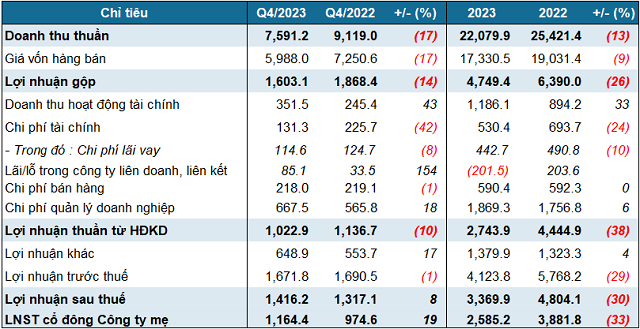

In Q4, the net revenue of Vietnam Rubber Industry Group – JSC (HOSE: GVR) amounted to over 7.591 trillion VND, a decrease of 17% compared to the same period last year.

The main contribution still came from the production and sale of rubber latex, reaching over 6.065 trillion VND, accounting for 80% of the revenue. However, this business activity faced difficulties with a 20% decrease compared to the same period last year. In addition to rubber latex, the wood processing activity also decreased by 21%, amounting to over 660 billion VND, accounting for 9% of the revenue.

After deducting the cost of goods sold, GVR achieved a gross profit of 1.603 trillion VND, a decrease of 14%, thanks to a slight improvement in gross profit margin of 0.6 percentage points, reaching 21%.

The financial activities stood out as they generated a profit of 220 billion VND, 11 times higher than the same period last year. This was mainly due to a significant increase in interest income from deposits and loans, while interest expense decreased and provision for impairment of investment was reduced. In addition, GVR also achieved higher other profits, which increased by 17% to 649 billion VND, thanks to cost cutting measures.

The SG&A expense-to-net revenue ratio increased by 3 percentage points, reaching 11.7%, due to the impact of a 18% increase in management expenses, putting some pressure on profitability.

Finally, GVR achieved a net profit of 1.164 trillion VND in the fourth quarter, an increase of 19%. For the whole year, GVR achieved a net revenue of 22.080 trillion VND, a decrease of 13% compared to the previous year, and a net profit of 2.585 trillion VND, a decrease of 33%.

Considering the adjusted after-tax profit target of 3.363 trillion VND (reduced due to difficult business conditions), GVR timely completed the profit plan set forth.

GVR adjusts down its profit plan by 900 billion VND

|

Q4 2023 business results and full-year results of GVR

Unit: Billion VND

Source: VietstockFinance

|

As of December 31, 2023, the total assets of GVR amounted to over 78.385 trillion VND, almost unchanged compared to the beginning of the year. Of which, long-term assets accounted for nearly 54.200 trillion VND, accounting for 69%, mainly the fixed assets value of rubber plantations, processing factories, industrial parks and ongoing construction costs of essential rubber plantations.

Short-term financial investments also accounted for a high proportion in GVR’s asset structure, reaching over 11.227 trillion VND, mostly in the form of time deposits.

The capital structure shows that total borrowings amounted to over 6.579 trillion VND, mainly long-term loans. Compared to the beginning of the year, borrowings decreased by 11%.

The company also had nearly 8.947 trillion VND of unrealized revenue, mainly revenue from infrastructure leasing and residential areas. In fact, these are advance payments from tenants, and in recent years, GVR has been gradually shifting its focus to business activities in this area.

Contrary to the declining business situation, GVR’s stock has increased by nearly 40% over the past year, reaching 22.950 VND/share as of the close of January 30, with an average trading volume of over 2.7 million shares per day.

| GVR stock has performed well in recent times |

By Huy Khai