Mr. Lê Thanh Hạo Nhiên

|

Mr. Lê Thanh Hạo Nhiên was born in 1981 and holds a Master’s degree in Business Administration from the University of Hawaii (USA). He previously held the position of Director of Investment at VinaCapital Private Equity Fund before joining LTG on April 5, 2021 as Deputy General Director in charge of Finance, Accounting, and Taxation.

Since August 2021, he has been appointed as the Chief Financial Officer at LTG, replacing Mr. Nguyễn Duy Thuận. Therefore, after 2 and a half years in office, Mr. Nhiên will no longer hold this position starting from February 7, 2024. At LTG, he does not hold any shares.

Currently, Mr. Nhiên serves as the Chairman of the Board of Directors and legal representative in various subsidiaries of LTG such as Loc Troi Agricultural Products Corporation, Loc Troi Plant Varietal Joint Stock Company, An Thinh Dien Organic Fertilizer One Member Limited Liability Company, An Giang Real Estate Joint Stock Company, etc.

Prior to this, LTG has conducted a written shareholder opinion survey regarding the dismissal and appointment of Board members for the term 2019-2024, based on the shareholder list as of November 9, 2023.

According to the voting record, LTG shareholders did not approve the dismissal of Ms. Thuy Vu Dropsey (who submitted her resignation on July 31, 2023) as a Board member. Additionally, they did not approve the appointment of Mr. Mandrawa Winston Leo as a new Board member.

According to the candidate’s profile, Mr. Mandrawa Winston Leo was born in 1982, from Australia, and holds a Master’s degree in Engineering and Finance. He is currently the CEO of Affirma Capital since 2019. He also holds positions in Crystal Jade, Paddington Enterprise, and PT Travira Air.

According to their website, Affirma Capital is an independent private equity firm operating in emerging markets, managing assets worth over 3.5 billion USD and led by a highly experienced leadership team previously working at Standard Chartered Private Equity. Affirma Capital has stated that they have invested in LTG since September 2014.

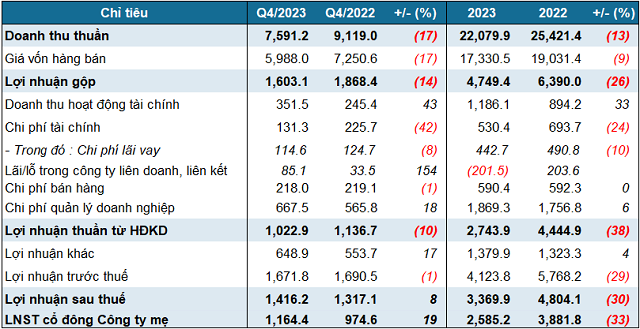

In terms of business performance, by the end of 2023, Loc Troi achieved a record revenue of over 16 trillion VND, an increase of 37% compared to the previous year. However, the net profit was only 265 billion VND, a decrease of 36%, due to the burden of interest expenses and provisions for bad debts. Consequently, the company was unable to achieve its set profit target of 400 billion VND for 2023.

| LTG’s 5-year business performance |

At the end of February 21, LTG’s stock price closed at the reference price of 27,000 VND/share, an increase of 3% compared to the beginning of the year and an increase of more than 30% from its short-term low in early November 2023.

| LTG’s stock price movement |