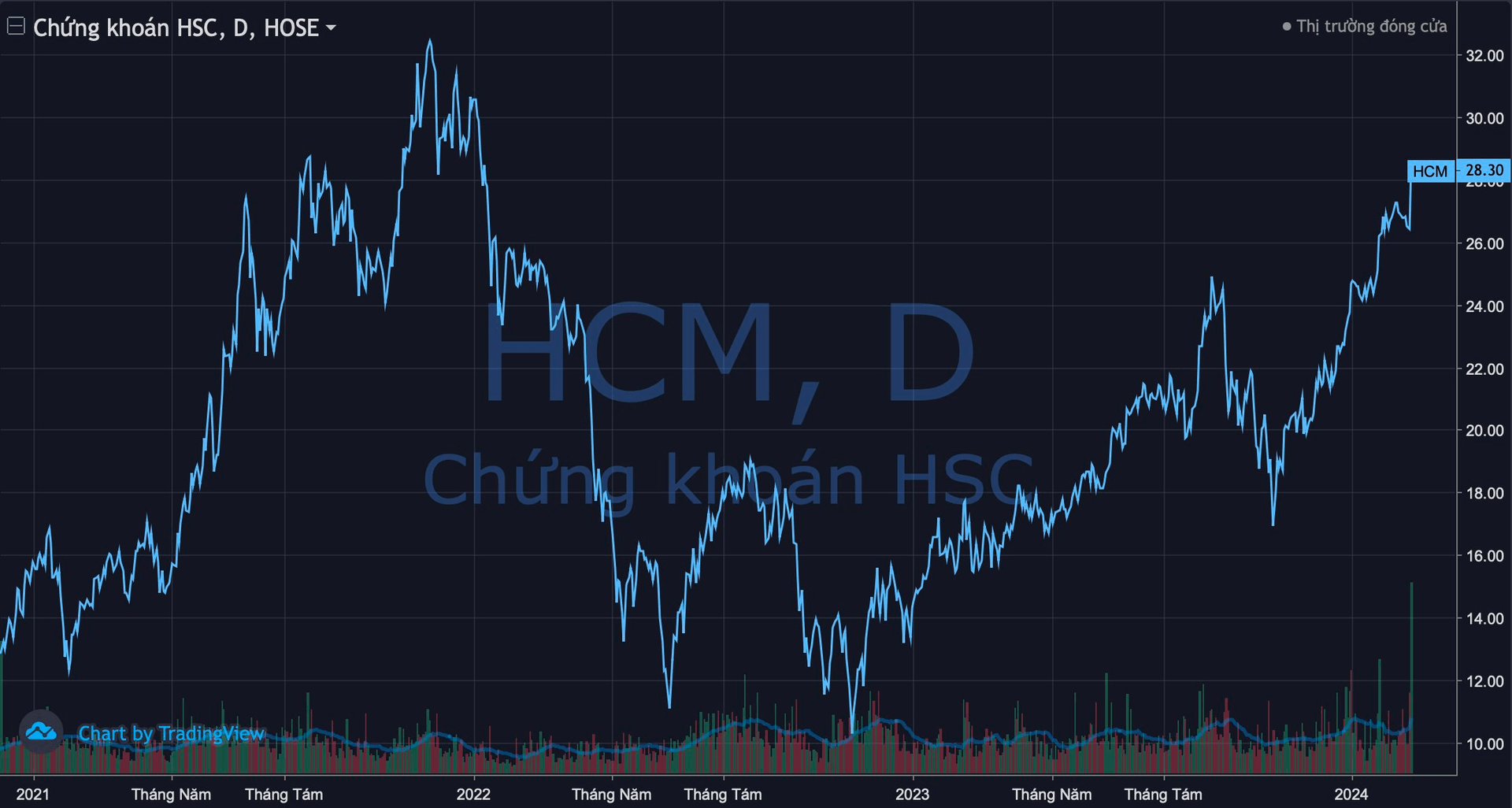

After a period of silence, securities companies’ stocks have unexpectedly surged, leading the market’s recovery on February 26. SSI, VND, VCI, MBS, SHS, BSI, CTS, AGR,… all increased sharply. Even HCM shares of HSC Securities reached the ceiling price with a record trading volume of nearly 32 million units matched orders.

The strong breakout session pushed HCM’s price to 28,300 VND/share, the highest in over 25 months since mid-January 2022. After nearly 4 months of waves (since the beginning of November into the previous year), this stock has increased nearly 67%. The market capitalization has also increased to over 21,300 billion VND, only about 13% less than the record level achieved in late November 2021.

In the past, HSC Securities used to be among the top competitors in various aspects of the securities industry. HCM stocks were even considered an indicator for market waves. However, difficulties in capital increase activities have caused HSC to gradually lose its position as its competitors have risen strongly. Brokerage market share on HoSE has continuously decreased from over 12% in 2016 to 5.32% in 2023.

At the annual general meeting of shareholders in 2022, HSC Securities leadership said that slow capital increase was one of the reasons that made HSC fall behind. “In the stock market, the company with a large capital will gain market share. The company has lost many large customers to competitors with stronger capital” – Chairman of HSC Securities Board of Directors emphasized.

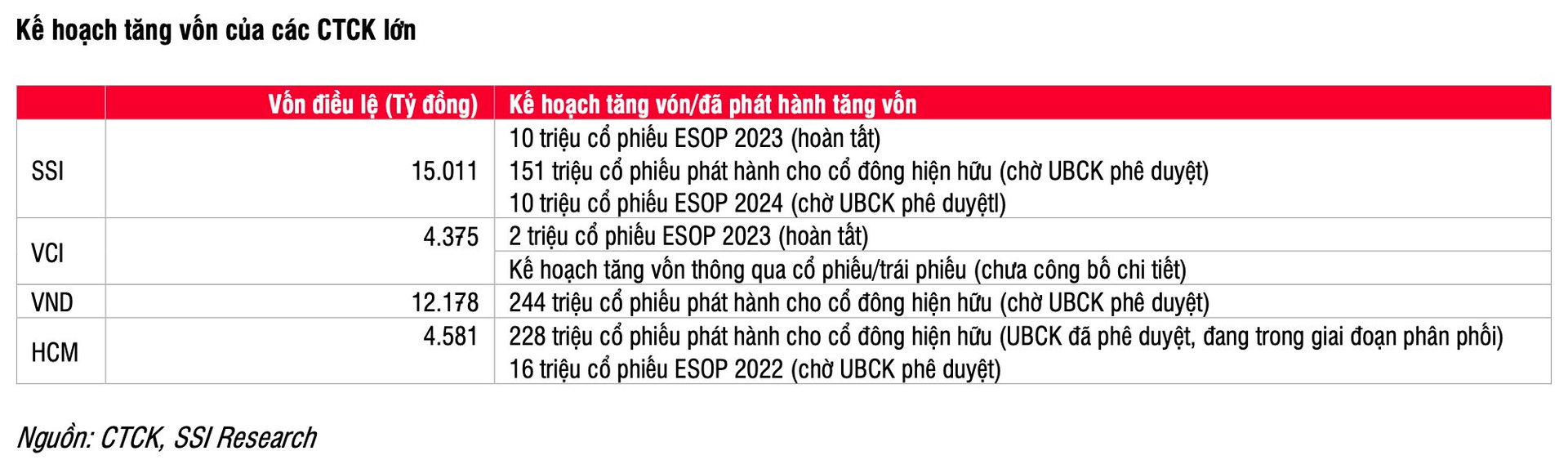

HCM stocks are making a comeback in the context that the capital increase button of HSC Securities has been removed after many years of “raising, lowering”. After being approved by the shareholders and State Securities Commission, at the beginning of 2024, this company has implemented the dividend payment offering to the existing shareholders (228.6 million shares – ratio 2:1) and the issuance of dividend payment shares from 2021 (68.6 million shares – ratio 15%).

The offering price for existing shareholders is 10,000 VND/share, equivalent to an expected total value of over 2,286 billion VND mobilized capital. The amount received from the offering process is planned to be allocated 78.13% for margin trading activities, equivalent to 1,786 billion VND; the remaining 21.87% for proprietary trading activities. The registration period is expected to take place from January 16 to February 26, 2024.

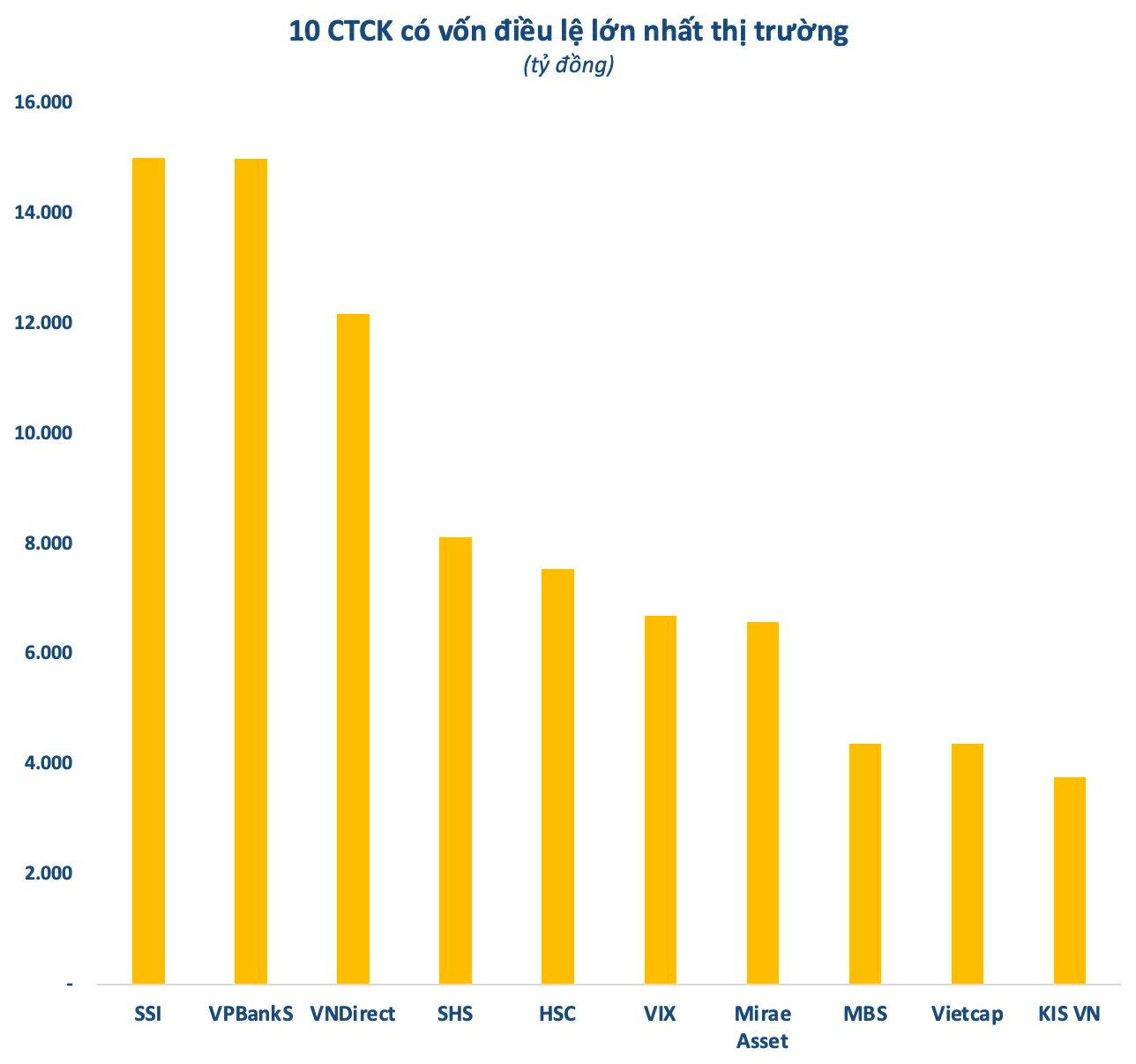

After the successful implementation, HSC Securities will raise its charter capital from nearly 4,581 billion to over 7,552 billion VND, ranking 5th in the industry. Although still modest compared to top names like SSI, VPBankS, VNDirect, the clear capital increase moves are optimistic signals, promising to bring positive changes to the company’s business situation in the near future.

Note: In this capital increase, the State shareholder is the State Financial Investment Company of Ho Chi Minh City (HFIC) – a major shareholder holding nearly 105.77 million HCM shares (23.09% capital ratio) is unlikely to participate. This organization has recently registered to sell all 105.77 million existing purchase rights through the auction method through HoSE in the expected time from February 28 to March 13. In case HSC Securities increases capital successfully and HFIC sells all the purchase rights, the ownership ratio of this shareholder will decrease to 14%.

In the newly announced 2024 strategy report, SSI Research assessed that the securities companies with the possibility of capital increase sooner would have better conditions to accelerate margin trading activities, gain more market share, and achieve better results compared to other securities companies.

According to this analysis division, securities companies have been increasing capital since the 2nd quarter of 2023 to prepare for the upcoming market demand. Except for a small number of securities companies increasing capital to restructure their corporate bond investment portfolios, the increase in capital will expand the margin trading capability of securities companies and maintain a healthy balance sheet, as well as meet the capital safety requirements set by the SSC.

It is expected that the race to increase capital will continue to consolidate the capital foundation of securities companies in the coming time. According to SSI Research, although the margin loan/debt ratio to market capitalization is currently at a high level, the possibility of repeating a wide-scale liquidation scenario like the end of 2022 is unlikely to happen if looking at the debt-to-equity ratio of the market (well-controlled). At the same time, the margin loan/debt capitalization ratio has not fully reflected the comprehensive growth rate of the market.