With just one session left until the market takes a break for the Lunar New Year holiday, liquidity remains positive. Although the VN-Index was only slightly affected by large-cap stocks, many stocks still experienced strong gains. It seems that domestic investors are still accumulating stocks in anticipation of a significant surge after the holiday. Meanwhile, foreign investors unexpectedly net sold VND 410 billion, a 7-week record high.

The banking sector saw 14 out of 27 stocks increase in price, with only CTG and HDB showing significant gains of 1.47% and 1.55%, respectively. The other four banking stocks increased by more than 1%, but they were small stocks with negligible impact and very low liquidity. Among the VN30 basket, only CTG and HDB saw gains of over 1%.

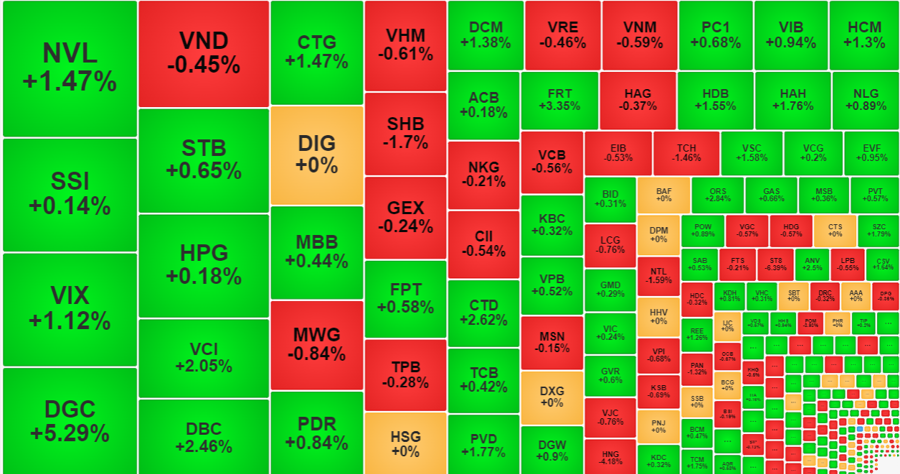

The VN30-Index closed with a 0.15% increase, with 20 gainers and 9 losers. The dominance of gainers indicates breadth, but the point value is weak, possibly due to small increases in stocks. Indeed, the index’s 1.81 point increase was mainly thanks to HDB’s 0.58% increase and VPB’s 0.52% increase. Among the top 10 stocks on the VN-Index by market capitalization, 7 increased, but except for CTG, the increases were not significant. VCB decreased by 0.56%, VHM decreased by 0.61%, and VNM decreased by 0.59%.

The strength of banking stocks overshadowed the VN-Index and other anchor stocks were unable to replace them. Today, liquidity in the banking sector on HoSE decreased by a total of VND 3,046 billion compared to the previous session (-54%), resulting in total HoSE liquidity decreasing by 24% to approximately VND 12,840 billion. The absolute decrease on this exchange was about VND 4,136 billion. Therefore, non-banking stocks also had a slight decrease in trading volume.

Overall, the total trading value on HoSE and HNX decreased more than 20% compared to the previous session, reaching VND 14,583 billion. This level is low compared to the past few sessions but is still not considered very low, equivalent to the average level of the past two weeks in January. This is especially significant considering the upcoming Lunar New Year holiday when trading value usually hovers around VND 10,000 billion per session.

The fact that investors maintain relatively high average trading volume indicates great expectations for the post-holiday market. If they buy stocks today, investors will have to wait to sell after the holiday and during the long break, during which unforeseeable information, especially global conditions, may arise. Investors continue to actively trade, showing a high level of confidence and the acceptance of short-term prospects despite a prolonged period of no trading.

Foreign investors unexpectedly acted as large net sellers today, net selling a total of VND 410 billion on HoSE. HNX also experienced net selling of VND 81.2 billion, while UpCOM had net buying of VND 11.3 billion. Stocks that were heavily sold included VHM (VND 89.7 billion net sold), SHS (VND 89.7 billion net sold), GEX (VND 67.7 billion net sold), HPG (VND 66.5 billion net sold), VCB (VND 60.5 billion net sold), MSN (VND 56 billion net sold), TPB (VND 55 billion net sold), MWG (VND 47 billion net sold), VNM (VND 44.6 billion net sold), VRE (VND 32.2 billion net sold), and NKG (VND 32 billion net sold). Among the VN30 stocks, this group had a net sale value of VND 563.1 billion, accounting for 28.7% of total trading in the basket. On the buying side, VIX had a net buying value of VND 45.6 billion, followed by NLG (VND 42.7 billion net bought), DGC (VND 40 billion net bought), FRT (VND 38.4 billion net bought), HCM (VND 33.4 billion net bought), CTG (VND 30.4 billion net bought), PVD (VND 22.9 billion net bought), and VCI (VND 20.9 billion net bought).

Overall, from the beginning of 2023 until yesterday’s session, foreign investors were still the dominant net buyers, with a total value of stocks on HoSE amounting to VND 1,194.8 billion. Although they don’t buy every day, their accumulation trend is clear. Thus, today’s net selling activity was most likely a routine short-term profit-taking activity.

Although the VN-Index only increased by 2.42 points or 0.2%, the breadth was very good with 244 gainers and 212 losers. The number of gainers included 73 stocks that increased by over 1%, even more than in the morning session (67 stocks). This strong group represented 30.5% of the total trading value on HoSE. Thirteen stocks had trading values exceeding VND 100 billion, including NVL, which increased by 1.47% with a trading value of VND 556.7 billion; VIX increased by 1.12% with a trading value of VND 463.2 billion; DGC increased by 5.29% with a trading value of VND 450.5 billion; VCI increased by 2.05% with a trading value of VND 315.3 billion; DBC increased by 2.46% with a trading value of VND 314.2 billion; CTD increased by 2.62% with a trading value of VND 148.9 billion; and many others. Stocks with trading values in the tens of billions and increases over 2% include LHG, ANV, and HTN. Less liquid stocks below VND 10 billion in trading value include LIX, DHA, BIC, DLG, SKG, and HVN.

The decrease in stock prices today was almost negligible, with very few stocks showing significant selling activity. Some stocks recorded significant decreases in price, but their trading values were slightly higher than the rest, such as ST8 (6.39% decrease with VND 38 billion in trading value), HNG (4.18% decrease with VND 63 billion in trading value), POM (3.93% decrease with VND 19.4 billion in trading value), SHB (1.7% decrease with VND 208.4 billion in trading value), NTL (1.55% decrease with VND 53.1 billion in trading value), BMP (1.48% decrease with VND 14 billion in trading value), TCH (1.46% decrease with VND 92.4 billion in trading value), DXS (1.42% decrease with VND 12.6 billion in trading value), and PAN (1.32% decrease with VND 33.2 billion in trading value).