Banking sector takes the lead with a growth of 1.23% in the morning session. Most stocks in the group performed well, such as BID (+2.45%), CTG (+4.26%), TCB (3.07%), MBB (+2.53%), STB (+1.17%), VIB (+2.72%), LPB (+1.69%). The other stocks also showed positive signs with VPB (+0.8%), ACB (+0.76%), SHB (+0.87%), EIB (+0.81%) and OCB (+1.03%).

Following closely is the technology and information sector with a growth of 1.13%, in which FPT and CTR increased by 1.27% and 2.42% respectively.

The other sectors such as construction materials, mining, and seafood processing also had positive growth. However, the insurance and plastic-chemical manufacturing sectors fell behind after a strong start in the morning session.

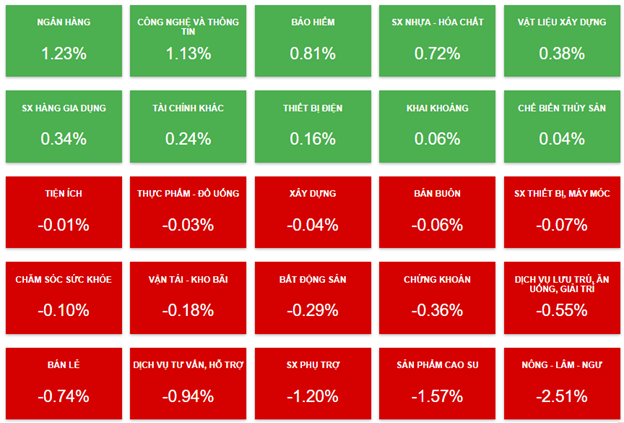

Development of sector groups in the morning session on 05/02. Source: VietstockFinance

|

At the end of the morning session, the market was dominated by red indicators. The banking sector showed the most positive growth with an increase of 1.23%. On the other hand, the agriculture-forestry-fisheries sector decreased the most with a drop of 2.51%.

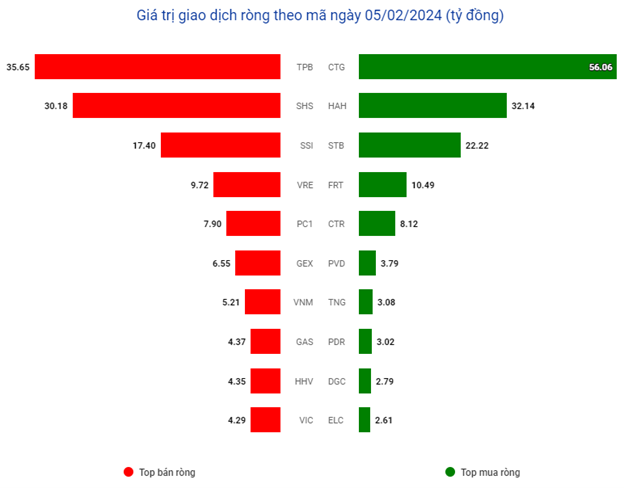

Foreign investors continued to net sell with a value of over 11.7 billion VND on HOSE, with TPB being the most sold stock. On HNX, foreign investors net sold nearly 5.5 billion VND, mainly focusing on selling SHS stock.

10:40 AM: Investors are still hesitant.

Investors remain cautious, which led to a slight increase in the main indexes and fluctuated around the reference level. As of 10:30 AM, VN-Index increased by 6.58 points, trading around 1,179 points. HNX-Index decreased by 0.27 points, trading around 230 points.

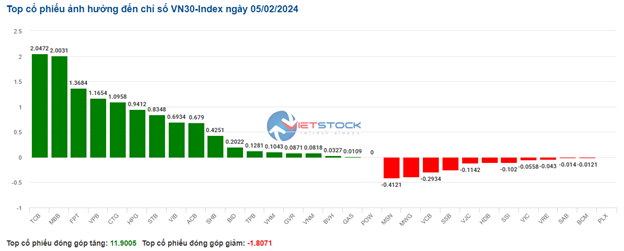

Most stocks in the VN30 basket saw strong increases. Specifically, TCB increased by 2.05 points, MBB increased by 2.00 points, FPT increased by 1.37 points, and VPB increased by 1.17 points. On the contrary, only a few stocks such as MSN, MWG, VCB, and SSB faced significant selling pressure.

Source: VietstockFinance

|

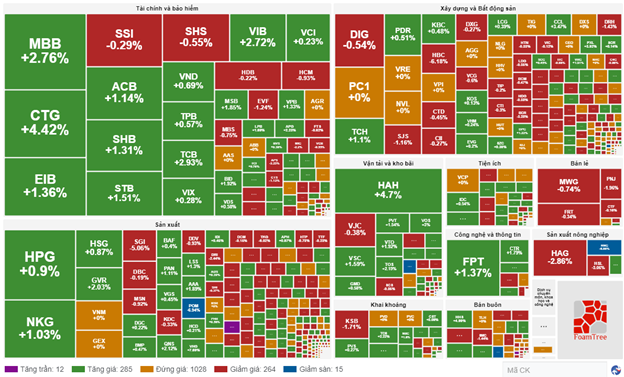

The banking sector is experiencing strong buying momentum, with notable increases in stocks such as MBB (+6.78%), CTG (+2.91%), TCB (+2.84%), and EIB (+1.16%)… The remaining stocks in the sector are showing a red color, such as VCB, HDB, SSB, EVF, and NVB. As of 10:30 AM, more than 810 billion VND has flowed into the banking sector.

The transportation-warehousing sector also had a good performance with 21 stocks showing positive growth, including notable stocks such as NAP (limit-up), HAH, VSC, GMD, VOS… The remaining stocks mostly remained unchanged.

In comparison to the opening session, buyers still have the advantage. The number of advancing stocks is 297 (including 12 limit-up stocks), while declining stocks number 279 (including 15 floor-limit stocks).

Source: VietstockFinance

|

The total trading volume on all three exchanges reached over 269 million units, equivalent to over 5.6 trillion VND. The negative point is that foreign investors still net sold over 3.1 billion VND, with a focus on TPB, SHS, and SSI.

Source: VietstockFinance

|

Opening: Positive sentiment spreads.

In the early session on 05/02, as of 9:30 AM, VN-Index slightly increased by over 2 points, reaching 1,175 points. HNX-Index also slightly increased above the reference level, reaching 230.63 points.

Green color has the advantage in this morning’s session, with some insurance stocks showing positive growth from the beginning, such as BVH (+1.71%), PTI (+7.28%), and BIC (+0.36%).

Large-cap stocks such as GVR, BID, and TCB led the index with an increase of nearly 2 points. On the contrary, VCB, MWG, and PNJ are putting pressure on the market, resulting in a total decrease of more than 0.7 points.

Lý Hỏa