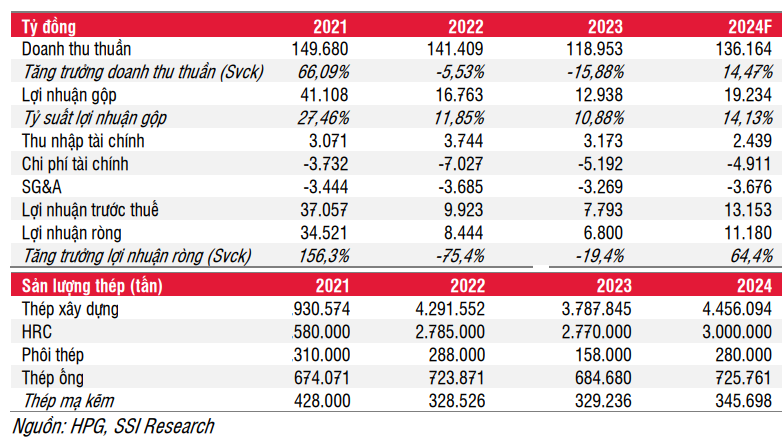

In 2023, Hoa Phat Group Joint Stock Company (HPG) achieved VND 120,355 billion in revenue, a 16% decrease. Net profit after tax was VND 6,800 billion, equivalent to 85% of the annual plan but only one-fifth of the record level achieved in 2021.

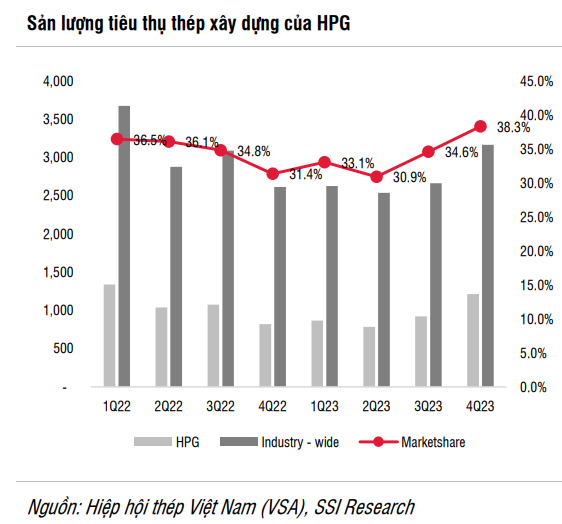

Specifically, although HPG’s market share in construction steel for the whole of 2023 remained at 34.7%, its market share in the fourth quarter of 2023 alone reached a record high of 38.3%. Furthermore, excluding export channels, HPG’s market share in the domestic market increased from 30.8% in 2022 to 32.5% in 2023 due to a decrease in production output by other manufacturing companies.

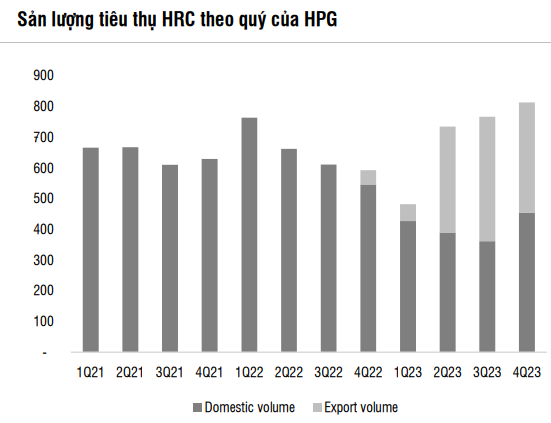

The HRC segment also marked a record high consumption volume with 804 thousand tons, increasing by 36% YoY and 5% compared to the previous quarter. At the same time, the average prices of HRC and construction steel increased by 5-7% YoY in the fourth quarter, offsetting the increase in iron ore and coke prices.

In a newly published analysis report, SSI Securities Corporation predicts that Hoa Phat is entering a new profit cycle with expectations of a recovery in demand in 2024, especially in the domestic market. The consumption volume of finished steel in various regions is expected to grow by over 6%, with domestic consumption forecasted to increase by 7%. According to SSI Research, the steel consumption in 2024 will be supported by the macroeconomic recovery, the real estate market, and the expected increase in global steel demand.

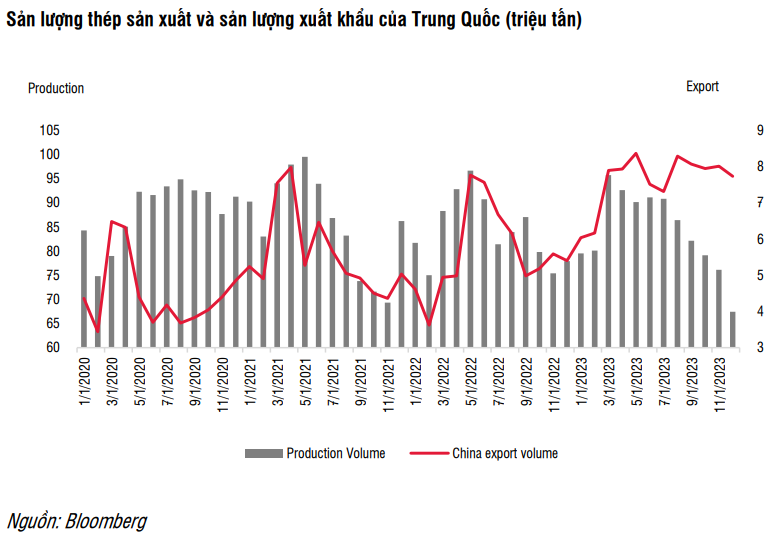

In addition, Chinese steel exports are expected to decline in 2024 compared to the high base in 2023, supporting Vietnamese steel export prices. According to the China Iron and Steel Research Institute, steel demand in China is expected to decrease by 1.7% in 2024 after a 3.3% decline in 2023. However, SSI Research holds the view that steel prices will be difficult to increase significantly this year due to the potential slow recovery of the Chinese real estate market, and an increase in steel prices could encourage the resumption of production activities in China.

On the other hand, the increase in iron ore prices may lead to higher production costs in the first quarter of 2024, but SSI believes that this will only have a short-term impact. The pressure from high raw material costs will gradually diminish in the long term as the impact of reduced inventories and the decrease in Chinese steel production stabilizes the supply of iron ore.

SSI Research maintains its net profit forecast for HPG in 2024 at VND 11.2 trillion, corresponding to a 64.5% increase over 2023, thanks to the recovery in both consumption volume and steel prices. SSI assumes that the consumption volume of construction steel and HRC of Hoa Phat in 2024 will reach 4.5 million tons (an 18% increase) and 3 million tons (an 8% increase), respectively. In addition, the average prices of construction steel and HRC are assumed to increase by 3% compared to an average increase of 5% for iron ore and coal prices. Therefore, the expectation is that HPG’s gross profit margin will improve to 14.1%.

In the long term, SSI expects the company’s profit to increase by over 30% annually during the 2025-2027 period due to the commencement of the Dung Quat 2 project in 2025-2026, which will help double the consumption volume of HRC from 2.8 million tons in 2023 to 7.5 million tons in 2027. The current domestic supply shortage is about 4-5 million tons/year, along with recent export promotion efforts, which will enhance Hoa Phat’s position in the HRC segment once the project becomes operational.