At the beginning of 2024, Mr. Nguyen Dinh, a young investor, decided to open a stock trading account and invest a small capital in it. Although he had a stable income from his own business, he recently saw limited growth prospects for his store as customers tightened their spending. He thought he needed to diversify his investment channels.

The idea of investing in stocks came to him when he remembered his friend, who works in a bank, participating in the stock market with billions of Vietnamese dong capital from 2020 to 2022.

In 2024, the stresses and strains of the previous year had passed, but the road to economic recovery was still challenging. In contrast to 2023, which started with many financial market constraints both domestically and globally, 2024 was considered “easier” in most aspects compared to the previous year.

Entering the new year, the market is looking forward to the key keyword of Fed interest rate cuts. The global macroeconomic context, especially in the US, is favorable for the stock market, as signals regarding the Federal Reserve and central banks of many countries have become increasingly clear in the process of raising interest rates. Economies and stock markets are expecting the Fed to begin the process of interest rate cuts from mid-2024.

Domestically, Vietnam’s management policies will continue to loosen monetary policy to support economic growth.

The macroeconomy will recover from the low level of 2023 due to the positive confluence of fiscal and monetary policies, which will begin to have a good spillover effect on other economic components in 2024. The recovery of global orders after 2023 will reduce inventory and improve consumer confidence, boosting consumer spending and retail sales.

For the stock market, analysts believe that 2024 is a year ready for acceleration. The current PE ratio of the Vietnamese market is around 11x, which is quite attractive based on the long-term prospects of the economy. In addition, the market is near the bottom of a 1-year period. Therefore, this can be seen as an ideal time to accumulate stocks.

Whether the market enters a long wave or not depends on the actual health of the economy.

|

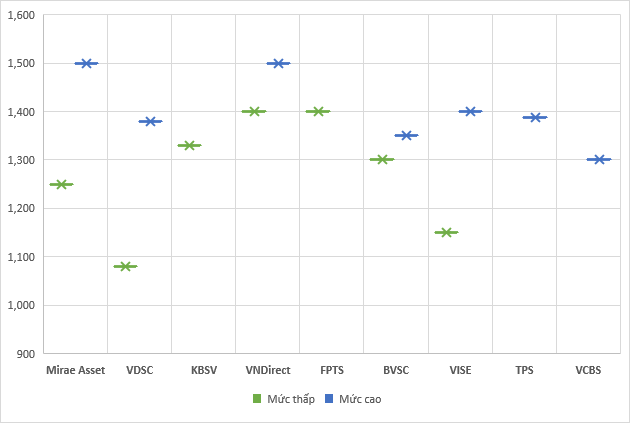

Forecast of VN-Index 2024 by securities companies

Source: Compiled

|

Furthermore, the Vietnamese stock market is also on the verge of a change in quality as the prospects of upgrading to an emerging market are approaching.

If the pre-funding issue before trading is resolved and FTSE adds Vietnam to the list of upgraded markets in the evaluation period in September 2024, eligible Vietnamese stocks will be added to FTSE’s indices (e.g., FTSE EM Index and FTSE Global Index).

The most direct impact is on ETF funds that use these indices as references, as they will automatically buy Vietnamese stocks.

In the long run, when being upgraded, the openness, investment ability, and transparency of Vietnam will reach a new level, attracting more capital from various funds and investors to the stock market.

Individual investors are also hopeful for positive things in the new year.

After years of accompanying the market, Mr. T.K. (Ho Chi Minh City) expects that 2024 will not have as many volatile fluctuations as the previous year. Investors hope that companies will have a more favorable business environment to operate and increase profits. As a result, VN-Index is expected to increase to 1,300 before the end of the year.

Individuals like Mr. N.X.N, another experienced investor, are looking forward to many positive developments in the stock market in 2024: maintaining low interest rates, increasing liquidity with multiple billion-dollar sessions, market upgrades towards the end of the year, and the KRX being put into operation. He expects the VN-Index to reach 1,400 points.

Despite the many prospects, a pessimistic scenario is still put forward for investors to have a cautious view.

In a pessimistic scenario, the economies of the US and Europe could enter a recession with the potential risk of a crisis. The Fed may cut interest rates more aggressively, negatively impacting investor sentiment in the global market due to concerns about the crisis. In a negative phase of the global stock market, the Vietnamese stock market tends to have a high correlation.

In addition, geopolitical risks that affect logistics costs will put pressure on global inflation.

There are still many challenges to consider, but participants in the stock market are still hopeful for a positive year.

Looking ahead, the stock market is aiming for higher goals. According to the market development plan, by 2025, the market capitalization of stocks will reach 100% of GDP, the debt market will reach at least 47% of GDP (with corporate bond debt reaching at least 20% of GDP), and by 2030, the market capitalization of stocks will reach 120% of GDP, the debt market will reach 58% of GDP (with corporate bond debt reaching at least 25% of GDP).

The derivative stock market will grow at an average rate of about 20% – 30% per year in the period 2021 – 2030.

The number of stock trading accounts owned by investors in the stock market is expected to reach 9 million accounts by 2025 and 11 million accounts by 2030, with a focus on developing institutional investors, professional investors, and attracting the participation of foreign investors.

In recent years, the level of interest and coverage of the market has been broader than before. From the prejudice of fraud and easy money loss, the stock market is gradually becoming a familiar part of society. Investors are gradually having more reasonable expectations for the market, realizing that buying stocks doesn’t guarantee immediate profits.

In the short term, the market is unpredictable, but in the long run, the stock market is still wide open with prospects for growth and quality. The key is for investors to have patience in investing systematically to take advantage of the growth potential in the coming years.

Chí Kiên