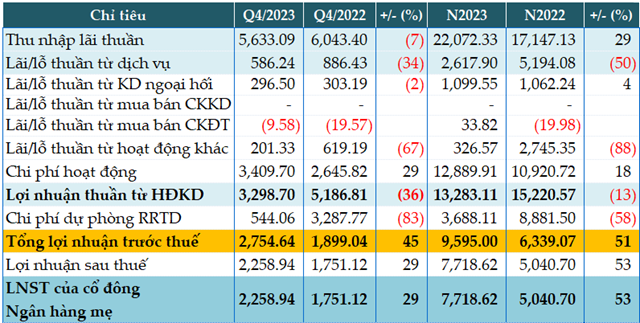

Overall in 2023, the core operations of Sacombank increased by 29% compared to the previous year, reaching a net interest income of 22,072 billion VND.

Meanwhile, non-interest income decreased compared to the previous year. Income from services amounted to only 2,618 billion VND, a 50% decrease. Additionally, other income recorded 327 billion VND, an 88% decrease.

During the year, the Bank set aside 3,688 billion VND for credit risk provisions, a 58% decrease compared to the previous year, resulting in a pre-tax profit of 9,595 billion VND for Sacombank, a 51% increase. Therefore, the Bank has achieved the set goal of 9,500 billion VND in pre-tax profit for the entire year.

|

Business results for the fourth quarter and the full year of 2023 for STB. Unit: Billion VND

Source: VietstockFinance

|

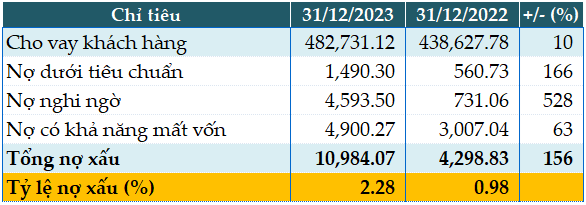

The Bank’s total assets at the end of 2023 amounted to 674,389 billion VND, an expansion of 14% compared to the beginning of the year. Of this, deposits at other credit institutions doubled from the beginning of the year, reaching 50,114 billion VND. Lending to customers increased by 10% to 482,731 billion VND.

In terms of capital sources, deposits and borrowing from the Government and the State Bank accounted for only 19 billion VND, compared to 9,901 billion VND at the beginning of the year. Deposits at other credit institutions increased by 60% (34,386 billion VND), while customer deposits increased by 12% (510,744 billion VND).

Not immune to the overall situation of the banking system, Sacombank’s non-performing loans also increased to 10,984 billion VND, 2.5 times higher than at the beginning of the year. The ratio of non-performing loans to outstanding loans increased from 0.98% at the beginning of the year to 2.28%.

|

Quality of STB’s borrowing as of 31/12/2023. Unit: Billion VND

Source: VietstockFinance

|

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-150x150.jpg)

![[Photo Essay]: Experts, Managers, and Businesses Unite to Forge a Path Towards Sustainable Green Industry](https://xe.today/wp-content/uploads/2025/07/z678592918-100x70.jpg)