Services

Strong revenue growth, leading profitability performance

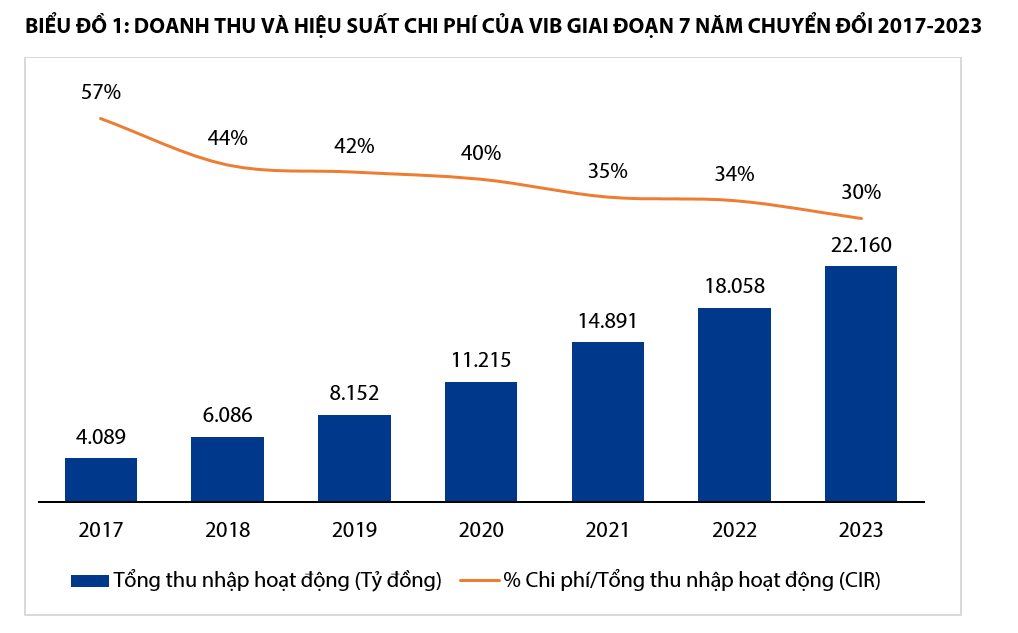

By the end of 2023, VIB achieved total revenue of over 22,000 billion VND, growing by 23% compared to 2022, of which interest income reached over 17,000 billion VND, increasing by 16% compared to the same period. Non-interest income accounted for 22% of total revenue, with positive contributions from credit cards, insurance, foreign exchange, and revenue from risk-controlled debt collections.

Operating expenses continued to be well-controlled, maintaining at 6,600 trillion VND, an increase of only 7% compared to the same period, amid VIB’s continued strong investment in technology, brand, branch network, and people. The 16% difference between revenue growth and expense growth has helped increase VIB’s cost efficiency, with a cost-to-income ratio (CIR) of only 30%, the best level ever and among the top in the industry. As a result, pre-provision profit reached over 15,500 billion VND, growing by 31% compared to 2022.

CHART 1: VIB’S REVENUE AND COST EFFICIENCY STAGE 7 OF 2017-2023 TRANSFORMATION

|

In addition to maintaining steady business growth, VIB actively provisions strong buffers to enhance asset quality and create a solid provisioning. By the end of 2023, VIB recorded pre-tax profit of over 10,700 billion VND. Return on equity (ROE) reached 25%, maintaining a leading profitability efficiency in the industry.

Strong asset summary, credit growth of 14.2%, lowest concentrated risk

As of December 31, 2023, VIB’s total assets reached nearly 410,000 billion VND, an increase of nearly 20% compared to the beginning of the year. The outstanding loan balance at the end of the period reached over 267,000 billion VND, growing by 14.2%, using the entire credit limit provided by the State Bank of Vietnam at the beginning of the year and higher than the system’s average credit growth rate.

Notably, thanks to the close risk management measures and cautious risk appetite, VIB’s NPL ratio has declined sharply, only at 2.2% compared to the peak of 2.62% at the end of Q1 and showing a downward trend in the context of positive signals in the market and low interest rate landscape in the past 20 years.

According to VIB’s leadership, despite the market fluctuations, VIB remains consistent with its retail strategy and cautious risk appetite. VIB is currently one of the commercial banks with the lowest credit risk focus in the market with the maximum risk concentration diversification. As of the end of 2023, the proportion of retail loans at VIB accounted for over 85% of the total lending portfolio, and more than 90% of the retail loans were secured loans. In addition, VIB is also cautious in providing loans to areas with potential risks. Over the past four years, VIB has had zero loans in activities and sectors such as BOT, renewable energy, corporate bond guarantees, real estate bond investments. The investment portfolio in corporate bonds at VIB is also in the lowest group on the market, accounting for only 0.3% of the credit portfolio and mainly from companies in the manufacturing and service sectors.

As of December 31, 2023, VIB’s total capital mobilization reached 283,000 billion VND, of which customer deposits amounted to nearly 237,000 trillion VND, an increase of 18% compared to the beginning of the year. The main growth driver came from the increase in individual customer deposits by 21%, of which CASA balance of individual customers also increased by 33% compared to the beginning of the period. The achieved results were through designing and providing superior product and service solutions to customers, maintaining the leading position in some critical retail business areas. In addition, to diversify and optimize sources of capital, VIB also conducted mobilization through various channels to ensure liquidity and minimize market risks. With its position and reputation in the international capital market, VIB successfully raised an additional 280 million US dollars from major international financial institutions as leading partners such as UOB, Maybank, raising the total international capital mobilization in 2023 to nearly 400 million US dollars, being the only Vietnamese bank to successfully implement a proper loan agreement within the year.

As of December 31, 2023, all management indicators were maintained at safe and optimal levels, with a CAR (Basel II) capital adequacy ratio of 11.7% (above the requirement of 8%), a short-term capital to medium- and long-term loan ratio of 27% (below the requirement of 30%), a loan-to-deposit ratio (LDR) of 73% (below the requirement of 85%), a liquidity coverage ratio (LCR) of 18% (above the requirement of 10%), and a net stable funding ratio (NSFR) based on Basel III standards of 115% (above the requirement of 100%).

Top industry ranking by SBV, continued building reputation and leading brand

In the last quarter, VIB received a ranking from the State Bank of Vietnam, with an overall ranking in the highest group of the banking industry. VIB is one of the few commercial banks with the highest ranking by the SBV for 3 consecutive years, based on transparency criteria set by the SBV. With this ranking, VIB continues to be assigned by the SBV with the highest credit growth limit in 2024, above 16%.

VIB’s brand reputation is also closely associated with its pioneering role in applying international standards to Vietnam. In 2019, VIB was the first bank in Vietnam to successfully implement the three pillars of the Basel II risk management standard. By August 2023, VIB was selected by the SBV, along with 9 other commercial banks, to participate in the Steering Committee for implementing enhanced capital standards Basel II and Basel III. In parallel, VIB is the only bank, along with another joint-stock commercial bank, that has completed and issued audit reports according to international financial reporting standards (IFRS) since 2019, 6 years earlier than the Ministry of Finance’s requirement.

In addition to the recognition from the SBV and Forbes, in 2023 VIB continues to consolidate its brand and reputation with awards from the International Finance Magazine, Vietnam Record Association, VN50, and card issuers such as MasterCard, Visa. Specifically, VIB achieved two records recognized by the Vietnam Record Association for the Super Card – the first credit card line in Vietnam that allows users to design card features and VIB Checkout – the first integrated digital banking application Soft POS. In addition, the MyVIB app was awarded the “Fastest Growing Mobile Banking Application in Vietnam” in 2023 by the International Finance Magazine. The music program “The Masked Singer” with VIB as the diamond sponsor made a strong impression in the past time, delivering VIB’s message of “leading the card trend” to more than 2 billion views on all channels in 2023.

2024 marks the 8th year of VIB’s 10-year strategic transformation journey from 2017 to 2026. As one of the banks with the highest proportion of retail banking in the market, VIB continues to be committed to becoming a leading retail bank in Vietnam in terms of scale and quality. In the coming time, the bank will continue to design and provide superior product and service solutions to customers, maintain a leading position in some critical retail business areas. At the same time, VIB will continue to strengthen investment in the digital transformation of all banking products and services, develop human resources, upgrade operational models, and focus on risk management to ensure safe, sound, and transparent ratios.