On the international market, the USD-Index decreased by 0.68 points from its peak of 104.96 points on February 13th, but increased by 0.32 points after one week, reaching 104.28 points.

According to a report released by the US Department of Labor on February 16th, the PPI index increased by 0.3% compared to the previous month, much higher than economists’ forecast of 0.1%. Previously, the PPI had decreased by 0.2% in December.

The stronger-than-expected increase in the PPI will further raise investors’ concerns. Previously, the market hoped that the Fed would aggressively cut interest rates this year, but after the recent inflation report, this hope has somewhat dissipated.

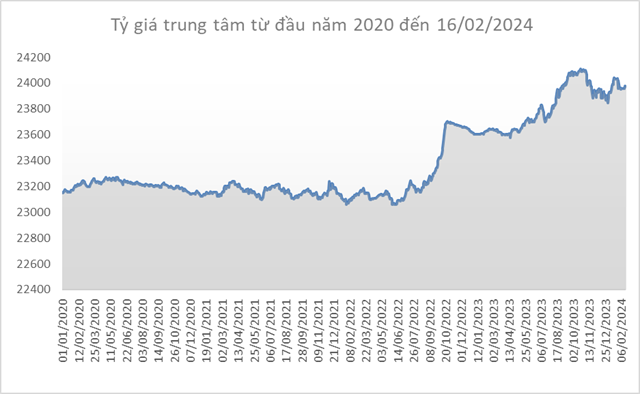

Source: SBV

|

Domestically, the central exchange rate of the Vietnamese dong against the USD increased by 15 dong/USD compared to the previous week (session on February 7th), reaching 23,971 dong/USD in the session on February 16th.

The State Bank of Vietnam (SBV) maintained the spot buying rate unchanged at 23,400 dong/USD. Meanwhile, money changers increased the spot selling rate by 15 dong/USD compared to February 7th, reaching 25,119 dong/USD.

Source: VCB

|

In addition, the quoted rates at Vietcombank increased significantly by 110 dong/USD in both directions, reaching 24,310 dong/USD (buying) and 24,680 dong/USD (selling).

Source: VietstockFinance

|