VinaCapital’s projection for Vietnam’s economy this year and the perspective of foreign investors on the country’s economic prospects.

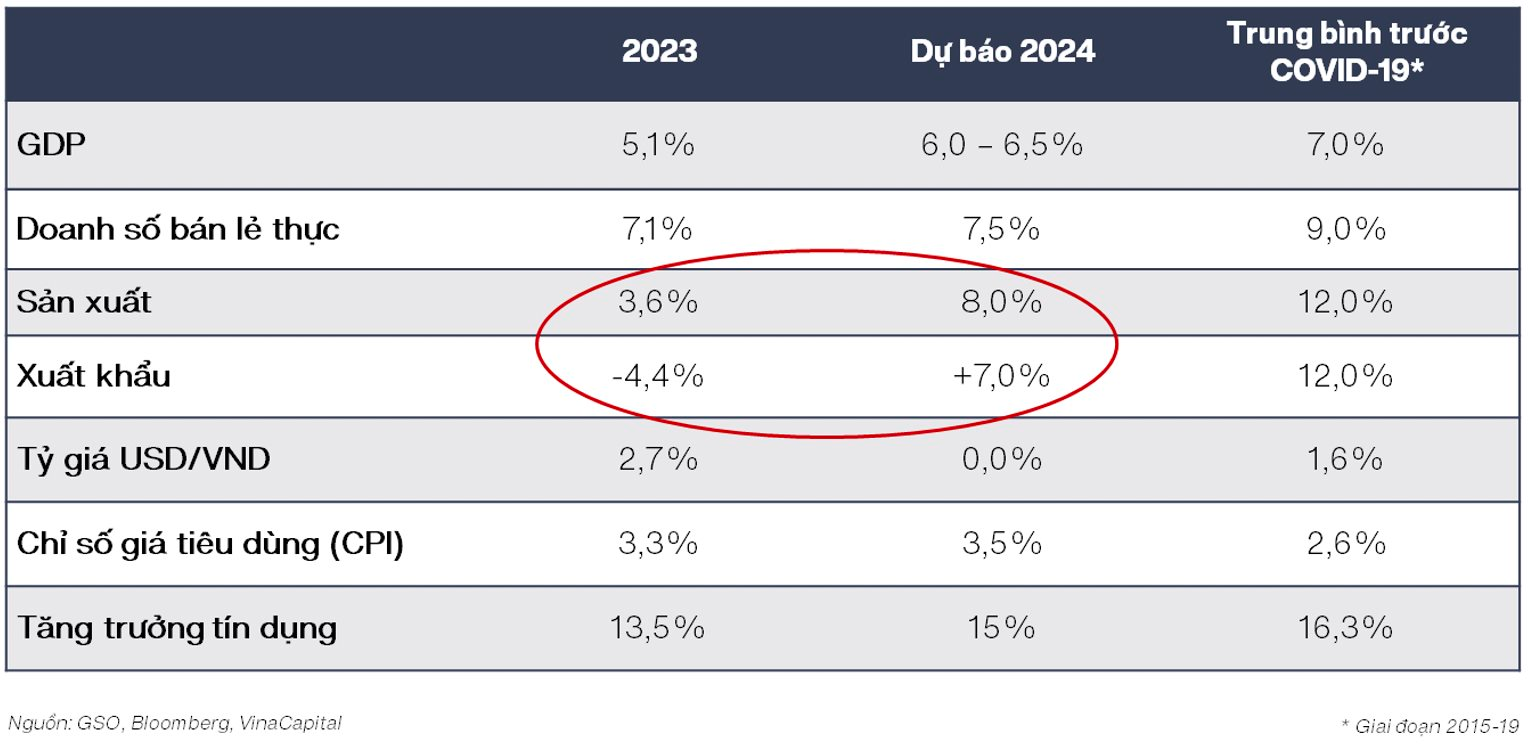

VinaCapital’s macroeconomic research department forecasts that Vietnam’s GDP will grow by around 6 – 6.5% in 2024, thanks to export and industrial production recovery. This will have a positive impact on people’s income as well as economic growth. In the process of bridging Vietnam and international investors, introducing attractive investment opportunities in Vietnam, we have a good understanding of international investors’ views on Vietnam.

Specifically, they all pay great attention to the prospects of Vietnam’s stock market in the coming years, thanks to the stability of the economy, politics, and society, the increase in income and consumption of a population of 100 million people, the strong FDI attraction when multinational corporations apply the China + 1 strategy, and the effort to upgrade the Vietnam stock market to a new emerging market in the next 2-3 years.

Photo: Economic forecasts for 2024 (according to the General Statistics Office, Bloomberg, VinaCapital).

Specifically, the growth momentum is positive profit growth and attractive current valuation. We forecast that the profit of companies in VinaCapital’s tracked stock portfolio (representing 95% of the market capitalization of the VN-Index) will grow by about 13% in 2024, quite attractive compared to ASEAN countries as well as China and India (two markets with high growth. traditional growth of Asia).

With the above profit growth rate, the P/E of the VN-Index will be about 10 times for 2024, about 26% lower than the valuation of the ASEAN-5 countries (Singapore, Malaysia, Indonesia, the Philippines, and Thailand).

Can you tell us about potential industries and companies today? How did the Company prepare its investment strategy for the new year?

In terms of valuation, some sectors are currently the most attractive in many years, including banking, consumer goods, some companies in manufacturing, industry or oil and gas.

The profit growth picture of 2024 is also bright when most sectors are expected to record positive profit growth. Among them, the financial, information technology, industrial park, consumer goods, and companies benefiting from energy investment projects, infrastructure will be the industries with the most positive growth. However, the business results of each company in the above sectors will be differentiated, so the right choice of companies to invest in will be very important.

We have taken advantage of the market correction opportunity in Q4/2023 to accumulate some good long-term stocks and adjust the portfolio according to VinaCapital’s macroeconomic forecast for 2024, which is a recovery economy due to export recovery, leading to domestic consumption growth stronger than in 2023. Considerations about industry groups as mentioned above, along with parameters of valuation, asset quality, profit quality, and corporate governance are also considered in building the portfolio for the new year.

Securities investors in Vietnam are facing many opportunities, what recommendations do you have for them to effectively exploit this golden time?

Efficient open-ended equity funds also often have better returns than the VN-Index.