According to the information from the Hanoi Stock Exchange (HNX) on January 31, 2024, Ho Chi Minh City Infrastructure Investment Joint Stock Company (HoSE: CII) spent VND 115 billion to buy back a portion of the CII012029-G bond. This is the first time in 2024 that CII has repurchased bonds.

This bond was issued on January 31, 2019, with a term of 10 years and an issuance value of VND 1,150 billion. After the repurchase transaction, the outstanding value of this bond decreased to VND 1,035 billion.

In 2023, CII carried out 4 bond repurchases, including the full settlement of two bonds CIIBOND2020-04 (with an issuance value of VND 800 billion) and CIIH2023006 (with an issuance value of VND 550 billion).

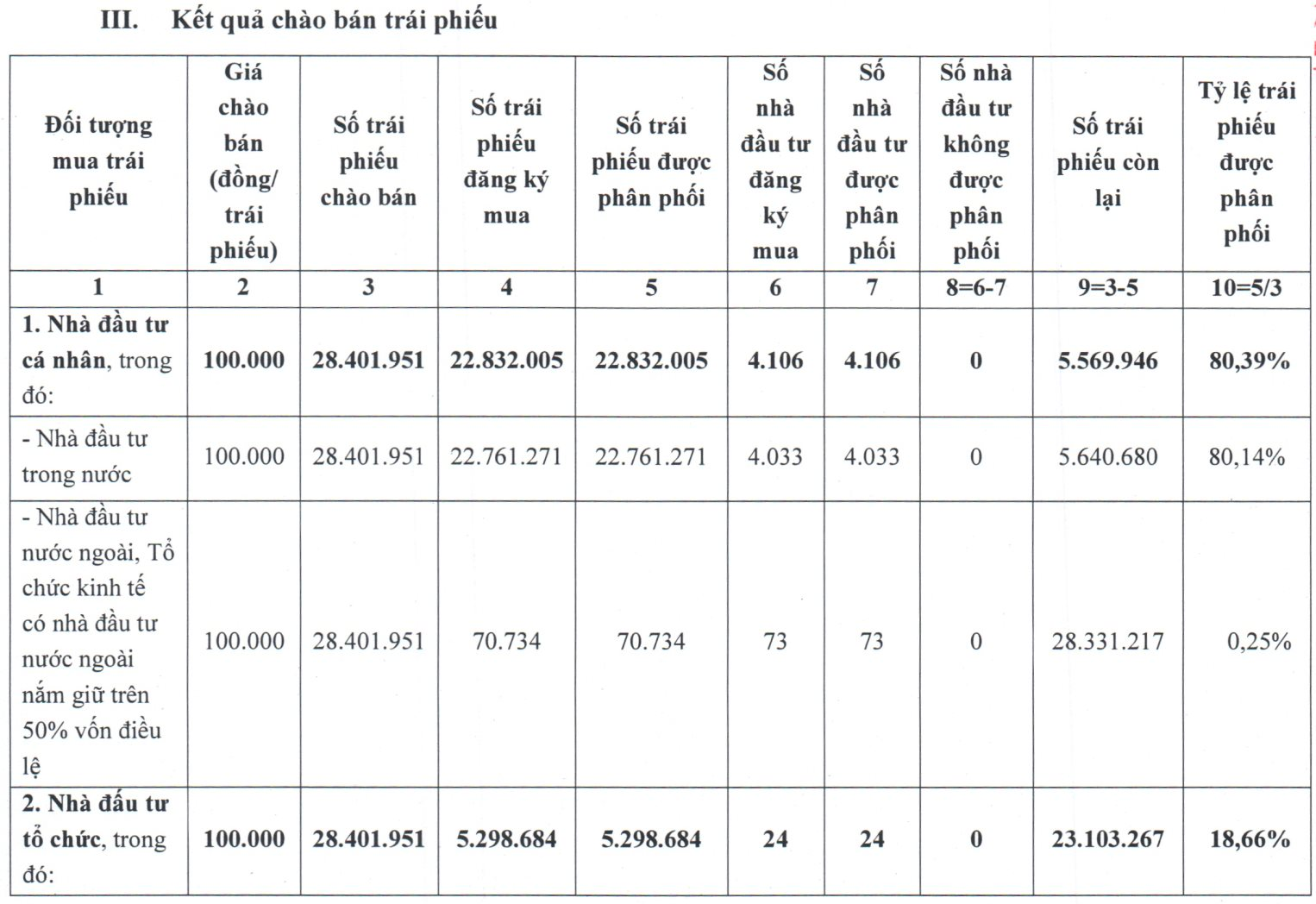

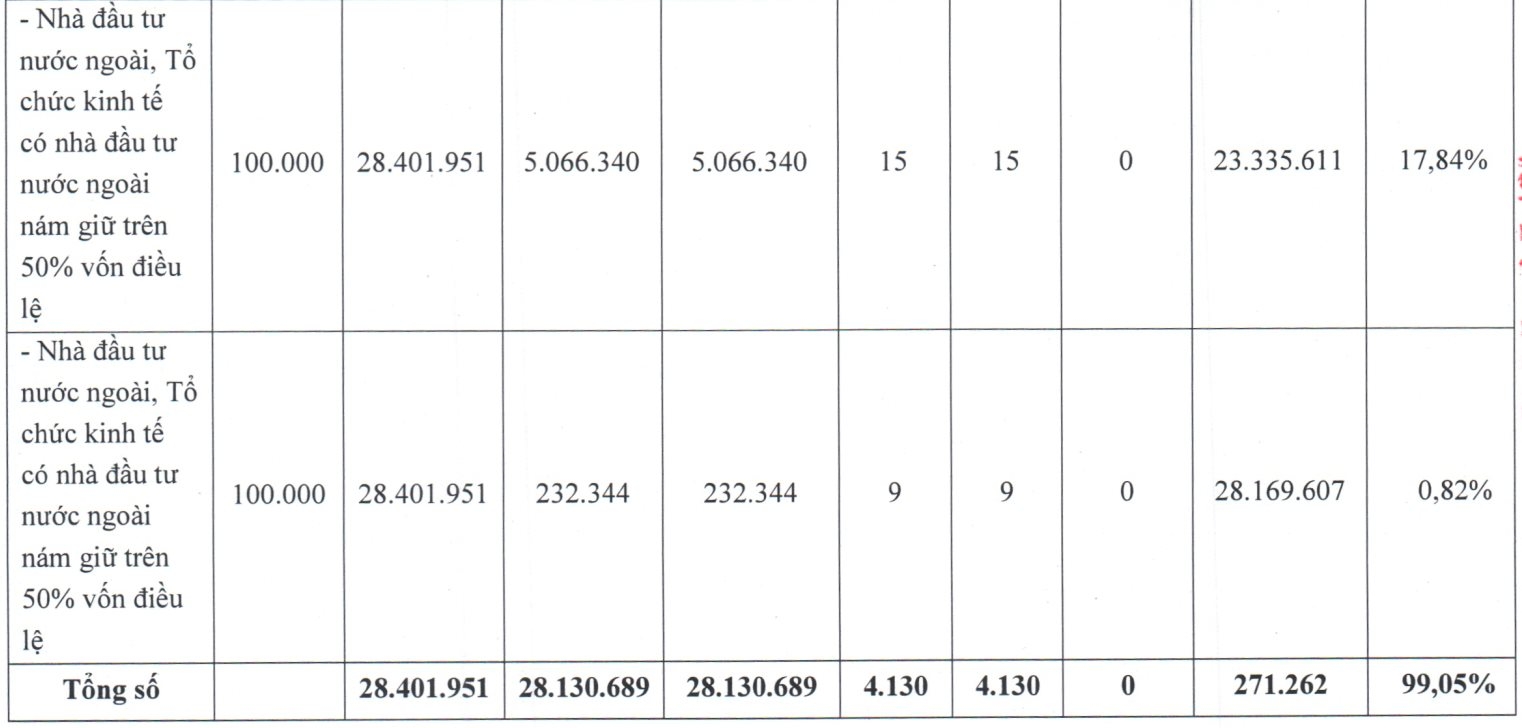

The move to spend VND 100 billion to buy back bonds before maturity by CII took place just a few days after the company raised thousands of billion VND from its convertible bond offering. Specifically, on January 25, CII concluded the public offering of bonds, successfully issuing 28,130,689 CII42301 bonds out of a total of 28,401,951 bonds, achieving a successful offering rate of 99.05%.

CII raised a total of VND 2,812 billion from the offering. The bond transfer process is expected to take place from February to March 2024.

CII42301 bond is a convertible bond into ordinary shares, without collateral and warrants. Every 12 months, the bond can be converted into ordinary shares, with a conversion rate of 1:10.

From the proceeds of the offering, CII will use VND 1,200 billion for investment in the corporate bond of Ninh Thuan BOT One Member LLC and VND 1,640 billion for investment in the corporate bond of Investment and Construction JSC Xa Lo Ha Noi.

The company also just announced its Q4/2023 financial statements, recording gross profit from sales of VND 409 billion, up 34.84% compared to Q4/2022. Additionally, financial activities generated revenue of VND 576 billion, more than 2.5 times higher. As a result, CII’s net profit in Q4/2023 reached VND 167.3 billion, an increase of over 20 times compared to the same period in 2022 (VND 8.1 billion).

In 2023, CII’s total revenue reached VND 3,055 billion, a decrease of 46.83%, and the company’s net profit after tax was VND 187 billion, a decrease of over 73% compared to the previous year.

As of December 31, 2023, CII’s total assets were VND 33,244 billion, an increase of over 16% compared to the beginning of the year. Of which, current assets were VND 6,975 billion, a decrease of 3.92%. Inventory was VND 616 billion, a decrease of 62.45%. The company’s equity was VND 8,516 billion, an increase of 2.23%.

Notably, cash and cash equivalents as of the end of 2023 were VND 1,190 billion, an increase of more than 4.1 times compared to the beginning of the year (VND 287 billion).

On the other side of the balance sheet, CII’s total liabilities as of the end of 2023 were VND 24,728 billion, an increase of more than 22% compared to the beginning of the year, equivalent to nearly VND 4,500 billion. Its total financial borrowings as of the end of 2023 were VND 18,855 billion, accounting for 76.37% of the company’s total liabilities.

Recently, CII has attracted attention as the owner of many land plots in Thu Thiem after the information about the auction of land in this area was restarted. Specifically, participating in the program “Citizen’s Questions – Government’s Answers” broadcast live on HTV9 on January 7, 2024, Mr. Huynh Van Thanh – Deputy Director of the Department of Natural Resources and Environment of Ho Chi Minh City (Department of Natural Resources and Environment) – said that the City Party Committee and the City People’s Committee have approved the auction plan for land in the Thu Thiem area.

Previously, in July 2023, Ho Chi Minh City also planned to auction dozens of land plots and 3,790 apartments in Thu Thiem, including 4 “prime” land plots that were forfeited. It is worth noting that 4 “prime” land plots were forfeited, causing a stir 2 years ago when the starting price reached VND 2.44 billion/m2 (including a land plot with an area of 10,015 m2 that was successfully auctioned by Tan Hoang Minh Group with a surprisingly high price of VND 24,500 billion). At that time, the land plots in Thu Thiem owned by these companies attracted attention. Their stocks, including NVL, CII, PDR, DXG, also soared along with the “fever” of Thu Thiem land prices.

CII, in particular, is considered the “landlord” of Thu Thiem. Currently, CII is the investor of the Tho Thiem River Park project in the New Urban Area of Thu Thiem with a capital investment of USD 400 million, in cooperation with HongKong Land. The construction area of the Tho Thiem River Park project in District 2 is about 3.5 hectares, including block 3 – 15 with an area of 15,376 m2, 10-15 floors high, and block 3 – 16 with an area of 19,881m2, 10-20 floors high.

CII also has The Riverin project in the Tho Thiem area. Specifically, the Ho Chi Minh City People’s Committee has approved CII to implement the apartment building project in blocks 3-15 and 3-16 (The Riverin) in Functional Area No.3 within the New Urban Area of Thu Thiem, District 2, under a BT contract. The Riverin project has a total area of 35,259 m2, and the project’s investor is Khu Bac Thu Thiem One Member LLC (CII’s subsidiary).

The Tho Thiem Lake View and Marina Bay Tho Thiem are two new urban area projects that CII signed a credit contract with the Bank for Investment and Development of Vietnam (BIDV), Ho Chi Minh City branch, with an investment capital of over VND 10,000 billion, covering a total area of 85,255 m2, in subzones 3 and 4 in Thu Thiem Urban Area. Besides, CII also invested in infrastructure for these two areas with a total investment of up to VND 2,600 billion.

In 2023, CII announced the restart of the Thu Thiem BT project after over 4 years of construction suspension. CII will also continue to study new infrastructure projects with a total investment from VND 5,000 billion to VND 10,000 billion, such as overhead roads, intersections in Ho Chi Minh City, Tho Thiem Bridge 4…