After the “sideway up” phase, HPG shares of Hoa Phat Group unexpectedly accelerated in the last session of February. The stock rose 5.38% to 30,350 dong/share, the highest level in over 21 months since May 11, 2022.

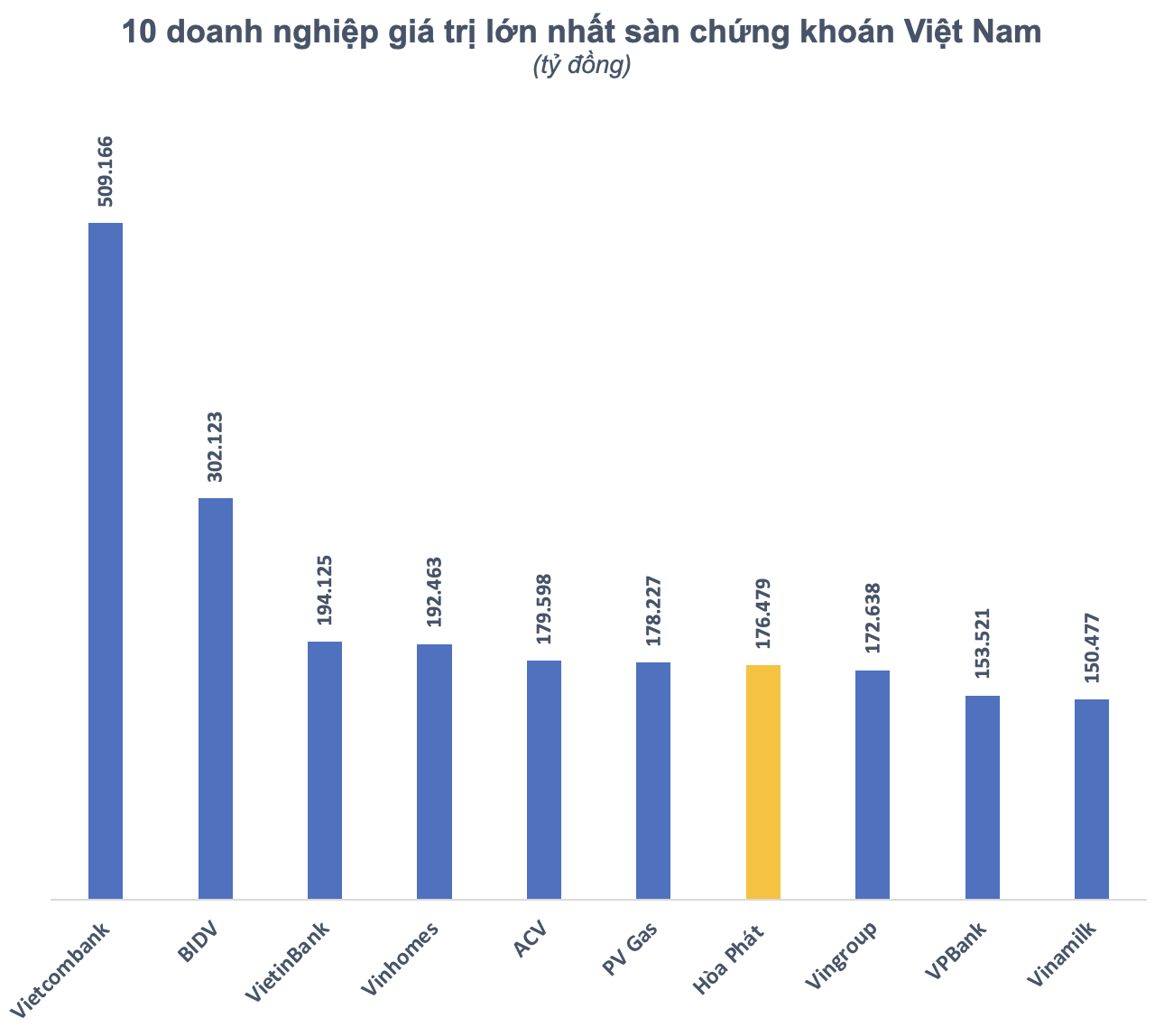

The market capitalization also increased to approximately 176,500 billion dong (~7.4 billion USD). This is enough for Hoa Phat of billionaire Tran Dinh Long to regain the 7th position in the list of the most valuable companies on the stock exchange from Vingroup and only ranks behind Vietcombank, BIDV, VietinBank, Vinhomes, ACV, PV Gas.

Notably, trading on HPG is also particularly active with a trading volume of nearly 87 million shares (mostly through the matching channel). This is the second largest liquidity level in HPG’s history, only after the session on November 18, 2022 (nearly 100 million shares traded). The corresponding trading value reached 2,600 billion dong, the highest on the stock exchange on February 27, far surpassing the rest.

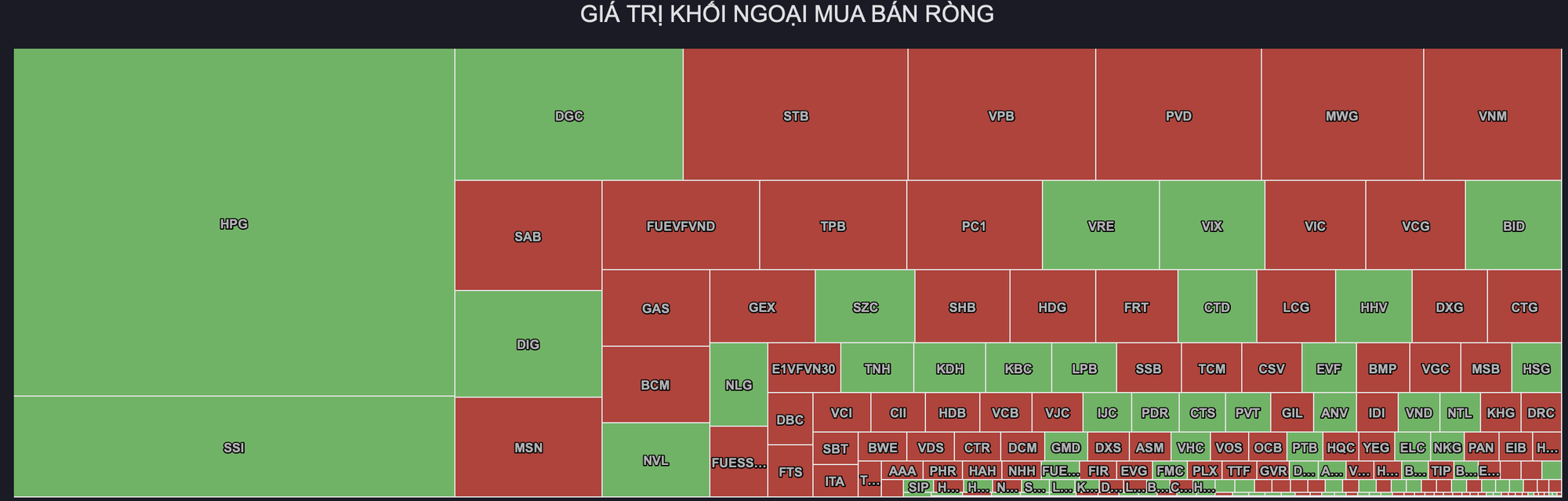

The explosive trading session reached a 21-month peak of HPG with significant contribution from foreign investors when they net bought over 15 million shares. This is the largest net buying volume in one session by foreign investors on this stock since the beginning of December 2022. The corresponding net trading value exceeded 450 billion dong, the largest on the stock exchange on February 27.

HPG shares unexpectedly attracted a lot of attention from investors to the upcoming important event of Hoa Phat. Most recently, on March 26-27-28, the Group will organize Investor Visit to the Hoa Phat Dung Quat Iron and Steel Complex. The registration time is from 9:00 am on February 26 to 05:00 pm on February 27, 2024. According to the statistics by the Investor Relations (IR) Department of Hoa Phat, more than 500 investors registered to participate in the program on the first day.

About 2 weeks after the above-mentioned event, Hoa Phat is expected to hold its Annual General Meeting of Shareholders in 2024. According to the plan, the General Meeting will take place on the morning of April 11 at Melia Hanoi 5-star Hotel (Hanoi). The last registration date to finalize the list of shareholders is March 11, 2024.

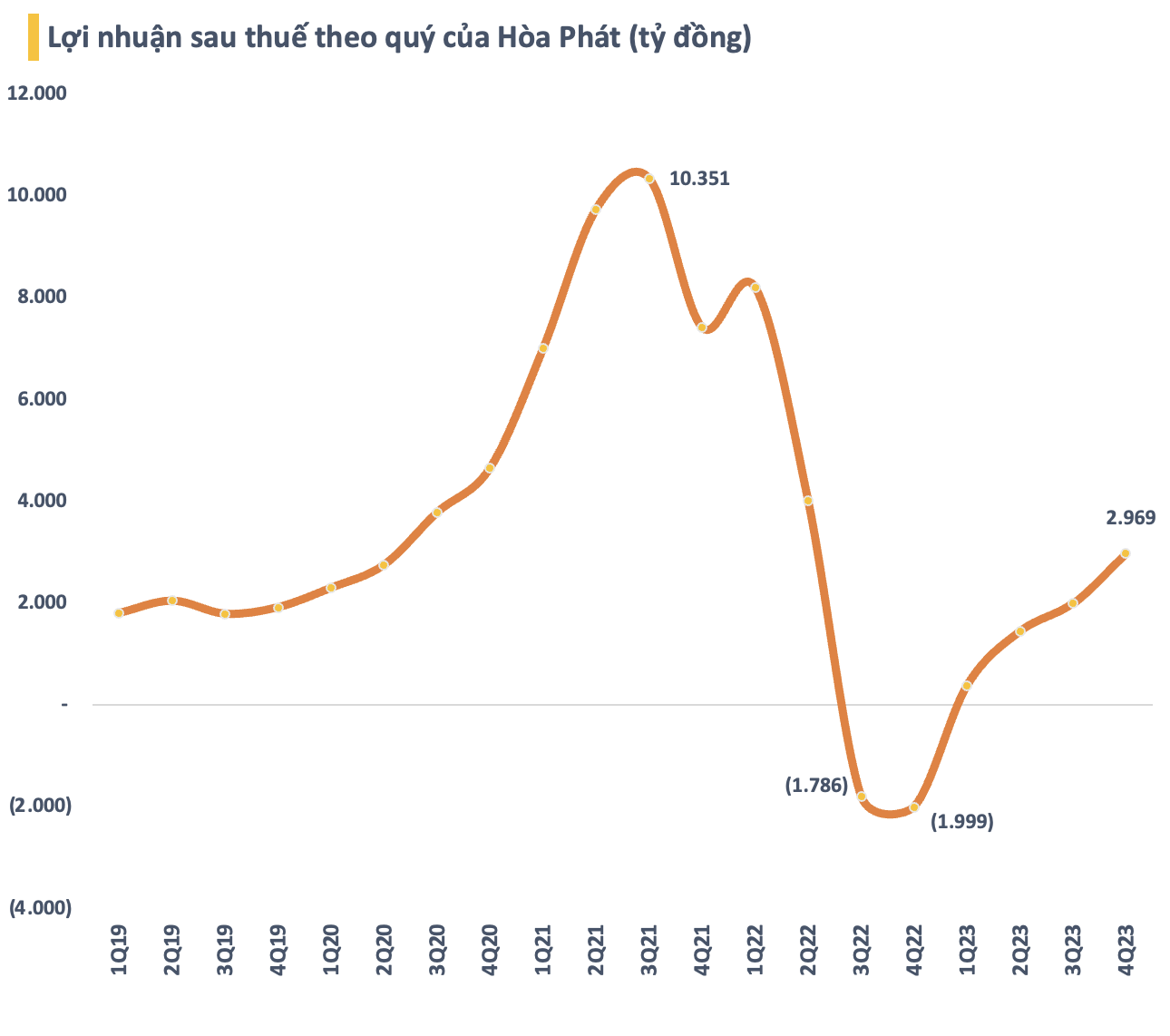

The increase of HPG stock is supported by positive developments in business operations. In the fourth quarter of 2023, Hoa Phat had an impressive recovery quarter with net revenue and net profit reaching 34,400 billion dong (an increase of 33% over the same period) and 2,970 billion dong (an increase of 48% compared to the previous quarter, marking the best business results in the recent 6 quarters).

In the long term, Hoa Phat’s profit is expected to increase more than 30% per year in the period of 2025 – 2027 thanks to the commencement of the Dung Quat 2 project in 2025 – 2026, which will help increase HRC consumption to more than double from 2.8 million tons in 2023 to 7.5 million tons in 2027. The current domestic supply shortage of about 4 – 5 million tons/year, together with recent export promotion, will also help Hoa Phat enhance the HRC segment after the project is put into operation.