After a sharp drop, the stock market quickly recovered with the leadership of the financial group (banks, securities). VN-Index closed the session on February 26th, up 12.17 points (+1%) to 1,224.17 points, almost regaining what was lost in the previous session. The liquidity decreased compared to the previous session, but the trading value on HoSE exchange still maintained above 19,500 billion VND. Foreign investors net bought 70 billion VND in the entire market.

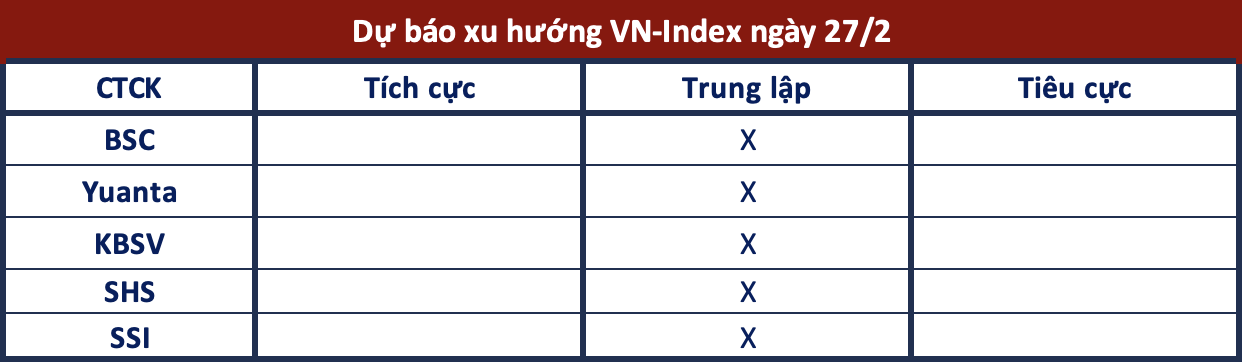

Regarding the market outlook in the coming sessions, most securities companies have given opposite opinions:

Difficult to avoid fluctuations

BSC Securities: VN-Index recovered and closed the February 26 session at 1,224.17 points, up more than 12 points compared to the previous day. The market breadth leaned towards the positive side with 13 out of 18 sectors gaining points, with the chemical sector leading the increase, followed by the information technology sector, financial services, etc.

Bottom fishing appeared at the 1,210 threshold, but liquidity significantly decreased compared to the previous session, showing that the market sentiment is still hesitant. In the short term, VN-Index may recover back to the 1,250 threshold after the correction phase, but it will not be able to avoid fluctuations.

Unclear trend accumulation phase

Yuanta Securities: The market may soon return to correction when the indexes approach the highest level in the February 23 session. At the same time, the market is still in the adjustment phase, so it may continuously have alternating up and down sessions, especially midcap and smallcap stocks have confirmed the short-term downward trend, and the downward momentum has not shown signs of stopping.

The market is differentiating between groups of stocks, and the ratio of the number of stocks tending to increase to the number of stocks tending to decrease is balanced, showing that the market is in an accumulation phase and may have an unclear trend in the upcoming trading sessions.

Market conditions are less negative

KBSV Securities: VN-Index went through a session of gaining points with small fluctuations. The positive point increase of the midcap stock group and some pillar stocks played a main role in the index, despite the increasing selling pressure at some points in the morning session, helping the index form a piercing candlestick pattern, making the market conditions less negative.

There is still the possibility that VN-Index will face a short-term correction, but KBSV evaluates that the upward trend is still confirmed for VN-Index with an opportunity to recover back at the notable support levels, around 1,200 (+-5) and further around 1,170 (+-10).

Not optimistic about the ability to break through 1,250 points

SHS Securities: In the short term, although VN-Index is recovering, to be able to surpass the strong resistance at 1,250 points, the market will continue to experience unusual movements in the near future, following a strong shakeout and a long accumulation period. Therefore, SHS does not have a high assessment of the possibility of VN-Index soon surpassing 1,250 points.

Short-term investors should be cautious at the current stage because VN-Index is operating at high levels within the medium-term accumulation channel and has issued a correction signal, so the short-term risks are increasing.

Dispute at the 1,224 – 1,226 point range

SSI Securities: The positive recovery momentum brought VN-Index close to the resistance zone at 1,220 – 1,224 points. The technical indicators RSI and ADX are still within the range of favorable signals, but the strength of the trend has somewhat cooled down. The VN-Index may experience a dispute at the 1,224 – 1,226 range before correcting back to the 1,215 point range.