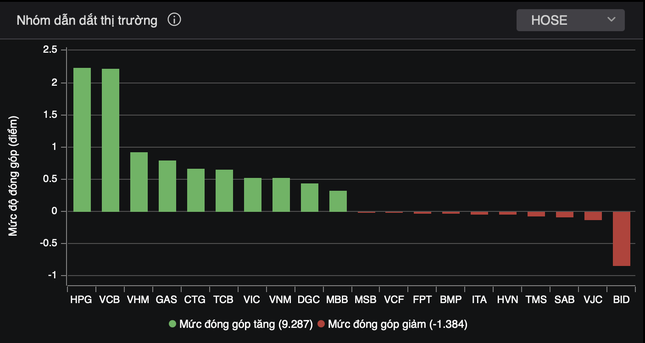

HPG emerged as a bright spot in today’s trading session, with its price increasing by 5.38% to 30,350 VND per share. Over 87.5 million shares changed hands, more than 4 times the previous session. The trading value reached over 2,621 billion VND, accounting for more than 11% of HoSE’s liquidity.

The net worth of billionaire Tran Dinh Long also increased significantly due to the positive development of HPG. According to Forbes’ estimate, he gained an additional 184 million USD today (an increase of 7.74%), bringing his total net worth to 2.6 billion USD. This increase surpasses that of other Vietnamese billionaires.

HPG’s market capitalization reached nearly 176,500 billion VND, surpassing Vingroup and ranking 6th in the list of the most valuable companies on the stock market.

HPG leads the market-leading group in terms of contribution.

In the same steel sector, stocks traded positively. The color green covered VGS, TLH, HSG, NKG, TVN, POM… Steel stocks perform well in the context of positive forecasts for steel companies’ profits this year, thanks to improved steel prices and recovery in domestic demand and exports.

A recent analysis report by SSI Research forecasted that total steel consumption could recover by over 6% in 2024, with domestic consumption expected to grow nearly 7%. Steel prices may have bottomed out and will improve this year due to a better supply-demand balance. Export volume can maintain growth thanks to positive global demand prospects. Steel companies’ profits will grow strongly from the low baseline of 2023, thanks to improved consumption.

Other large-cap stocks in the VN30 basket also made positive contributions to the market’s upward trend, such as VCB, VHM, GAS, CTG, TCB… VCB led the main index to increase by over 2 points, similar to the impact of HPG. In the VN30 group, 21 out of 30 stocks increased. Positive developments also spread to many industry groups, with 380 stocks on HoSE experiencing price gains. Influential sectors such as banking, real estate, and securities also saw strong stock performance.

The securities group narrowed the upward trend in some large-cap stocks, but the color green still dominated nearly 20 stocks. TVS hit the ceiling. SSI continues to attract capital with the second highest liquidity on the exchange with a trading value of 1,685 billion VND. Regarding the stock market, tomorrow (28/2) will see the Conference on Implementing the Development of the Stock Market in 2024 with the participation of Prime Minister Pham Minh Chinh.

At the end of the trading session, VN-Index increased by 13.29 points (1.09%) to 1,237.46 points. HNX-Index increased by 2.52 points (1.08%) to 235.38 points. UPCoM-Index decreased by 0.09 points (0.1%) to 90.4 points. VN-Index is approaching the old peak of 2023, around the 1,245-point mark.