According to Nikkei Asia, the price of natural rubber in the world has reached its highest level in nearly three years due to increased demand from China’s electric vehicle industry and a seasonal shortfall in Thailand, the leading country in tire production material. Vietnam is also among the top 3 countries in the rubber industry.

In the trading session on February 1st, natural rubber in futures contracts traded at 283.60 yen ($1.93)/kg on the Osaka Exchange, up 11% from the end of 2023. Previously, the rubber price reached 289.50 yen/kg on January 25th, the highest level since February 2021.

The driving force behind this rally is the surge in car sales in China. In the first half of last year, new car sales were only around 2 million units/month, according to the China Association of Automobile Manufacturers (CAAM).

However, in November 2023, sales surged 27.4% compared to the same period last year to reach 2.97 million units, and continued to rise 23.5% to 3.15 million units in the following month. In particular, sales of new energy vehicles, including electric cars, exceeded 1 million units for the first time in November last year.

The increase in car sales has pushed up the demand for natural rubber. In December 2023, tire demand for new cars in China increased by 30% compared to the same period in 2022, according to tire manufacturer Michelin.

In addition to increasing demand, the natural rubber market is also being driven by tightening supply. Heavy rain in December 2023 in Thailand, the world’s leading natural rubber producer, has affected the crop. In Southeast Asia, the period from November to January is usually the high-yield season for rubber trees.

Gu Jiong, head of the corporate service and investment division at Yutaka Trusty Securities, said that due to the impact of severe weather this year, rubber growers in Thailand were unable to increase production enough during this peak season. On February 1st, the futures rubber price in Thailand reached its highest level in 19 months at 73.07 baht ($2.06)/kg.

The seasonal shortfall in Thailand has tightened stockpiles in Japan. As of January 20th, warehouses belonging to the Osaka Exchange had 6,240 tons of natural rubber, much lower than the usual level at that time of year of around 10,000 tons.

Rubber prices are expected to remain high until the low-yield season in Southeast Asia, which lasts from February to April, ends. Meanwhile, according to CAAM, China’s car sales are forecast to increase to around 31 million units this year.

In the Vietnamese market, from the beginning of January 2024 until now, the price of raw rubber in many provinces and cities across the country has remained stable compared to the end of 2023. At rubber companies, the current purchase price of raw rubber is maintained around 270-305 dong/TSC.

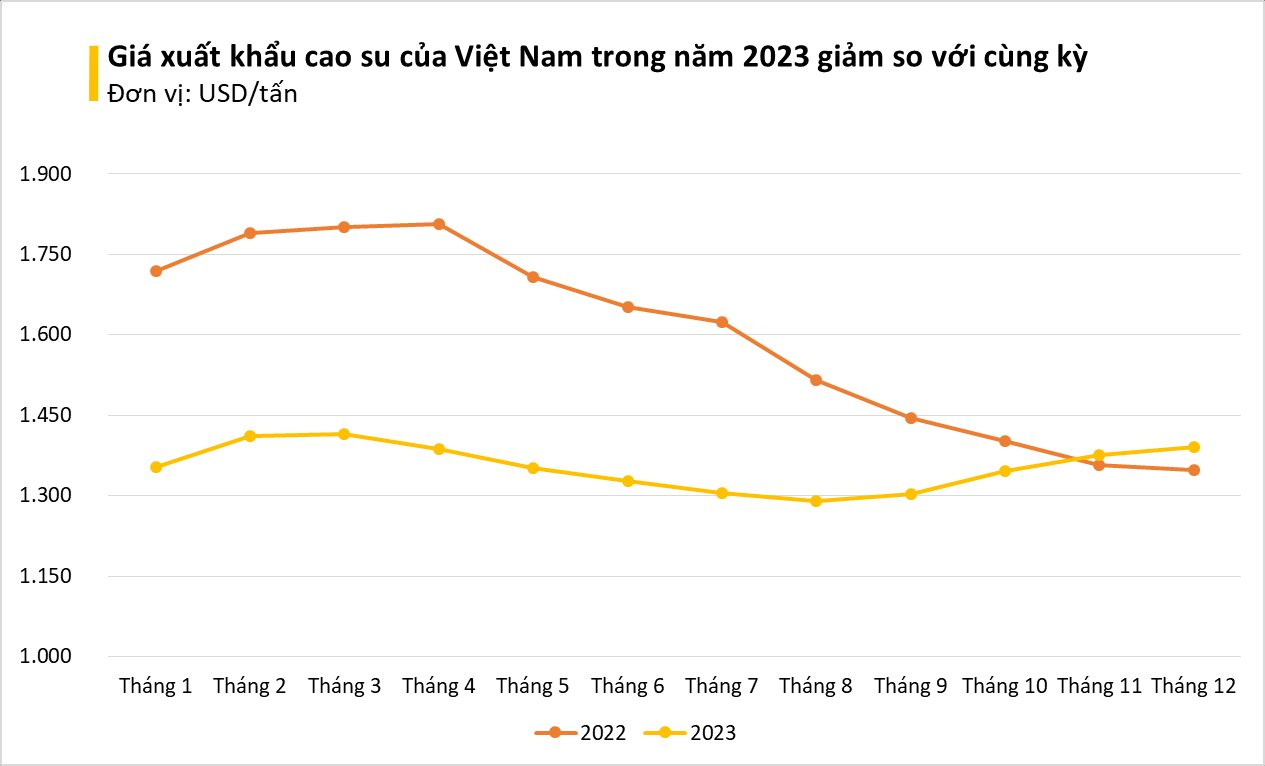

According to statistics from the General Department of Vietnam Customs, in 2023, Vietnam exported 2.14 million tons of rubber, worth $2.89 billion, down 0.1% in volume and 12.8% in value compared to 2022.

In terms of export prices, in 2023, the price of exported rubber decreased sharply compared to 2022, averaging $1,350/ton, down 12.7% compared to the average export price in 2022. However, rubber prices gradually recovered in the last few months, significantly supporting the production and business activities of enterprises in the industry.

It is worth noting that China has always been Vietnam’s largest customer for many years.

At the end of 2023, Vietnam exported 1.7 million tons of rubber to China, earning over $2.2 billion, up 6.6% in volume but down 4.7% in value compared to the same period in 2022, accounting for 78% of the total. 2023 also recorded the highest proportion of China in the past 5 years. With its low cost and abundant supply of rubber, Chinese partners prefer to buy semi-processed rubber from Vietnam.

It is forecasted that in the next quarter, the rubber industry will gradually recover due to the demand from major markets, especially the Chinese market, helping rubber prices to increase in the context of the possibility of oil prices remaining high. This will give exporting businesses the opportunity to increase profits.