The SCMP report suggests that the durian competition in China is extremely vibrant. The world’s largest durian market is expected to increase its agricultural production of this fruit by 10% by 2030, as Chinese consumers are increasingly seeking durian.

While the Philippines and Malaysia are preparing to boost their export volumes to China, Thailand’s durian throne is at risk of being taken over by Vietnam.

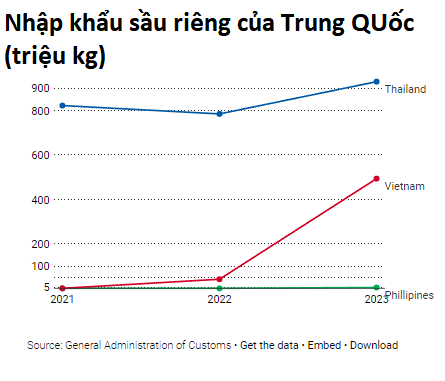

In 2021, Thailand exported over 800,000 tons of durian to China, while Vietnam only exported 5,000 tons. However, by 2023, Thailand’s exports reached over 900,000 tons, while Vietnam reached 500,000 tons, capturing a 32% market share.

In 2023, China imported 1.4 million tons of durian from abroad.

The SCMP even suggests that in the next 5 years, Vietnam, the Philippines, and Malaysia are likely to compete for the number one durian exporter position to China, surpassing Thailand.

A report by USD Analytics shows that the global durian market is expected to grow by 7.51% between 2023-2030. Meanwhile, a report by Research and Markets estimates that this agricultural market will grow by 9.77% annually from now until 2030.

Data from the Food and Agriculture Organization (FAO) shows that China currently holds up to 95% of the international durian market share, a significant advantage for neighboring Asian countries.

However, the demand for durian in China is still immense, as the retail price of this commodity is considered too high for many consumers.

“To this day, the price of durian remains quite high, indicating that the market is not yet saturated. If China continues to import, the price will decrease to meet people’s demand,” said Professor of Finance Zhao Xijun from Renmin University.

King of Fruits

According to SCMP, the demand for durian in China is so high that this fruit is now nicknamed the “king of fruits” in the market, replacing peaches and grapes in gift baskets.

Despite its strong odor, each portion of durian in China can cost up to 200 RMB, equivalent to $28 or 700,000 VND.

There are even cases like Ms. Zhao Yu, a 37-year-old finance professor in Shanghai, who had to pay 400 RMB, equivalent to 1.4 million VND, for a box of premium durian.

“If the price of durian is lower, maybe I will try them, but at this high price, there are cheaper options,” said Ms. Zhao.

Similarly, Ms. Wang Hui living in Beijing said that the current price of durian is quite high and the quality is not stable depending on the season. Therefore, when hearing news of China’s additional durian imports from Vietnam, Malaysia, and the Philippines, this 44-year-old woman was delighted.

“The price of durian is currently too high, so if I choose a spoiled fruit, it will leave a bad impression.,” Ms. Wang said.

Currently, Vietnam, the Philippines, and Malaysia are aiming to capture a 68% market share of durian in China from Thailand.

Although durian has become the king of fruit in gift baskets for new mothers, new homeowners, or during holidays like Tet, SCMP believes that the Chinese market still has a lot of untapped potential. The supply chain and transportation of durian from Southeast Asia to China have not been fully developed to effectively reduce prices for end consumers.

Malaysia has only been able to sell frozen durian to China, and the country is negotiating in 2024 to be able to sell fresh durian like Vietnam.

The Ministry of Agriculture of Malaysia said they expect to increase durian exports to China from 236 tons in 2018 to 22,000 tons in 2030.

In the Philippines, the government is also trying to expand the scale of durian cultivation from 1,200 hectares to 3,000 hectares in Mindanao. Currently, the country’s durian accounts for less than 1% of the export market share to China in 2023.

According to SCMP, northern China can still absorb additional durian imports, and the market is still large with suppliers from Southeast Asia. Not to mention the expansion into processed durian products for snacks, beverages, etc., to serve a population of 1.4 billion consumers.

Professor Zhao from Renmin University said that the Chinese market still has a lot of untapped potential with the supply from Southeast Asia, creating attraction for many countries to enhance the development of this agricultural product.

Similarly, Victor Gao, Deputy Director of the China International Center (CCG), believes that the development of e-commerce and delivery networks in China will significantly increase durian consumption in the future to meet the demand of consumers nationwide.

*Source: SCMP