ton, but the decline was limited by tight supply, a weaker US dollar, and positive data from China.

Three-month copper futures on the London market fell 0.8% to $8,528 per ton.

Copper prices have remained unchanged this week after rising to a 1-month high ($8,704.5 per ton) and then declining as the US Federal Reserve pushed back the idea of an interest rate cut in early March 2024.

Iron ore prices on the Dalian Exchange and steel decrease

Iron ore prices on the Dalian Exchange fell, while iron ore prices in Singapore rose, as investors reassessed demand prospects in the leading consumer – China – amid asset crisis and stimulus efforts.

May 2024 iron ore futures on the Dalian Exchange fell 0.36% to 968 CNY ($134.79) per ton – the third consecutive session decline.

Meanwhile, March 2024 iron ore futures on the Singapore Exchange rose 1.09% to $131.2 per ton.

On the Shanghai market, rebar steel prices fell 0.69%, hot-rolled coil steel prices fell 0.52%, stainless steel prices decreased 1.65%, and steel coil prices fell 0.44%.

Rubber prices decline in Japan

Rubber prices in Japan fell, influenced by weak Asian production data and declining vehicle output.

July 2024 rubber futures on the Osaka market fell 1.4 yen, or 0.49%, to 283.6 yen ($1.93) per kg.

At the same time, the May 2024 rubber futures on the Shanghai market fell 140 CNY to 13,385 CNY (1,863.89 USD) per ton.

The February 2024 rubber futures on the Singapore market fell 0.33% to 152.4 US cents per kg.

Coffee prices rise in Vietnam, decline in Indonesia and London

Coffee prices in Vietnam increased due to slow trading ahead of the Lunar New Year holiday, while coffee prices in Indonesia declined.

Vietnam’s exported robusta coffee prices (grade 2, 5% black & broken) were offered at a premium of $160 per ton against the May 2024 futures contract on the London market. In the domestic market, raw coffee beans were sold at prices of 79,100-80,000 VND ($3.24-3.28) per kg, up from 73,000-75,000 VND/kg the previous week.

In the first two weeks of January 2024, Vietnam exported 96,000 tons of coffee, up 4.2% compared to the same period last year. Coffee export turnover in the first two weeks of January 2024 increased by 40% to 283 million USD.

In Indonesia, grade 4 robusta coffee prices (80 defects) were offered at a premium of 480-490 USD per ton against the March 2024 futures contract on the London market.

In London, March 2024 robusta coffee futures fell $18, or 0.5%, to $3,287 per ton.

In New York, March 2024 arabica coffee futures were unchanged at $1.942 per pound.

Sugar prices decline

March 2024 raw sugar futures on the ICE Exchange fell 0.57 US cents, or 2.4%, to 23.56 US cents per pound, falling back from a 7-week high of 24.62 US cents per pound in the previous week.

Meanwhile, March 2024 white sugar futures on the London market fell 2.1% to 652.2 USD per ton.

Soybean and corn prices decline, wheat increases

Soybean prices in the US fell 1.5% due to disappointing weekly US export sales data, along with competition from Brazil – where soybean production is increasing.

On the Chicago Exchange, March 2024 soybean futures fell 19 US cents to $12.0314 per bushel. March 2024 corn futures fell 1 US cent to $4.4714 per bushel, while March 2024 wheat futures rose 6-14 US cents to $6.015 per bushel.

Rice prices rise in Vietnam and India, decline in Thailand

The price of rice exports from India rose to a record high, driven by tight supply and increased demand due to high prices in other centers, while rice prices in Thailand fell due to abundant supply from new harvests.

In India – the top rice exporter, 5% broken rice was offered at $537-546 per ton, higher than the $533-542 per ton offered the previous week.

For 5% broken rice, Vietnamese rice prices were at $635-640 per ton, up from $630 per ton the previous week.

In Thailand, 5% broken rice was offered at $640-658 per ton, lower than the $655 per ton offered the previous week.

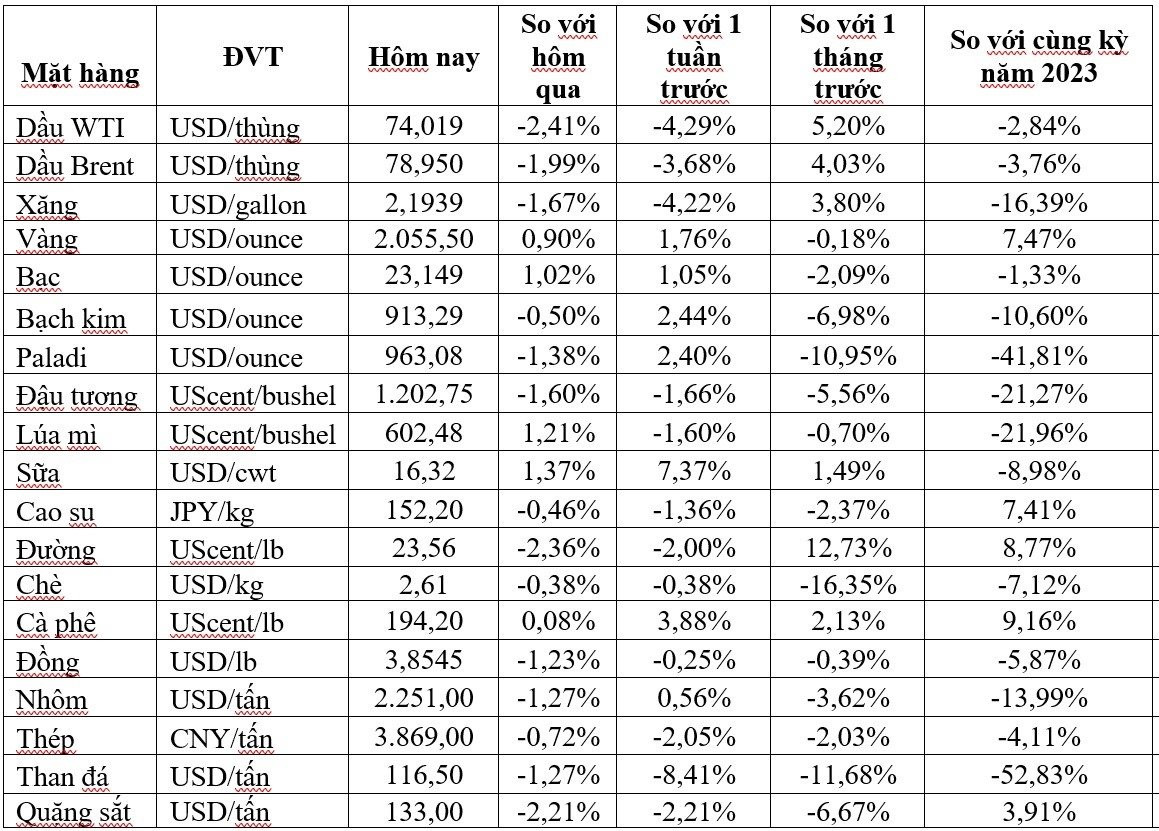

Key commodity prices as of February 2, 2024

At the same time, July 2024 rice futures on the Osaka market fell 1.4 yen, or 0.49%, to 283.6 yen ($1.93) per kg.

The May 2024 rice futures on the Tokyo market fell 140 CNY to 13,385 CNY (1,863.89 USD) per ton.

February 2024 rice futures on the Singapore market fell 0.33% to 152.4 US cents per kg.

Some key morning prices on February 2

+