The private corporate bond market saw a slight recovery in 2023, with new issuances reaching VND 345.8 trillion, an increase of 8.6% compared to the same period, according to statistics from FiinGroup.

The value of corporate bonds issued to the public showed exceptional growth, reaching VND 37 trillion, a 74.6% increase compared to the same period. In terms of the overall market, credit institutions were the main driving force, accounting for 56.2% of the total issuances, a 17.1% increase compared to the same period. This was driven by the need for issuances in 2H2023 to increase capital and meet the short-term funding ratio for medium- and long-term loans. Real estate followed with 25.5% of the total issuances, a 27.9% increase compared to the same period.

The estimated value of late principal/interest payments, including restructured corporate bonds and extended maturities, reached VND 195 trillion from 135 issuers as of December 31, 2023, accounting for 16.13% of the total outstanding corporate bonds and 23.76% of the outstanding non-bank corporate bond value at the beginning of the year.

In terms of sectors, real estate accounted for the largest proportion of delayed payments by major sector (31%), followed by energy (47.1%), and trade and services (19.92%).

After the issuance of Decree 08/2023/NĐ-CP, allowing bond restructuring, companies tend to choose restructuring options to address short-term liquidity issues.

FiinRatings data shows that 61.9% of the value of restructured corporate bonds with principal/interest maturities account for 77.8% of the total value of restructured corporate bonds. This is a popular option due to its cost optimization and only requires agreement between the parties involved. Other options include more complicated valuation methods such as asset liquidation, real estate asset swaps, or receivables exchanges.

Some corporate bond lots have also seen changes in terms such as interest rate adjustments, additional collateral, and other commitments. In the coming period, FiinGroup expects the default rate to continue to increase, but the value of late principal/interest payments in 2024 will be lower than in 2023.

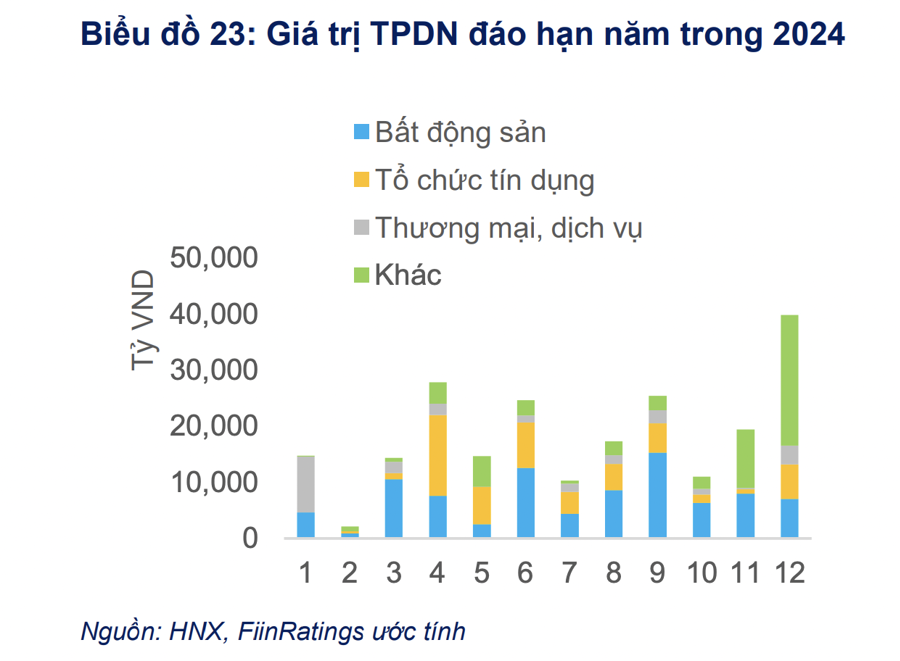

In 2024, the estimated value of maturing corporate bonds is expected to reach VND 234 trillion (+6.47% compared to the same period). Real estate accounts for over 41% of the maturing value (-2.4% compared to the same period), followed by credit institutions with 22.2% of the maturing value (+7.1% compared to the same period).

Compared to 2023, the market will face additional pressure from previously extended corporate bond lots through Decree 08, with an estimated value requiring resolution of VND 99.7 trillion.

The payment pressure of real estate companies is expected to be difficult to resolve as the market has not fully recovered, legal obstacles continue due to policy delays, and companies need time to balance their cash flows. The default risk of the market will also increase due to some expired provisions in Decree 08 and the pressure from corporate bond issuances with buy-back commitments in 2024.

In addition to the above challenges and difficulties, Fiingroup also expects the corporate bond market in 2024 to enter a new development phase with closer adherence to higher requirements for all market participants. This will help the new bond issuance activities gradually recover.

Many provisions in Decree 65/2022/NĐ-CP, which take effect in 2024, will establish stricter discipline for all parties involved and support the restoration of market confidence. The large issuance demand from the banking group to supplement capital and meet financial safety indicators will lead the corporate bond market in 2024.