The seafood group’s upward trend comes as the industry’s exports show strong signals at the beginning of the year. Data from the Vietnam Association of Seafood Exporters and Producers (VASEP) shows that seafood exports in January reached nearly $750 million, an increase of 64% compared to the same period last year, with exports to China, the US, Japan, and the EU all showing significant growth.

Seafood companies have also revealed bright business results. Vinh Hoan (VHC) recently announced its business performance for January with revenue reaching VND 921 billion, an increase of 102% compared to the same period last year. This is the highest result in the past 8 months. Today, VHC reached the upper limit with a 7% increase, reaching VND 69,100 per share.

In the same seafood group, ANV, IDI, and ACL have all increased significantly, reaching the upper limit and attracting sellers. At the end of the session, there were millions of shares in the upper limit buy orders, with investors willing to buy at high prices. ANV had 1.5 million shares in upper limit buy orders, while IDI had 651 thousand shares. Although the stock prices increased collectively, the contribution of the seafood group to the overall market is still modest due to its low market capitalization ratio.

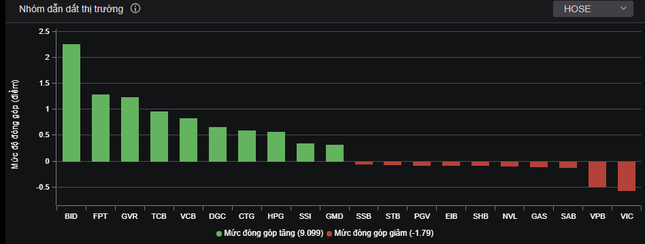

BID continues its 3.1% increase, making the biggest contribution to the main index.

VN-Index is dependent on large-cap stocks. The VN30 group and large-cap sectors have not reached a consensus. In the banking sector, besides the contributions from the Big 4 banks (state-owned), other stocks are relatively sluggish. BID continues its 3.1% increase, closing at VND 53,600 per share, making the biggest contribution to the main index. CTG and VCB are leading stocks, outperforming stocks in the same sector. Some individual stocks have supported the market’s upward trend: GVR, DGC, HPG, GMD…