Illustration photo

According to the preliminary statistics of the General Customs Department, soybean imports to Vietnam in December 2023 reached 203,220 tons, equivalent to 121.04 million USD, an increase of 348.4% in quantity and 300.2% in value compared to November.

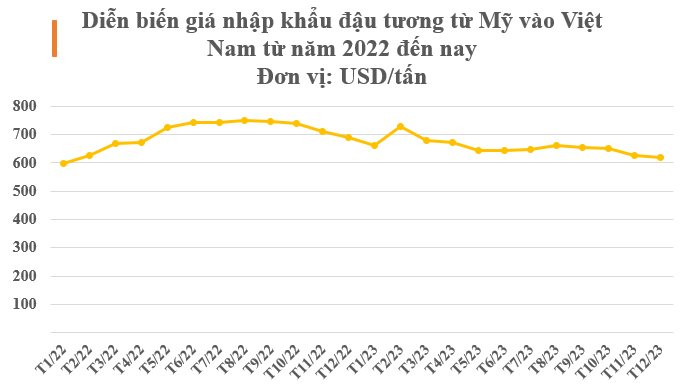

Overall in 2023, our country imported over 1.86 million tons of soybeans, with a value of nearly 1.17 billion USD, an increase of 1.1% in quantity but a decrease of 8.3% in value compared to the previous year. The average import price reached 629 USD/ton, down 9.3% compared to 2022.

In terms of the market, Brazil is the largest supplier of soybeans to Vietnam. In 2023, this country exported 987,569 tons of soybeans to Vietnam, equivalent to 586.08 million USD, accounting for 53.2% in total quantity and 50.1% in total soybean import value of the country. However, this decreased by 7% in quantity and 20.7% in value.

Notably, the world’s agricultural tycoon is increasing soybean exports to Vietnam at preferential prices. Specifically, soybean imports from the US market reached 677,749 tons, equivalent to 450.72 million USD, an increase of 14% in quantity and 10.4% in value. The US is Vietnam’s second largest supplier with a market share of nearly 40% in both quantity and value. The average import price reached 665 USD/ton, down 5% compared to the previous year.

In the report at the end of December, the US USDA forecasted that the annual soybean production of the country for the 2023/24 season from September 2023 to August 2024 will increase to nearly 112.4 million tons due to a potential increase of 20.18 kg/ha in productivity to the level of 3,355 kg/ha.

According to importers of agricultural products, Vietnam imports corn, wheat, soybeans used as raw materials for food processing and animal feed. The products of these 2 industries are not only serving domestic consumption but also for export, which is increasing.

For Vietnam’s neighbor, China, soybean imports are also increasing significantly. At the end of 2023, China unexpectedly purchased a large amount of soybeans, one of the important ingredients for animal feed production. This move is similar to when China increased its corn imports from the US in the first half of 2021 and pushed up global commodity prices to the highest level in nearly a decade.

Global supply is low and unfavorable weather conditions may affect the harvest season in South America, which has prompted Chinese importers to increase soybean purchases.

Argentina’s soybean crop suffered serious damage due to prolonged drought last year. Although the 2023/24 season is forecasted to recover to 48 million tons from 25 million tons, the available supply for the new season has not been harvested. The available quantity from Argentina is still limited, at least until the beginning of March, making the price of Argentine soybeans higher than the price of Brazilian soybeans in the international market.

Taking advantage of the price competitiveness, Brazil has increased its exports to China in the past few months. However, like Argentina, the amount of goods from this South American country will gradually become scarce until the harvest stage next year. In addition, the current crop situation is also experiencing many difficulties. Since the beginning of sowing, Brazilian soybeans have always had to undergo unfavorable weather conditions. Even some production areas are at risk of replanting or switching to other agricultural products.