In the stock trading session on February 28, the market showed strong performance and the VN-Index surpassed the 1,250 points milestone, reaching 1,254.55 points.

The market was driven by banking stocks, with Vietcombank (VCB) leading the way. Right from the start of the afternoon session, VCB experienced a sharp increase and closed the session at the ceiling price of 97,400 dong per share.

This is the first time Vietcombank’s stock has hit the ceiling price since March 2020. In its long trading history, this is only the seventh time Vietcombank’s stock has hit the ceiling price out of 3,661 trading sessions.

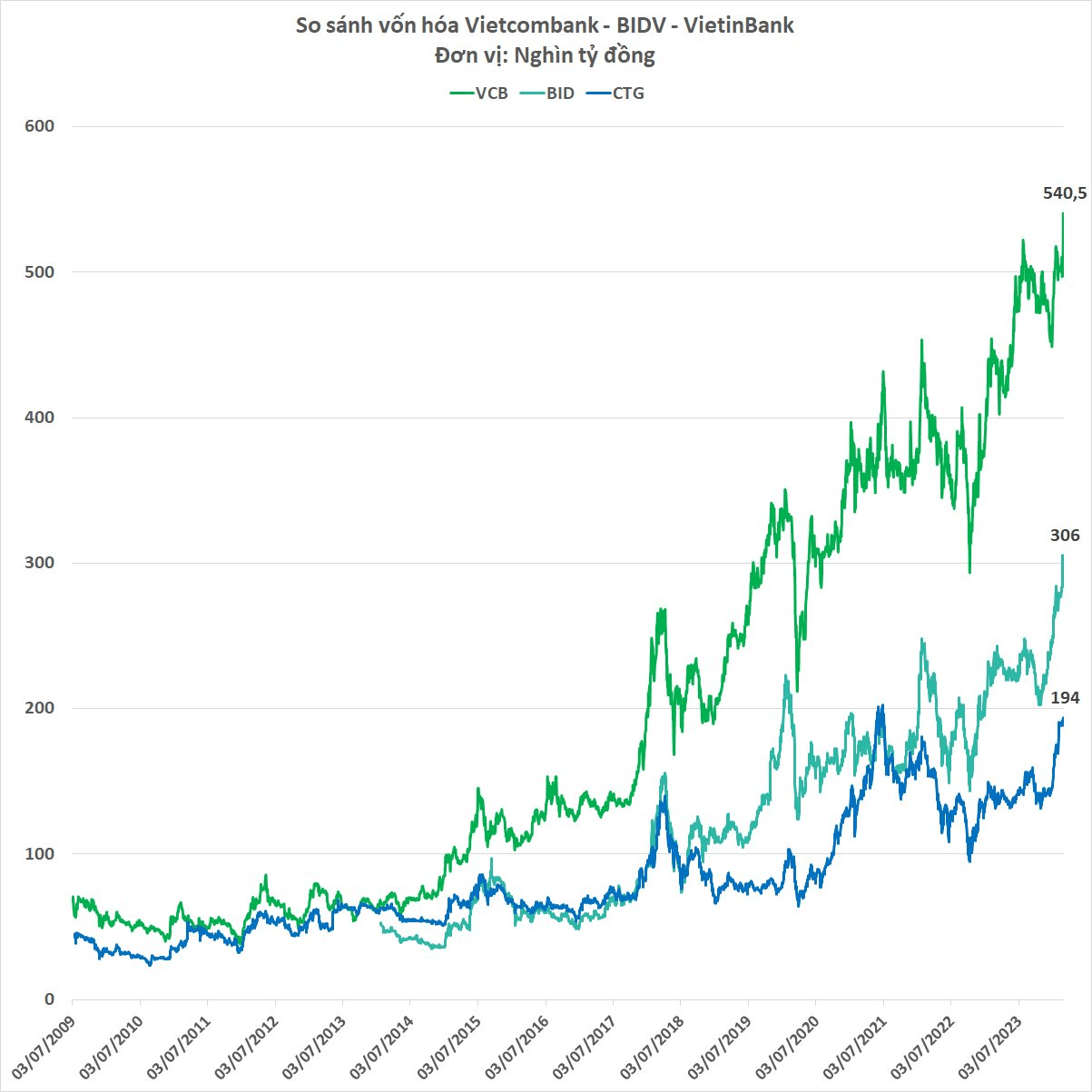

With today’s closing price, Vietcombank also reached a new market capitalization record of 540.5 trillion dong, surpassing the combined market capitalization of the other two state-owned banks, BIDV and VietinBank. As of the end of February 28, BIDV’s market capitalization was 306 trillion dong, while VietinBank’s market capitalization was 194 trillion dong.

Vietcombank’s stock price surged immediately after the bank’s Board of Directors approved the 2022 profit distribution plan based on the State Bank of Vietnam’s approval principle.

Specifically, Vietcombank’s audited standalone after-tax profit for 2022 is 29,387 billion dong. Adding the adjustment from the previous year’s profit of over 3 billion dong, the total profit distribution for 2022 of Vietcombank is 29,390 billion dong.

Vietcombank will allocate a 5% supplementary charter capital reserve fund (1,469.5 billion dong), a 10% financial reserve fund (2,939 billion dong), a reward and welfare fund (3,291.5 billion dong), and deduct other adjustment reduction of 9.8 billion dong.

After allocation, the remaining profit for 2022 is 21,680 billion dong. Vietcombank plans to use all of this profit to distribute dividends in the form of shares. This plan will need to be submitted to the State Bank of Vietnam for approval.

In 2023, Vietcombank achieved a consolidated profit before tax of 41,244 billion dong, a growth of 10.4% compared to 2022.

This result affirms Vietcombank’s position as the “king of profits” and continues to surpass BIDV (27,650 billion dong), MB (26,306 billion dong), Agribank (25,400 billion dong), and VietinBank (25,100 billion dong), while setting a new record in the banking industry.

As of the end of 2023, Vietcombank’s total assets reached over 1,839 trillion dong, an increase of 1.4% compared to the beginning of the year. Of which, customer loans amounted to over 1,270 trillion dong, an increase of 10.9%. Customer deposits increased by 12.2% to nearly 1,396 trillion dong.

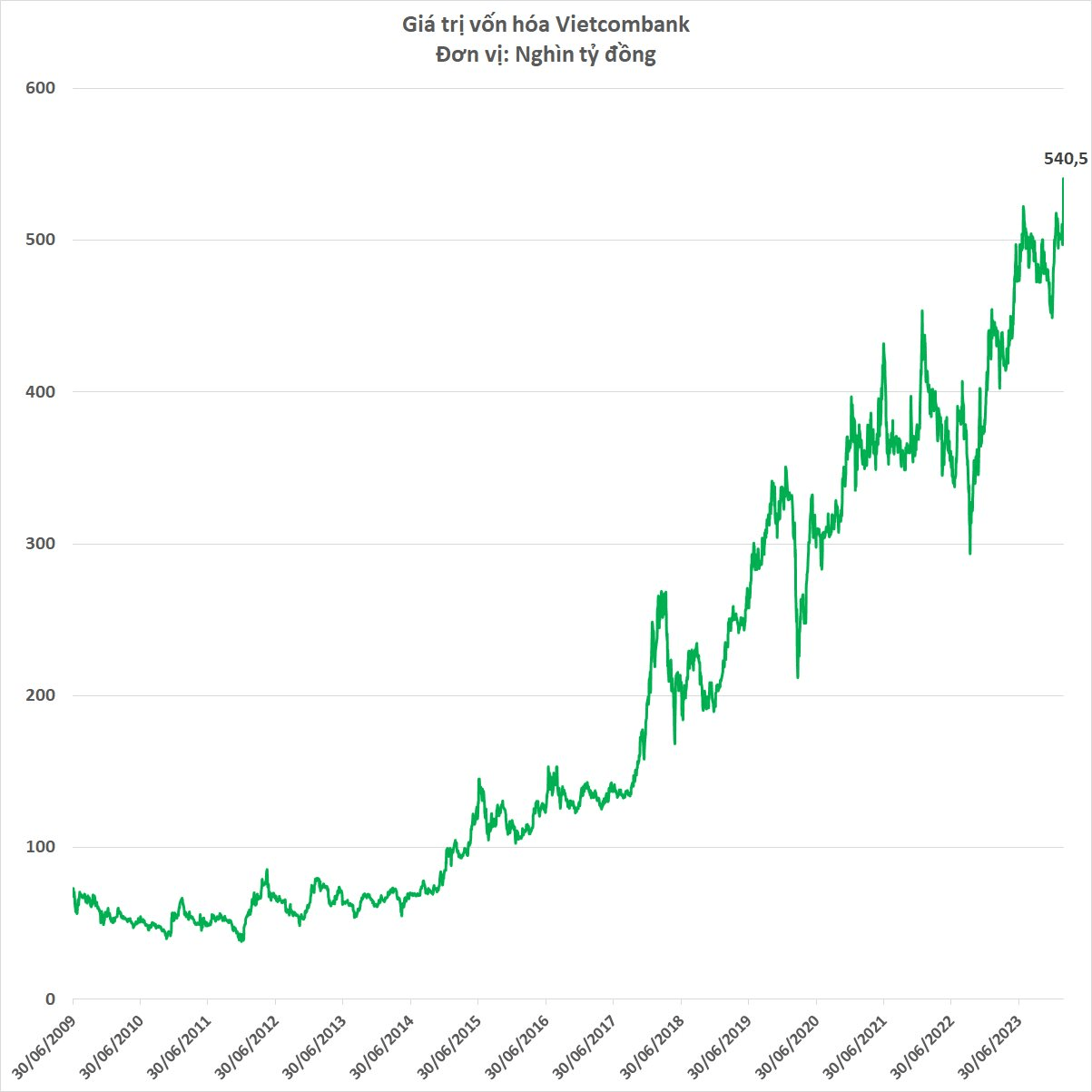

After listing on the stock market in June 2009, it took Vietcombank 1,408 sessions to reach the milestone of 100,000 billion dong, achieved on May 7, 2015.

To reach 200,000 billion dong, Vietcombank needed an additional 724 trading sessions, achieved on January 9, 2018.

The next milestone was 300,000 billion dong, reached by Vietcombank on July 29, 2019, with only 382 trading sessions remaining.

In the following period, the Vietnamese stock market plummeted due to the Covid-19 pandemic, so Vietcombank took as many as 474 trading sessions to reach the milestone of 400,000 billion dong on June 18, 2021.

After another 521 trading sessions, Vietcombank reached a historic market capitalization milestone of 500,000 billion dong on July 19, 2023.