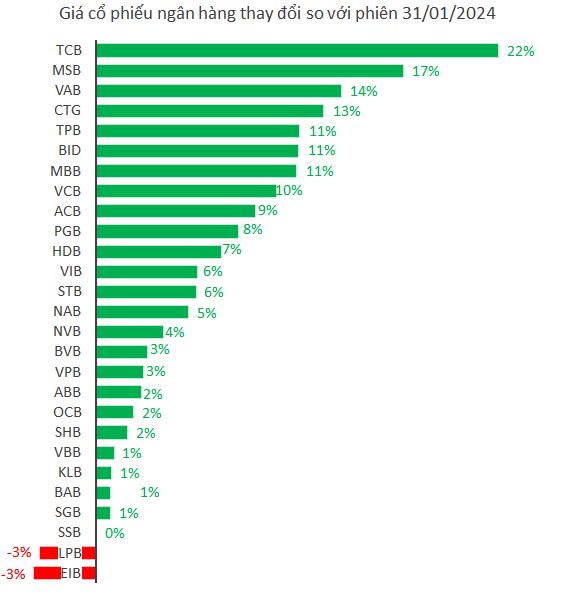

The VN-Index concluded the second trading month of 2024 positively with a nearly 8% increase compared to the end of January, reaching 1,252.73 points (at the end of the session on February 29, 2024). In particular, banking stocks have continued to assert their leadership position in the market with a higher increase than the VN-Index. Specifically, data from VietstockFinance shows that the banking sector index in February increased by 9% compared to the previous month, reaching 718.5 points.

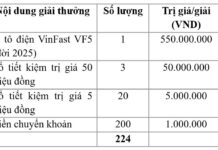

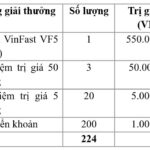

The market capitalization increased by over 174 trillion dong.

In February, the market capitalization of the banking group increased by 174,081 billion dong, reaching nearly 2.12 million trillion dong (as of February 29, 2024), a 9% increase compared to the 1.94 million trillion dong at the end of January session.

Source: VietstockFinance

|

It can be seen that the banking stocks have once again become the focus of the market after some minor fluctuations, leading the VN-Index to approach the highest price level in 2023, surpassing the 1,250 point level.

Notably, the bluechip stock VCB (rising to the limit of 97,400 dong per share in the session on February 28) set a new price peak after the BOD approved a 38.79% stock dividend for 2022.

This is the first time since March 2020 that Vietcombank’s stock has hit the ceiling. In the entire historical length, this is only the 7th ceiling-hit session out of 3,661 trading sessions.

In this February alone, VCB’s share price increased by 10% compared to January, thereby helping the market capitalization surpass half a million trillion dong. This is also the bank with the highest market capitalization in the industry.

Techcombank (TCB) led the growth rate of market capitalization in the past month with a 22% increase thanks to the corresponding increase in stock price.

According to BIDV Securities (BSC), the current valuation level of the banking sector is still suitable for accumulation, especially for the private sector, while the state-owned sector still has a basis to raise acceptance from private placements. BSC also noted that tighter risk management regulations and improved balance sheet health are the main differences in the current cycle compared to the past. The amended Credit Institutions Law, aimed at minimizing systemic risk, has also just been passed.

Accordingly, BSC has a positive outlook for the banking sector in 2024 based on the following key points: Low-interest environment and economic recovery prospects help improve credit growth and NIM, thanks to the reset cost of capital, strengthening the handling of bad debts in 2023 creates room for recognizing debt recovery profits in 2024, thereby improving the prospects of profit growth in 2024, supported by a valuation still in the appropriate range for accumulation.

Source: VietstockFinance

|

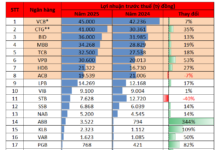

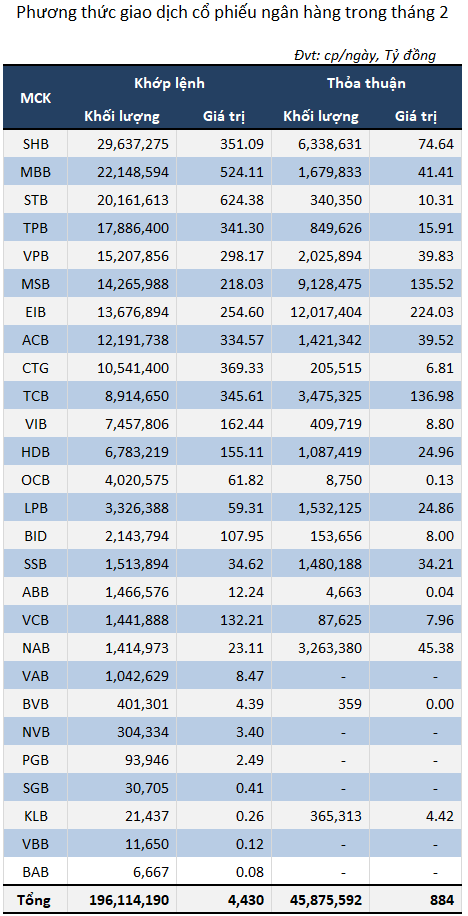

Trading volume continues to increase.

In February, nearly 242 million bank shares were traded per day, a 12% increase compared to January, equivalent to an increase of over 25 million shares per day. The trading value also increased by 19%, reaching over 5,313 billion dong per day.

Source: VietstockFinance

|

Among them, the banks with the highest liquidity growth rate were PGB (5.1 times), MSB (2.6 times), and VAB (2 times).

On the other hand, VBB had the sharpest decrease in liquidity in the past month, with only 11,650 shares traded per day, a 99% decrease compared to the previous month.

This month, SHB continued to lead in terms of liquidity with nearly 30 million shares traded per day and 6.3 million shares “changing hands”, with a total average trading volume of over 36 million shares, a 20% decrease compared to the previous month.

BAB had the lowest liquidity with only 6,667 shares traded per day, a 54% decrease compared to the previous month, with a value of just over 84 million dong per day.

Source: VietstockFinance

|

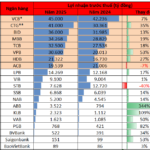

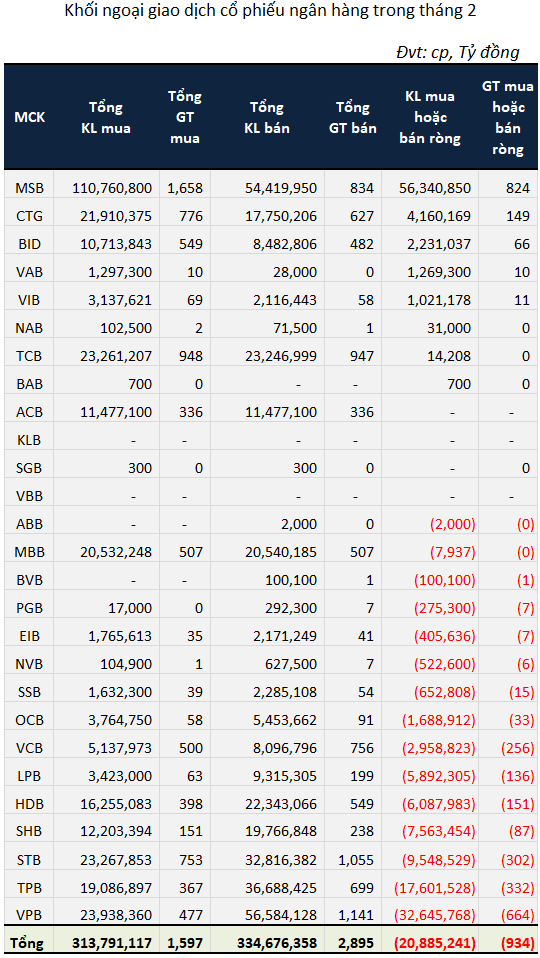

Foreign investors had a net selling of 934 billion dong.

With the increasing trend of the “bank” sector, foreign investors took the opportunity to take profits in February with a net selling volume of nearly 21 million shares, with a value of 934 billion dong.

Source: VietstockFinance

|

MSB was the stock with the strongest purchase by foreign investors, with over 56 million shares (824 billion dong) in the past month. On the contrary, foreign investors took profits on VPB stock, with the highest net selling volume of nearly 33 million shares, equivalent to a value of 664 billion dong.