When can you receive a one-time social insurance adjustment?

A social insurance adjustment is understood as an additional amount to create a balance in the value of currency at the current time compared to previous periods. This amount is calculated based on the adjustment of monthly wages and incomes that have been contributed to social insurance by the Ministry of Labor – Invalids and Social Affairs published for each year.

The social insurance adjustment amount is added when the worker withdraws social insurance at one time to counteract the devaluation of the currency at the current time compared to previous periods. From there, the process of social insurance contributions of the worker will be ensured fairness, because the amount of social insurance contributions of previous years is much lower than the current one.

Currently, the 2014 Social Insurance Law and the guiding documents do not have specific regulations on the time of payment for the social insurance adjustment amount.

However, in the calculation formula for one-time social insurance as stipulated by the Social Insurance Law, the social insurance adjustment amount has already been included in the one-time social insurance amount. In the case of making one-time social insurance procedures in the early months of the year, when the devaluation coefficient has not been announced, the social insurance agency will temporarily not calculate the social insurance adjustment amount for the worker.

Therefore, depending on the time of making one-time social insurance procedures, the time to receive the social insurance adjustment amount will vary:

– In case of withdrawing social insurance at the beginning of the year when the devaluation coefficient has not been announced: The social insurance adjustment amount will be received after the social insurance agency receives the official letter instructing the application of the devaluation coefficient.

– In case the devaluation coefficient has been announced: The social insurance adjustment amount will be received along with the one-time social insurance amount (the one-time social insurance amount includes the social insurance adjustment amount).

On December 29, 2023, the Ministry of Labor – Invalids and Social Affairs issued Circular 20/2023/TT-BLDTBXH regulating the adjustment of monthly wages and incomes that have been contributed to social insurance.

Although this Circular took effect on February 15, 2024, the regulations on the devaluation coefficient have been applied since January 01, 2024.

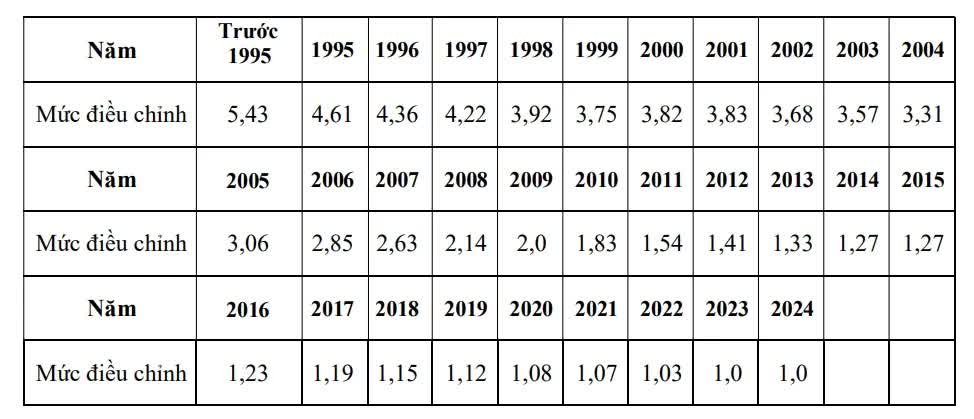

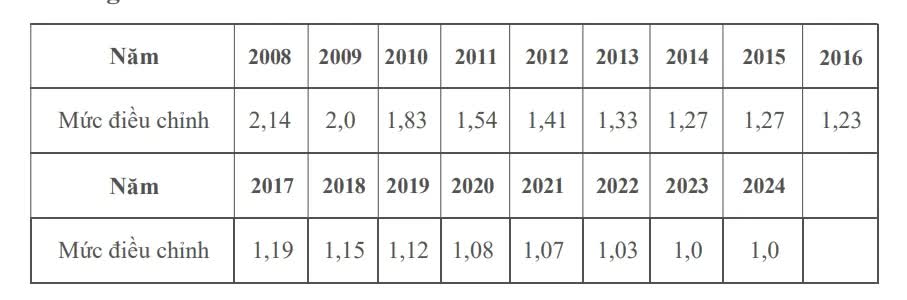

Accordingly, from January 01, 2024, the social insurance devaluation coefficient will be applied according to the following tables:

Devaluation coefficient for mandatory social insurance participants

Devaluation coefficient for voluntary social insurance participants

How to receive the social insurance adjustment amount after withdrawing social insurance at one time?

There is currently no consensus on the form of additional payment for the social insurance adjustment amount for workers among social insurance agencies. However, there are 2 most popular ways for workers to receive the adjustment amount as soon as possible.

Method 1: Go directly to the social insurance agency to receive the adjustment amount

After the devaluation coefficient of the new year is announced, workers can proactively contact the one-stop section of the social insurance agency where they have processed their one-time social insurance to inquire about the adjustment amount.

When going, workers should bring the following documents:

– Decision on receiving one-time social insurance (Form 07B-HSB).

– Original Identification Card or Citizen Identification Card to present.

Method 2: Wait for the adjustment amount to be automatically credited to the account or wait for the social insurance agency to call and receive cash

When there is an official letter instructing the application of the devaluation coefficient of social insurance for that year, the social insurance agency will calculate the adjustment amount and contact the workers to receive the additional amount.

Depending on the form of registering for one-time social insurance before, workers will receive the additional adjustment amount differently. Specifically, if workers register to receive one-time social insurance in cash, they need to go to the social insurance agency to receive the adjustment amount.

In case workers register to receive one-time social insurance via ATM, the adjustment amount will be directly transferred to their ATM card.