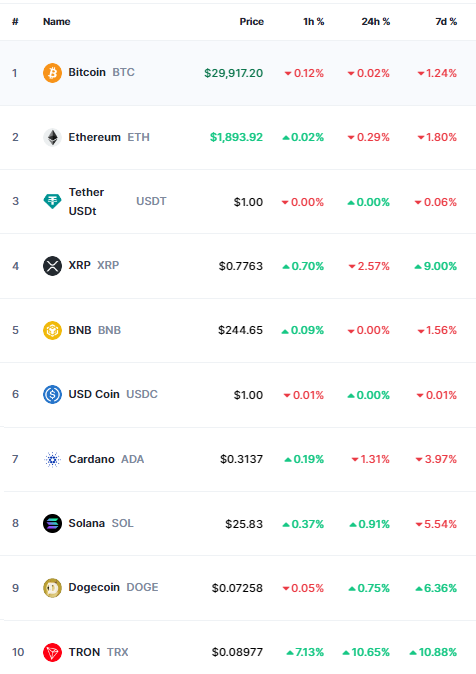

As of the morning of July 22, the world’s largest cryptocurrency is fluctuating at $29,917, down more than 1% from the previous weekend. Ethereum, on the other hand, dropped nearly 2% to $1,893.

The other cryptocurrencies in the top 10 are experiencing mixed changes, with Cardano down 4%, Solana down 5.5%, while XRP is up 9%, Dogecoin is up 6%, and TRON is soaring by 11%.

Trends of the top 10 cryptocurrencies

Source: CoinMarketCap

|

SEC to consider 6 Bitcoin ETF applications

According to Reuters, the US Securities and Exchange Commission (SEC) has accepted applications from 6 companies, including BlackRock, to review the establishment of Bitcoin ETFs. This is the first step in the SEC’s approval process. The remaining applications are from Bitwise, VanEck, WisdomTree, Fidelity, and Invesco.

Previously, the SEC had rejected dozens of applications for Bitcoin ETFs, stating that the proposals did not meet anti-fraud and investor protection requirements.

Nasdaq, where BlackRock plans to list its ETFs, said it will address these concerns by partnering with Coinbase to monitor market volatility.

Indonesia to open National Cryptocurrency Exchange in July

On July 17, the Indonesian Commodities and Futures Trading Supervisory Agency (Bappebti) announced that it will open the National Cryptocurrency Exchange in July to meet market demand and promote the financial sector.

According to Didid Noordiatmoko, Head of Bappebti, all cryptocurrency transactions must use the national exchange. Bappebti plans to focus on developing the trading volume of domestic cryptocurrency transactions and synchronize with trends in other markets.

Mr. Didid stated that the exchange will provide transactions through an integrated and tested application. To ensure efficiency and investor protection, Bappebti will authorize investors to participate in the exchange for one month.

Also, according to Mr. Didid, the development of the national cryptocurrency exchange began in 2021, but it will not be completed until 2023 due to the need for research and evaluation of the impact of this business model.

Russia to begin testing digital Ruble in August

Interfax news agency, on July 11, quoted a source from the Central Bank of Russia as saying that the country will begin testing a digital version of the Ruble with customers in August.

Russia, like many other countries, has been developing digital currencies for several years as part of efforts to modernize the financial system and regulate digital currencies like Bitcoin.

On March 16, the Russian State Duma approved a bill to provide a basis for using the digital Ruble and implementing cashless digital Ruble payments.

The law defines the concepts of platform, platform rules, platform participants, users of the digital Ruble platform, and digital accounts (wallets).

The list of entities in the national payment system has been supplemented with a new entity, the operator of the digital Ruble platform.

The Central Bank of Russia has conducted tests of the digital Ruble with some banks after Western countries imposed sanctions related to the conflict in Ukraine.