With the above achievements, while many businesses are cutting labor to save costs, TNG still maintains employment and stable income of 9.4 million VND/person/month for 18,000 workers.

TNG presents 50 gifts to workers at TNG Phu Binh Factory on the occasion of Tet holiday

|

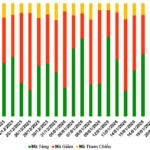

By the end of January 2024, the consumption revenue of TNG Investment and Trading Joint Stock Company (HNX: TNG) is estimated at 523 billion VND, an increase of 126 billion VND compared to the same period last year (equivalent to an increase of 31.7%). This is also the highest January revenue of the company in the past 5 years, since 2020.

To achieve these results, TNG has signed export orders with many partners such as Decathlon, Columbia, The Children’s Place, Sportmaster, Costco, Nike, Adidas…

|

January revenue of TNG from 2020-2024

(Unit: Billion VND)

Source: TNG

|

In reality, TNG has maintained its revenue scale, with a promising growth rate even during the most difficult period. Last year, the company achieved its revenue target 16 days ahead of schedule. Many subsidiaries of the company have completed their annual plans ahead of time.

Specifically, by the end of 2023, TNG’s revenue reached 7,096 billion VND, an increase of 5% compared to 2022, and it is the highest record in its operational history. However, with high cost of goods, combined with the burden of expenses, the company’s net profit decreased by 23% to 226 billion VND, achieving only 76% of the annual profit target.

In Q4/2023, net revenue reached 1,654 billion VND and net profit was over 56 billion VND, an increase of 9% and a decrease of 5% respectively compared to the same period. Gross profit margin remained at 15%.

|

Record revenue chain of TNG from 2021-2023 |

By the end of 2023, TNG’s total assets reached 5,251 billion VND, a slight decrease of 41 billion VND compared to the beginning of the year. Cash and bank deposits decreased by over 200 billion VND to 299 billion VND; inventory decreased by nearly 400 billion VND, reaching 888 billion VND and accounting for 1/3 of the total, mostly finished products.

On the other side of the balance sheet, TNG’s payable debts reached 3,390 billion VND, a decrease of over 250 billion VND compared to the beginning of the year. Total borrowings decreased slightly to over 2,600 billion VND, of which short-term financial borrowings accounted for 1,819 billion VND. In 2023, the company’s interest expenses were nearly 325 billion VND, an increase of 16%.

In terms of operations, TNG is restructuring its business areas to concentrate on the core textile sector. The company announced the dissolution of TNG Golf Yen Binh Limited Liability Company, stating that it is no longer suitable for the company’s needs. This is a company in which TNG is a member and has contributed capital.

In Q3/2023, TNG dissolved 2 subsidiaries, including TNG Fashion and TNG Eco Green, in order to narrow down the retail fashion business segment that has not generated consistent revenue in the past.

Currently, TNG is actively accelerating the implementation of the printing factory project and technology factory in Son Cam 1 Industrial Park, aiming to fulfill ODM orders.