ST8 Investment and Development Joint Stock Company (HOSE: ST8) announced its consolidated financial statements for the fourth quarter of 2023, with net revenue of nearly 11 billion VND and net profit of over 1 billion VND, decreasing 74% and 67% respectively compared to the same period.

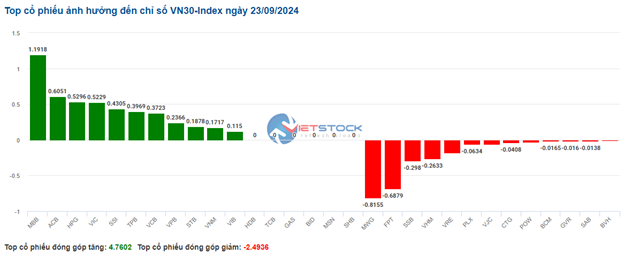

Source: VietstockFinance

|

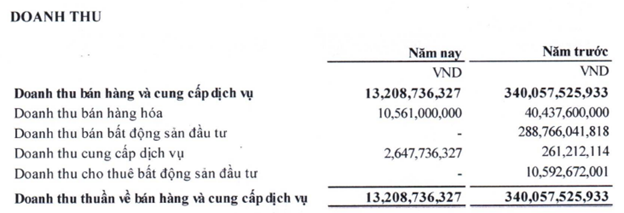

For the full year of 2023, ST8 recorded net revenue of over 13 billion VND, a 96% decrease compared to the previous year. The majority of the revenue came from sales of nearly 11 billion VND (a 74% decrease), as ST8 had revenue from office equipment, construction equipment, and car trading in the previous year.

ST8 also did not record any real estate revenue in 2023, while it reached over 289 billion VND in the same period. The revenue came from the liquidation of investment real estate, including ownership rights to houses and land use rights in Vung Tau and Ho Chi Minh City.

|

Revenue structure of ST8 in 2023

Source: ST8

|

Overall, for the entire year of 2023, ST8 only achieved a net profit of nearly 4 billion VND, a decrease of 98% and 82% compared to 2022.

Compared to the full-year plan, the company only achieved 3% of the revenue target and 10% of the net profit target. This is also the worst year for ST8 since it was listed on HOSE in 2007.

| Net revenue and net profit of ST8 from 2007-2023 |

Regarding the above results, ST8 stated that the company identified 2023 as a year of restructuring, adjusting some investment areas, so the profit would not be as high as the same period. In addition, the interest rate in 2023 fluctuated significantly, making it difficult for the company to access loan capital, and the general difficulties of the real estate and tourism market affected the progress of the company’s projects.

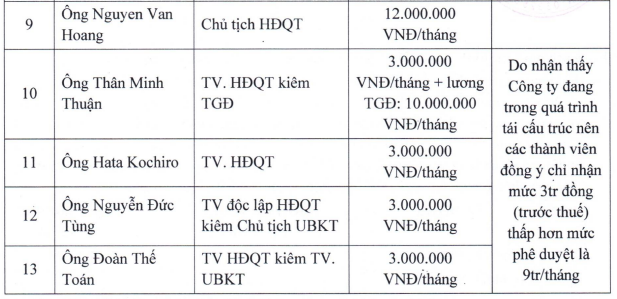

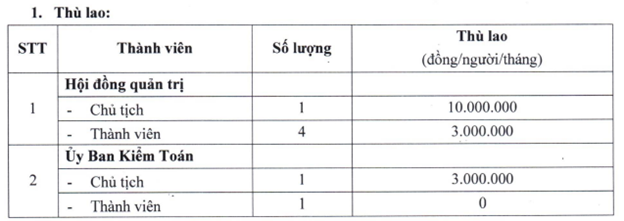

Board members receive a salary of 3 million VND per month.

On February 2, ST8 announced the documents for the annual general meeting of shareholders in 2024, which is scheduled to be held on April 22 at Park Hyatt Saigon, 2 Lam Son Square, Ben Nghe Ward, District 1, Ho Chi Minh City.

According to ST8, 2023 is a turning point year for the company, where the company does not prioritize pushing for sales growth in the year. Instead, it will thoroughly resolve existing issues and strengthen its internal resources, quickly stabilize and build a comprehensive system from personnel to infrastructure, and the production and business team will serve as a stronghold for the coming years.

What did the former Chairman of ST8 leave behind?

Notably, besides Mr. Nguyen Van Hoang – Chairman of the Board of Directors, who received the agreed remuneration according to the resolution of the annual general meeting of shareholders in 2023, the remaining Board members agreed to receive a salary of 3 million VND per month (before tax), which is lower than the approved amount of 9 million VND per month. According to the resolution of the annual general meeting of shareholders on April 5, 2023, the remuneration for the Chairman of the Board of Directors is 12 million VND per month, and for the Board members, it is 9 million VND per month.

|

Salary payment for the Board of Directors of ST8 after the resolution on April 5, 2023

Source: ST8

|

In 2024, ST8 will continue to propose a lower remuneration for the Chairman of the Board of Directors, with 10 million VND per month, and for the Board members and the Audit Committee, it will be 3 million VND per month.

|

Proposal to shareholders regarding the remuneration of ST8 in 2024

Source: ST8

|

For the 2024 business plan, ST8 set a target of net revenue of 350 billion VND and net profit after tax of 17.5 billion VND, an increase of 26.4 times and 4.5 times respectively compared to the implementation in 2023.

Payable liabilities decreased by 91%, and the total staff increased to 11 people.

As of December 31, 2023, the total assets of ST8 reached nearly 277 billion VND, a decrease of 11% compared to the beginning of the year, with almost all concentrated in short-term assets of nearly 276 billion VND. The cash and cash equivalents were only over 39 billion VND, a decrease of 85%.

Short-term receivables increased to nearly 234 billion VND, 5.4 times higher than at the beginning of the year, accounting for 84% of total assets. It is worth noting that ST8 generated short-term receivables at the Anh Huong Investment and Trading Company, which amounted to nearly 179 billion VND, which was a cooperative investment contract between ST8 Investment and Trading Joint Stock Company (a subsidiary) and Anh Huong Investment and Trading Company to acquire the rice production system in Can Tho City, with a total value of 160 billion VND, of which ST8 contributed 65% (during the period, ST8 transferred 104 billion VND to Anh Huong); and a cooperative investment contract with Anh Huong to own the Cao Lanh mineral mine in Binh Phuoc Province, with a total value of 115 billion VND, of which ST8 contributed 65.2% (ST8 transferred 75 billion VND to Anh Huong).

On the other side of the balance sheet, ST8’s liabilities decreased significantly by 91%, to nearly 5 billion VND. Undistributed post-tax profit was nearly 5 billion VND. ST8 did not record any financial borrowings.

| Capital structure of ST8 from 2007-2023 |

As of December 31, 2023, the total staff of ST8 increased from 4 people at the beginning of the year to 11 people.

Stock price continues to reach new lows

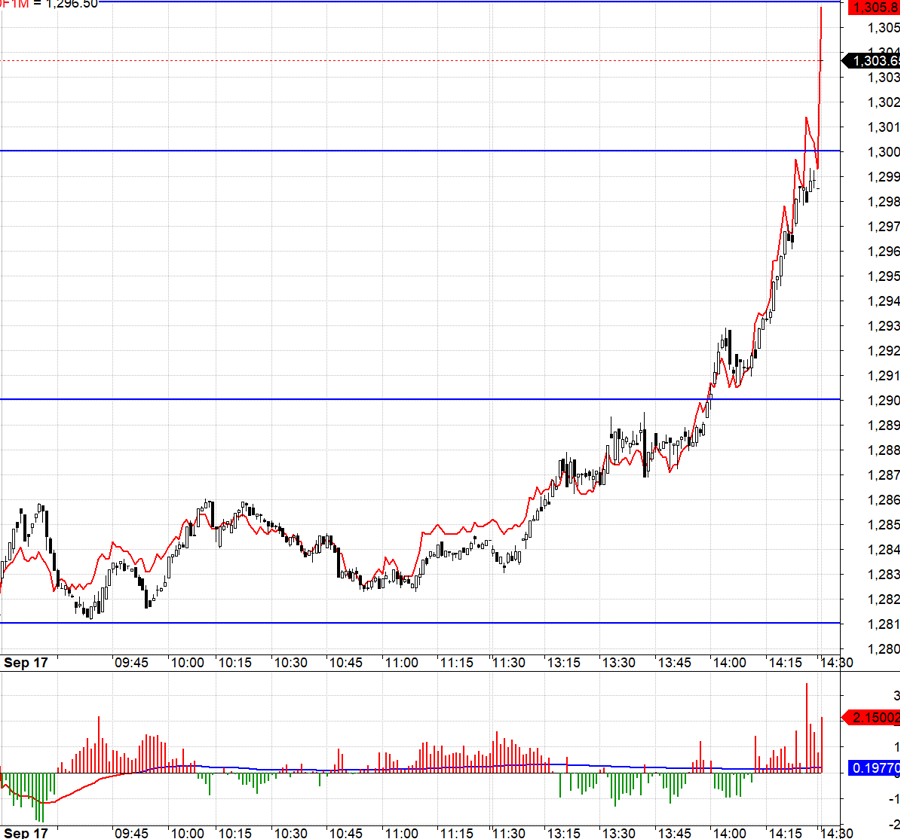

On February 5, ST8’s stock price continued to reach a low of 12,900 VND per share, marking the fifth consecutive floor-dropping session, causing the market capitalization to decrease by 30% in just one week.

Compared to the peak price of nearly 30,000 VND per share in late June 2023, ST8’s stock price has decreased by 57%. Compared to the short-term peak of 23,000 VND per share set in mid-January 2024, ST8’s stock price has decreased by 40%. The market capitalization of the company as of February 5 was only nearly 332 billion VND.

The trading volume of the stock also surged in recent selling pressure sessions. Specifically, all 4 floor-dropping sessions recorded a trading volume of over 1 million shares, with the highest of up to 4.6 million shares. On February 5, the volume of sell orders exceeded 5.9 million shares, indicating a high level of selling pressure.

| Stock price movement of ST8 from June 2023 |