In Q4/2023, the average national pig price mostly fluctuated below 50,000 dong/kg, much lower than the previous period. In addition to the pressure from cheap imports of pigs, the pressure on the livestock group continues to increase.

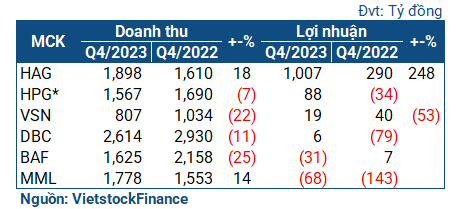

Statistics from VietstockFinance in Q4/2023 with 6 strong pig farming companies, 3 companies reported an increase in profits (1 changed from loss to profit), 1 company decreased profits, and 2 companies suffered losses.

|

Business results of pig farming companies in Q4

|

Leading the growth in profits is Hoang Anh Gia Lai (HAG) of businessman Doan Nguyen Duc (“Bau Duc”). In Q4, HAG net profit reached over 1 trillion dong, 3.5 times higher than the same period.

However, this increase mostly comes from financial activities. Specifically, HAG’s financial revenue increased 3.6 times compared to the same period, reaching 295 billion dong, due to the company liquidating some investments. In addition, being exempted from more than 1.4 trillion dong in borrowing from Eximbank (EIB), helping financial expenses record 996 billion dong. As for the livestock sector, pig sales in Q4 decreased by 34%, reaching 465 billion dong.

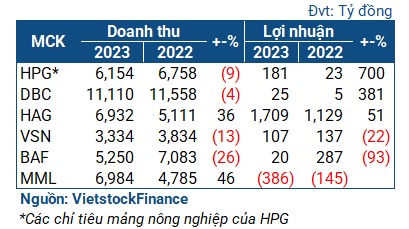

The profit from Q4 also makes HAG’s accumulated situation more optimistic. The company reported a profit of over 1.7 trillion dong in 2023, a 51% increase compared to the previous year.

| Business situation of HAG from 2020 |

Notably, at the end of 2023, HAG approved the divestment from Bapi HAGL – the unit distributing “banana-eating pigs” products. Accordingly, HAG wants to transfer all 2.75 million Bapi HAGL shares, with a face value of 10,000 dong/share, equivalent to 27.5 billion dong. After the Company completes the procedures for transferring all shares of Bapi HAGL, Bapi HAGL will no longer be an affiliated company of HAG. It is unclear whether this divestment is a move to cut back on pig farming activities or if HAG wants to focus more on wholesale pig farming.

HAG wants to divest from Bapi HAGL

Meanwhile, Dabaco (DBC) only reported a slight profit of 6 billion dong (79 billion dong loss in the same period). The reason is not from the livestock sector, but from other profit of 16 billion dong. Without this income, the Company would have reported a loss in Q4.

Accumulated for the whole year, Dabaco reported a profit of 25 billion dong, 5 times higher than the previous year. However, the strong profit growth was mainly due to the very poor business conditions in 2022. In general, the business picture of the “livestock tycoon” is still considered difficult, in the context of the ongoing livestock disease in many localities nationwide, continued decrease in consumer demand, and pig prices are currently at a bottom. If we exclude 2022, this is the worst business period for Vietnamese “livestock tycoons” in the past 15 years.

| If we exclude 2022, last year was the worst business period for Vietnamese “livestock tycoons” in the past 15 years |

Only HPG reported truly positive results, with the agriculture segment bringing in 88 billion dong in profits (34 billion dong loss in the same period). Accumulated for the whole year, this segment earned 181 billion dong, 8 times higher than the previous year.

In the group of companies that reported declines, Vissan (VSN) earned 19 billion dong in Q4, less than half of the same period. Accumulated for the whole year, the Company reported a profit of 107 billion dong, 22% lower than the previous year. VSN stated that its production and business activities last year were negatively affected by many unexpected external factors (macroeconomy, global – political tensions, reduced spending due to economic difficulties, etc.). At the end of 2023, realizing that it could not achieve its goals from the Annual General Meeting of Shareholders, VSN decided to reduce its profit plan by 24%.

“Vegetarian pigs” company BAF even reported a loss of 31 billion dong (7 billion dong net profit in the same period), also the first quarter with a loss since its listing. The Company said that high animal feed prices since the beginning and middle of the year had delayed and reflected in Q4/2023, while pig prices hit bottom during the period, which deeply affected revenue.

Accumulated for the whole year, BAF only reported a net profit of 20 billion dong, down about 93% compared to the previous year and also could not complete the profit plan approved at the 2023 Annual General Meeting of Shareholders.

Masan Meatlife (MML) – the pig meat business unit of Masan – reported its 6th consecutive quarter of loss, with a net loss of 68 billion dong (143 billion dong loss in the same period). The lower loss compared to the same period is due to additional revenue from the processed meat segment. However, for the whole year, MML recorded a loss of 386 billion dong (145 billion dong loss previously).

| Accumulated business results of pig farming companies |

|

Waiting for Q1/2024

According to a report from TPS, Vietnam is among the top 10 countries with the largest pork consumption in the world. According to OECD’s estimate, Vietnam’s pork output is expected to reach 4 million tons by 2025 and 4.7 million tons by 2030, equivalent to an average annual growth rate of 3.1%. Currently, domestic pork production only meets 95% of domestic consumption. Therefore, the livestock sector is a promising industry, attracting strong investments from both foreign and domestic sources. The prospects for the pig industry are considered positive in the long term. In the short term, there are also signs of improvement.

Starting from the beginning of 2024, the average national pig price has recovered, reaching over 56,000 dong/kg at times (some localities reach up to 58,000 dong/kg). The high consumption demand during the Lunar New Year is the basis for many companies to expect good results in Q1/2024.

Regarding the issue of smuggled pigs, Mr. Truong Sy Ba – Chairman of the Board of Directors of BAF – believes that it is a manageable risk, based on localities increasing patrols and controls since mid-January 2023.

Chau An