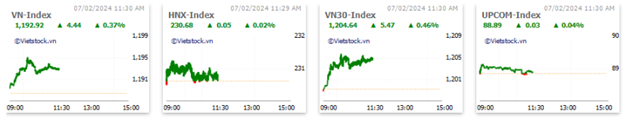

The VN-Index recorded a trading volume of nearly 266 million units, with a value of over 6,000 billion VND, in the morning session. The HNX-Index recorded a trading volume of nearly 28 million units, with a trading value of over 524 billion VND.

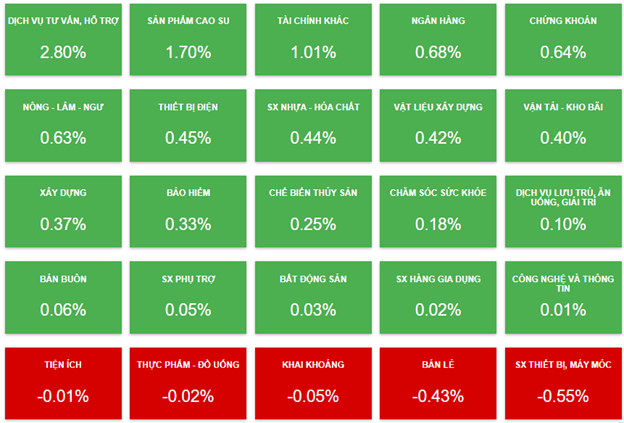

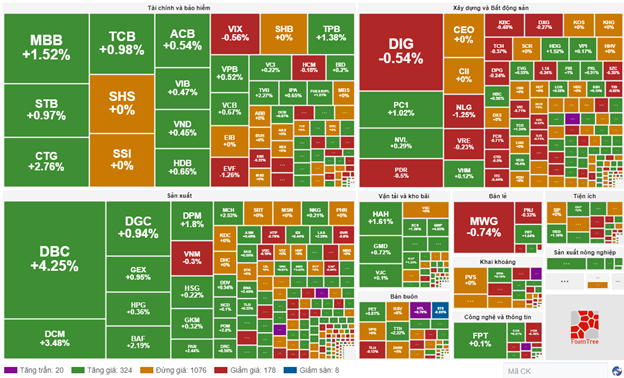

In the morning session, the consulting and support services sector temporarily took the lead with a growth rate of 2.8%. In particular, the TV2 stock recorded a 4.27% increase, and KPF increased by 0.44%.

The securities sector also contributed positively to the overall growth of the index. Most stocks in this sector remained in the green, including SSI (+0.29%), SHS (+0.57%), VND (+2.26%), VCI (+0.56%), HCM (+0.92%), MBS (+1.12%), VDS (+3.68%), FTS (+0.62%), and more.

Similarly, the banking sector continued to perform well in recent sessions. Stocks in this sector had good growth, such as CTG (+3.05%), TCB (+1.12%), MBB (+1.52%), STB (+1.14%), TPB (+2.21%), VPB (+0.52%), HDB (+0.65%), and more.

In contrast, sectors such as utilities, food and beverages, mining, retail, and manufacturing machinery and equipment all experienced slight declines.

Trends of sectors at the end of the morning session on 07/02. Source: VietstockFinance

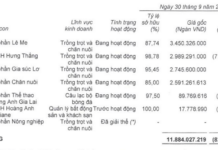

|

At the end of the morning session, the green color temporarily took the advantage when looking at the overall performance of the market. Specifically, the consulting and support services sector was the strongest performing sector with a growth rate of 2.8%. Conversely, the machinery and equipment manufacturing sector was the weakest performing sector with a decline of 0.55%.

10:35 AM: Leaning towards an increase

The VN-Index increased by 4.17 points, trading around 1,192 points. The HNX-Index increased by 0.08 points, trading around 230 points.

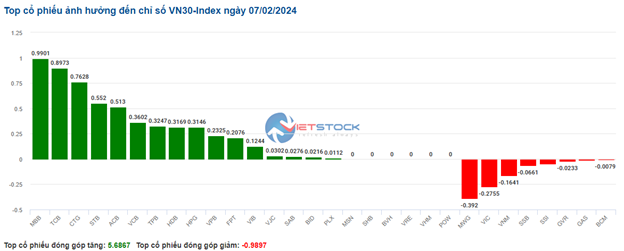

Most stocks in the VN30 basket saw significant gains. Notably, the majority of banking stocks, such as MBB, TCB, CTG, ACB, contributed 0.99 points, 0.90 points, 0.76 points, and 0.55 points respectively to the VN30 index. Conversely, MWG, VIC, VNM and SSB were under selling pressure, causing the index to lose nearly 1 point.

Source: VietstockFinance

|

Banking stocks stood out from the opening minutes. Specifically, MBB increased by 1.74%, CTG increased by 2.91%, STB increased by 1.14%, and TCB increased by 1.26%… The remaining stocks in this sector were mostly trading flat or experiencing slight declines, such as EIB, NVB, EVF, MSB, and SSB… As of 10:30 AM, over 856 billion VND had flowed into this sector, with a trading volume of more than 35 million units.

The transportation and warehousing sector also contributed to the overall market growth, with stocks like GMD (+1.01%), PVT (+0.38%), HAH (+1.36%), and SCS (+1.12%)… On the other hand, some stocks faced slight selling pressure, such as VJC (-0.1%), AST (-0.7%), CDN (-0.74%), and MHC (-0.13%)…

Meanwhile, the real estate sector saw mixed performances with both gains and losses. Stocks that negatively impacted the overall market included VIC (-0.59%), BCM (-0.16%), KBC (-0.48%), and PDR (-0.5%)… On the other hand, stocks like VHM (+0.12%), NVL (+0.29%), KDH (+0.16%), and DTD (+0.71%) had positive impacts.

Compared to the beginning of the session, the buying side still had an advantage. There were more than 340 stocks on the rise and over 180 stocks on the decline.

Source: VietstockFinance

|

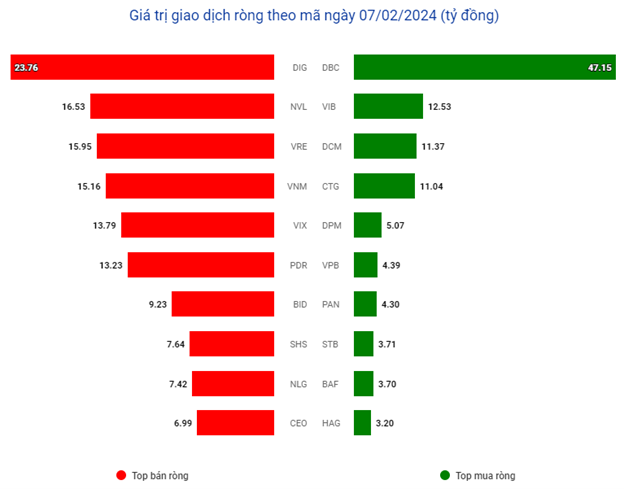

The total trading volume on all three exchanges reached over 192 million units, equivalent to over 4,400 billion VND. Foreign investors continued to be net sellers with a net selling value of over 89 billion VND, focusing on stocks such as DIG, NVL, and VRE.

Source: VietstockFinance

|

Opening: Positive green spreads

The VN-Index opened this morning in positive green, covering most sectors. The rubber and plastic-chemical sector made the biggest contribution.

The rubber sector led the market in the morning session. DRC stocks saw the highest increase at 2.61%, followed by BRC with a 1.14% increase.

The plastic-chemical sector also had a positive start, particularly stocks like DGC (+1.15%), DCM (+2.27%), DPM (+1.05%), HRC (+2.3%), BMP (+0.94%), and more.

The information technology sector continued to contribute to the index’s recent growth. Stocks like FPT, ELC, CTR, ICT continued to show good growth.